Arch Capital Group (ACGL) Valuation Spotlight: Analyzing the Expanded $2 Billion Share Buyback

Arch Capital Group (ACGL) just made headlines by announcing a $2 billion increase to its share repurchase plan, bringing the total remaining authorization to $2.3 billion. For investors weighing next steps, this is not just another announcement; it is a clear sign that management believes the stock is a good use of capital right now. Share buybacks often stir debate about whether a company is prioritizing returns for current shareholders or signaling undervaluation by the broader market.

This new buyback expansion comes at an interesting time for Arch Capital Group. The company has steadied itself through the year, with its stock price barely moving and down around 14% over the past 12 months, despite annual revenue and net income continuing to grow. Over the longer term, momentum has been strong, including a gain of more than 100% over three years and a doubling in value over the past five. The combination of long-term growth and a quiet year sets the stage for renewed scrutiny inside and outside the company.

So, is this increased buyback a hint that ACGL is trading at a discount, or does the current price already reflect all the future growth the company can deliver?

Most Popular Narrative: 16% Undervalued

According to the most widely discussed narrative, Arch Capital Group appears to be undervalued by around 16% relative to analysts' estimates of its fair value. This reflects a blend of cautious optimism about growth catalysts and ongoing uncertainties in the insurance landscape.

Arch Capital's cycle management strategy focuses on allocating capital to lines of business with attractive risk-adjusted returns, which could potentially drive future earnings growth. The company's investment in data and analytics is seen as a catalyst for enhancing risk selection capabilities, improving underwriting profitability and net margins over time.

What if Arch Capital’s future profits could surpass even bullish forecasts? This narrative leans heavily on forward-looking assumptions for revenue, profit margins and valuation multiples that you will want to see for yourself. Which financial levers are set to drive the next leap? Uncover what is fueling this undervaluation claim and how bold the underlying projections really are.

Result: Fair Value of $108.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, unexpected natural disaster losses or rising competition could still threaten Arch Capital’s margins and challenge even the most optimistic projections.

Find out about the key risks to this Arch Capital Group narrative.Another View: DCF Model Paints a Bolder Picture

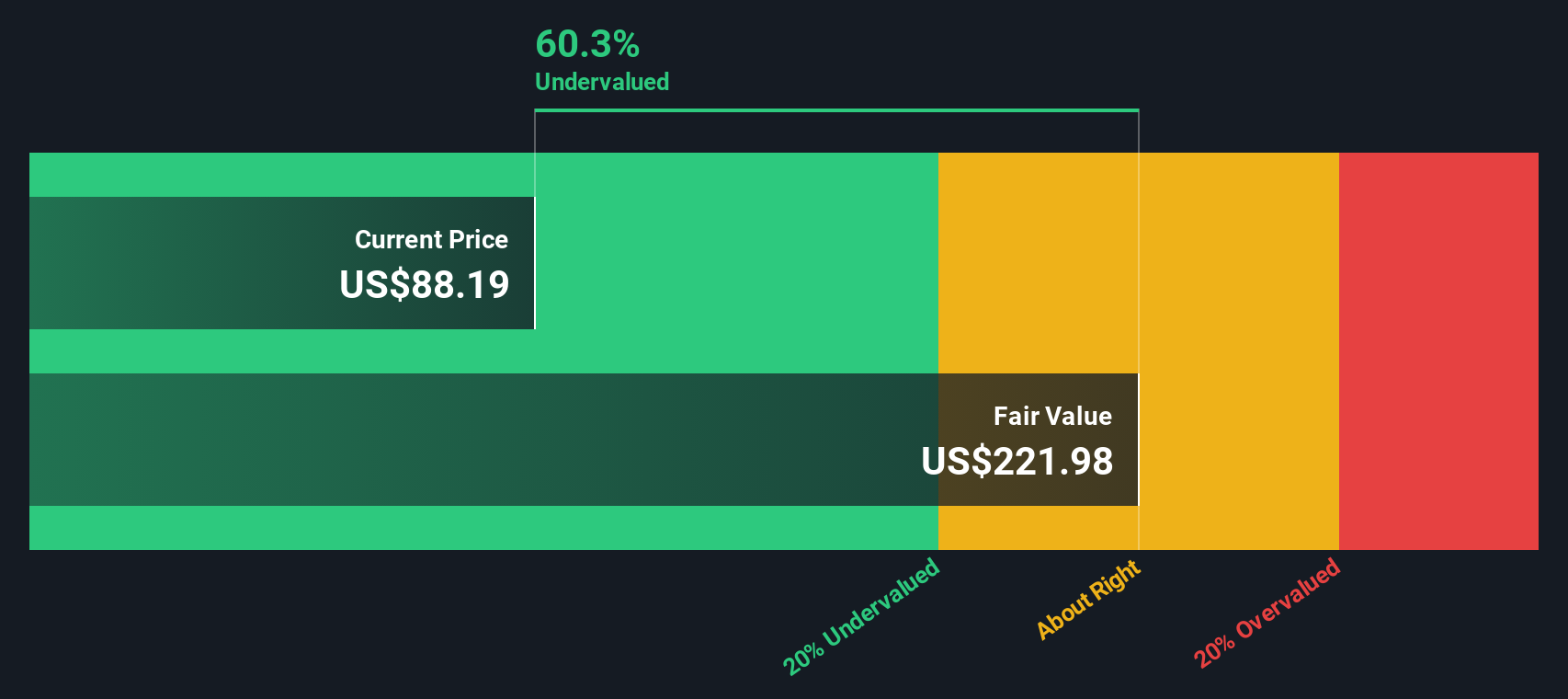

Stepping back from analyst price targets, our DCF model suggests Arch Capital Group’s shares could be even further undervalued. The SWS DCF model looks beyond current market sentiment and spotlights future cash flows as the key driver of value. Could this signal a larger opportunity than most expect?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Arch Capital Group Narrative

If you have a different outlook or want a hands-on approach to the numbers, you can quickly craft your own perspective using our tools: Do it your way.

A great starting point for your Arch Capital Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Smart Move?

Why stop with one opportunity? Put yourself ahead of the market by uncovering stocks with exceptional growth, future-focused technology, or income potential, all at your fingertips.

- Spot income opportunities and strengthen your financial future by adding dividend stocks with yields > 3% to your research toolkit.

- Capture high-upside potential by evaluating undervalued stocks based on cash flows on the radar for value-seeking investors.

- Stay on the pulse of healthcare innovation and see which companies could reshape medicine with healthcare AI stocks right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal