Arthur J. Gallagher (AJG): Revisiting Valuation After Mixed Momentum and Muted Short-Term Gains

Most Popular Narrative: 11.2% Undervalued

According to the most widely followed narrative, Arthur J. Gallagher is considered undervalued by 11.2%. The valuation is anchored on expectations of robust future earnings growth, rising margins, and the impact of ongoing expansion strategies.

"Broader adoption of digital tools, enhanced data analytics, and early-stage AI projects within the company's operations are producing measurable efficiency improvements and margin expansion. This is positioning net margins and overall profitability for continued long-term growth."

Want to know what’s fueling this bullish outlook? Underneath the surface are aggressive revenue projections, margin upgrades, and bold forecasts for future earnings, which go far beyond what industry averages suggest. Discover which specific numbers, assumptions, and financial hurdles are pushing the fair value higher in this narrative.

Result: Fair Value of $337.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, overreliance on acquisitions and sudden declines in property insurance rates could disrupt growth and challenge the optimism behind current analyst forecasts.

Find out about the key risks to this Arthur J. Gallagher narrative.Another View: Testing the Valuation with Earnings Multiples

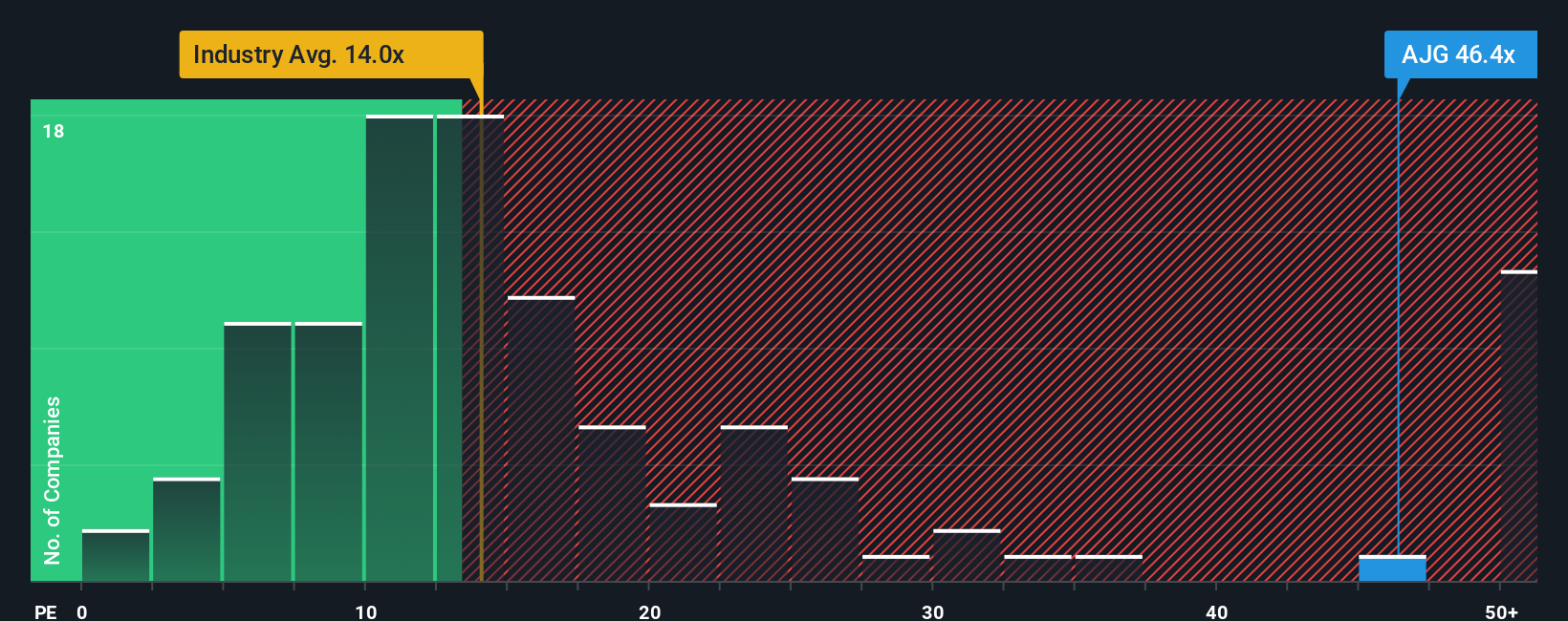

While the previous analysis points to an undervalued scenario, looking at the company through the lens of its earnings multiple compared to the broader industry offers a different perspective. Some believe this method signals caution and challenges the optimistic assumptions. Which approach gives the truest sense of value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arthur J. Gallagher Narrative

If the prevailing viewpoints do not quite match your investment style, consider diving into the data yourself. You can develop your own perspective in just a few minutes. Do it your way

A great starting point for your Arthur J. Gallagher research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock the full potential of your investment strategy by targeting companies and trends you might be missing. Take a closer look at these hand-picked opportunities designed to help you stay a step ahead.

- Supercharge your portfolio with companies leading the AI revolution by checking out AI penny stocks, making waves in intelligent automation and next-generation software.

- Secure steady income and long-term growth by searching for dividend stocks with yields > 3%, which consistently deliver reliable yields above 3% and reward investors year after year.

- Tap into value opportunities by browsing undervalued stocks based on cash flows, hidden gems that trade below their intrinsic worth and could offer strong upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal