Deere (DE): Evaluating Valuation After Leadership Shakeup and Renewed Tech Strategy

Most Popular Narrative: 9.9% Undervalued

Deere is currently seen as undervalued, with its fair value estimated nearly 10% above the present share price according to the most widely followed analysis of its future prospects and risks.

Rapid adoption of Deere's precision agriculture and automation solutions (such as JDLink Boost, Precision Essentials bundles, See & Spray technology, and new automation features) is driving higher-value product sales and increased software engagement globally. This positions Deere to benefit from shifts toward high-efficiency, technology-enabled farming, which could lift both future revenue and net margins through higher-margin recurring software and data services.

Can Deere’s big bets on tech-enabled farming really unlock value most investors are missing? Analysts behind this narrative are focusing on a dramatic shift in profit drivers, rising margins, and bolder financial projections. Want to know which assumptions could rewrite the company’s future and what powers this fair value call?

Result: Fair Value of $534.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent tariff pressures and volatile North American demand could challenge Deere’s margin growth and cast doubt on some analysts’ bullish projections.

Find out about the key risks to this Deere narrative.Another View: What Do Market Valuation Ratios Say?

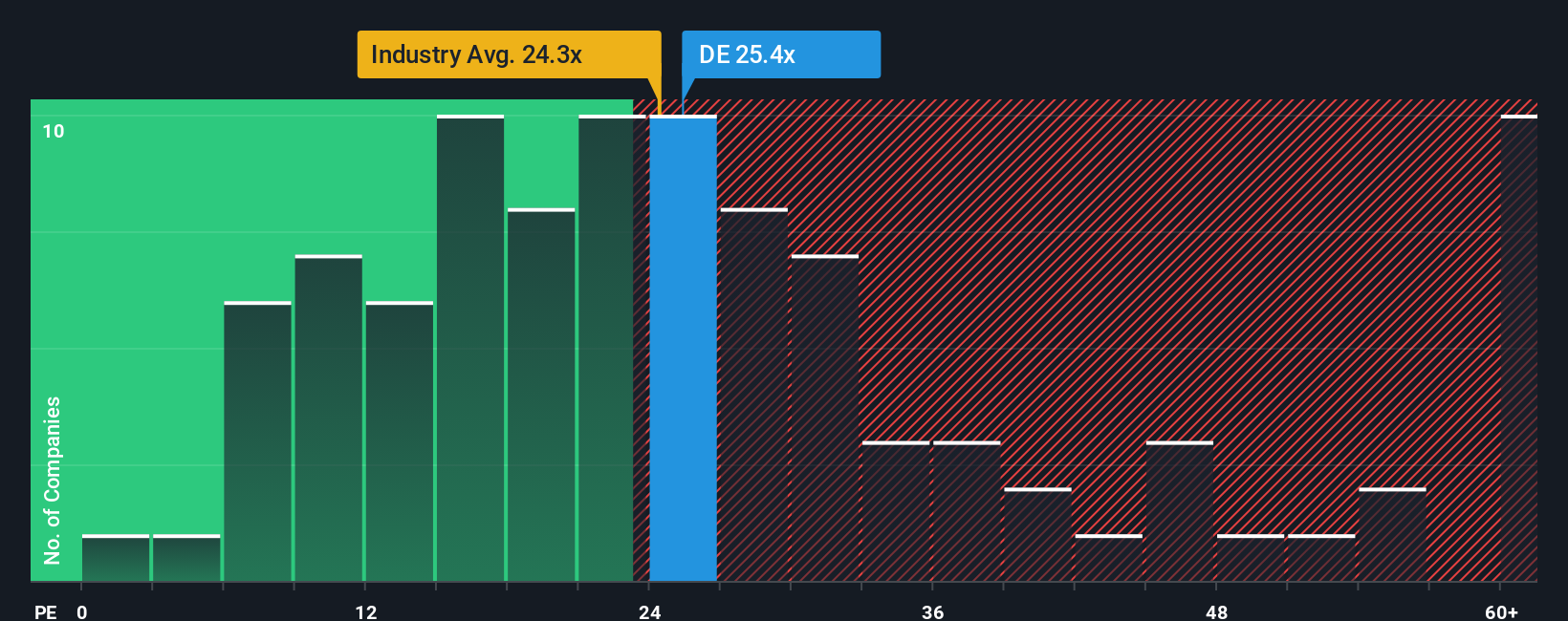

Looking through a different lens, Deere’s current market ratio aligns almost exactly with the US Machinery industry average. This suggests investors may already be pricing in the company’s tech growth story. Is there still upside, or is the market skeptical?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Deere Narrative

If you'd rather chart your own course or trust your own research over the crowd, you can build a narrative from scratch in just minutes. Do it your way

A great starting point for your Deere research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't limit your portfolio to just one story. Uncover high-potential opportunities and give yourself the edge by using the Simply Wall Street Screener to find stocks that could shape your financial future.

- Spot opportunities in small companies with robust financial health by checking out penny stocks with strong financials, which stand out for stability amid volatility.

- Fuel your strategy with income by tracking down dividend stocks with yields > 3%, which consistently deliver attractive yields above 3%.

- Tap into the forefront of innovation with healthcare AI stocks, leading the charge in transforming patient care through artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal