First Industrial Realty Trust (FR): Exploring Valuation After Recent Share Price Fluctuations

Most Popular Narrative: 7.1% Undervalued

The most widely followed narrative suggests that First Industrial Realty Trust is currently trading below its projected fair value, offering a potential opportunity for investors.

The company is currently benefiting from exceptionally strong rental rate growth (cash rental rate increases of 33% to 38% on new and renewal leasing), likely reflecting the ongoing shift toward e-commerce and supply chain reorganization. Investors may be overestimating the sustainability of these double-digit rent spreads given evolving demand and increased tenant caution, which could inflate both current revenue and forward earnings expectations.

Curious about the math behind this tantalizing valuation? One bold assumption stands out, hinting at future growth expectations and an industry-leading profit multiple. Ready to uncover which quantitative levers analysts are pulling to justify this price target? The full narrative reveals the surprising drivers you won't want to miss.

Result: Fair Value of $56.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent strong rent growth or tightening supply could counter investor caution and challenge the idea that First Industrial is already fully valued.

Find out about the key risks to this First Industrial Realty Trust narrative.Another View: Price Tag Problem?

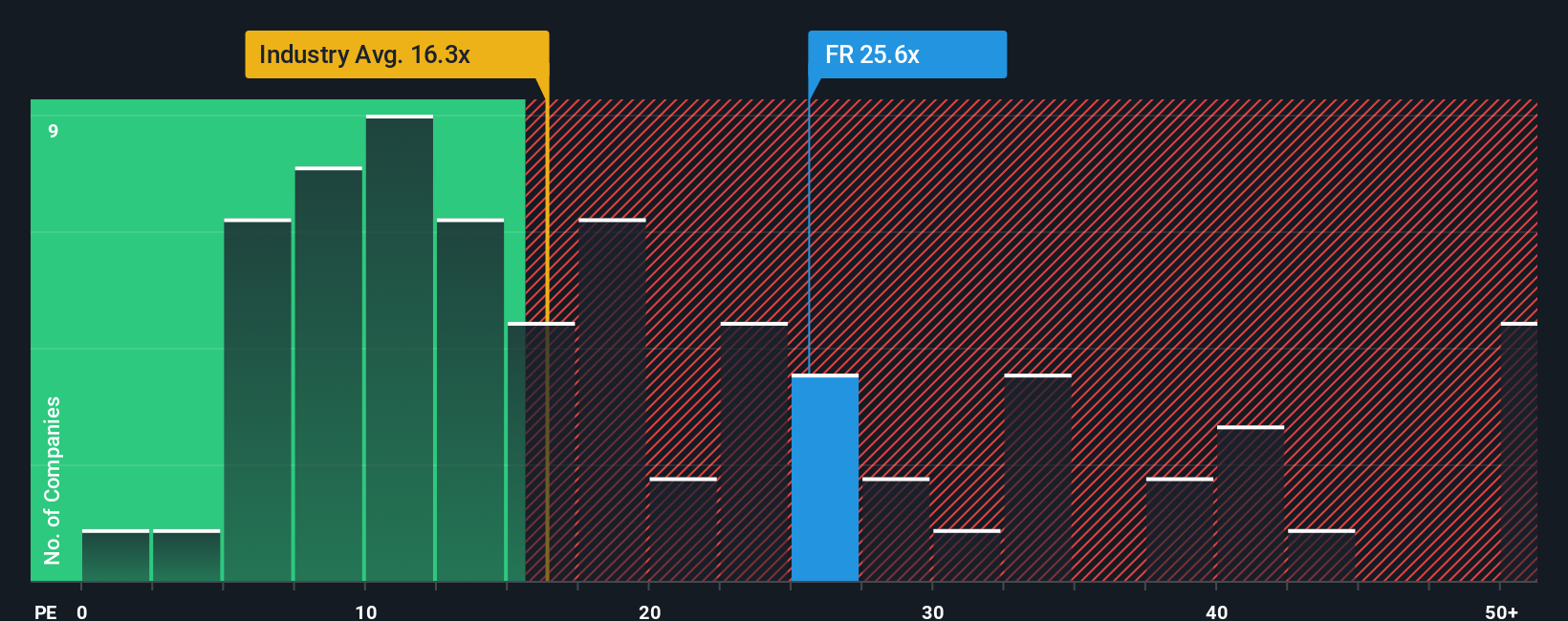

But not everyone agrees FR is a bargain. An alternative approach, focusing on its price compared to similar companies, actually flags the shares as expensive right now. Could the optimism be overdone?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Industrial Realty Trust Narrative

Not convinced by these perspectives, or have your own insights to share? Delve into the numbers yourself and shape a personal view in just a few minutes. Do it your way.

A great starting point for your First Industrial Realty Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Ways to Find Winning Stocks?

Don’t let standout opportunities pass you by. Use the Simply Wall Street Screener to zero in on companies that fit your investing style and spot trends ahead of the crowd.

- Pinpoint undervalued gems before they’re on everyone’s radar by running your criteria through our undervalued stocks based on cash flows tool.

- Jump on future-defining breakthroughs by targeting businesses accelerating healthcare with artificial intelligence using our healthcare AI stocks platform.

- Capture potential high-growth returns in the affordable share space by unlocking our selection of penny stocks with strong financials with robust financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal