Copart (CPRT): Assessing Valuation After Strong Earnings Beat and Digital Expansion Success

If you’ve been riding the waves with Copart (CPRT), the latest quarterly earnings might have turned your head. The company just posted standout gains in net income and earnings per share, surpassing analyst estimates against an industry backdrop that’s been anything but smooth. Management credits this performance to Copart’s sharp focus on digital auction expansion and operational improvements, two levers that continue to separate it from competitors and drive profitability in a challenging market.

This strong report comes after a stretch where Copart’s share price has moved with fits and starts. Over the last year, momentum has been mixed: the stock is down slightly during that period, but it’s rallied over the past month as recent results have rekindled interest. Even with some choppiness, Copart’s multi-year track record remains, showing major long-term gains and reinforcing the narrative that this is a business disciplined about innovation and capital returns.

So after this rebound on better-than-expected numbers, the question lingers: is Copart now trading at an attractive entry point, or has the market already factored in the next wave of growth?

Most Popular Narrative: 17.9% Undervalued

According to the most widely followed narrative, Copart shares are currently trading well below what analysts view as fair value, suggesting an attractive entry point for potential investors.

"Copart's advancements in artificial intelligence-enabled image recognition tools and vertical expansion into new service offerings, such as Title Express, are expected to improve efficiency and increase revenue from its insurance business. These technologies are likely to enhance operational margins by reducing processing times and increasing the accuracy of total loss decisions."

Curious how analysts justify Copart’s robust price targets? The backbone is a set of bold assumptions about growth that might surprise you. The narrative hinges on rising revenue streams, expanding markets, and ambitious profit margins. These numbers could set Copart’s future apart from typical industry players. Ready to unlock the real strategy behind this valuation?

Result: Fair Value of $59.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as potential retaliatory tariffs or shifting insurance trends could slow Copart’s momentum and challenge the bullish outlook analysts have set.

Find out about the key risks to this Copart narrative.Another View: Valuation Based on Earnings Multiple

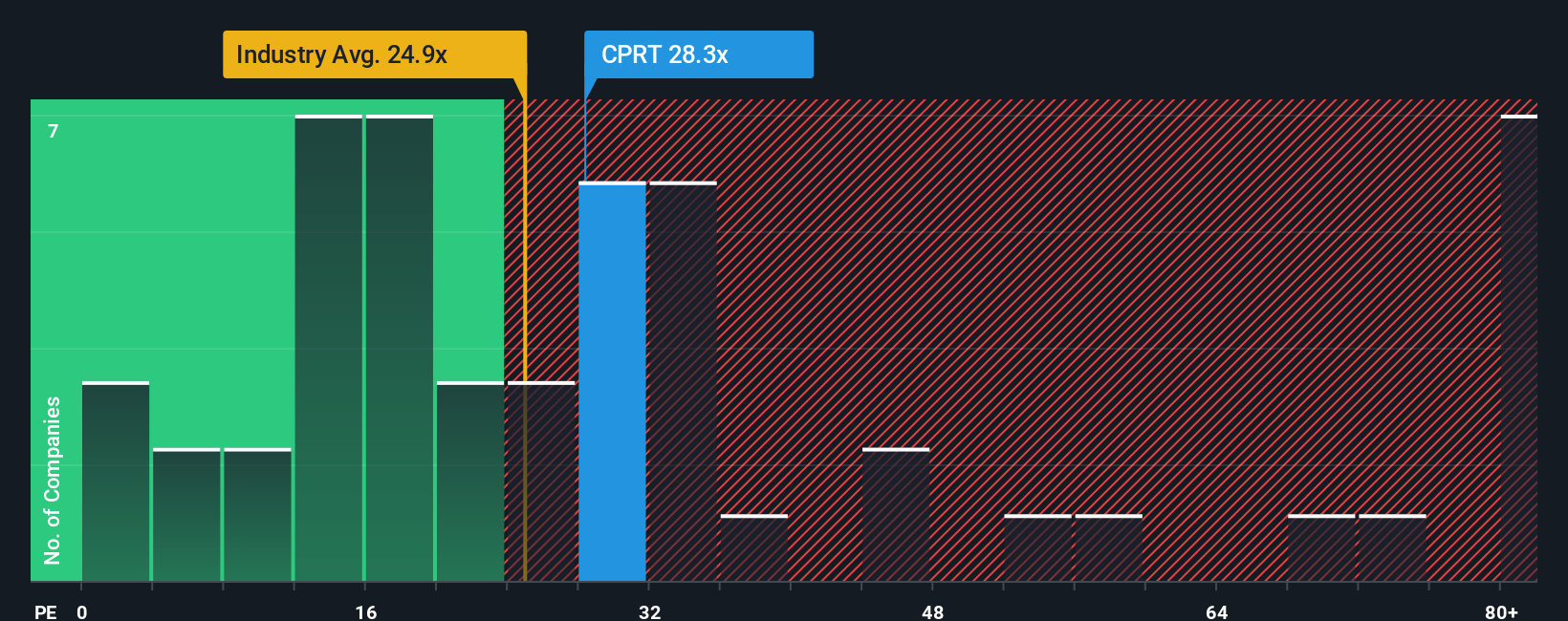

Looking at Copart through the lens of its price-to-earnings ratio offers a different perspective. Compared to similar companies in its industry, Copart appears more expensive. Does this indicate hidden risks, or is the premium warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Copart Narrative

If you want a different angle or prefer to check the numbers on your own, it’s easy to piece together your own story in just minutes. So why not Do it your way?

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Copart.

Looking for More Winning Investment Ideas?

Don’t miss your chance to unlock fresh opportunities. The Simply Wall Street Screener puts standout stocks just a few clicks away and tailors them to the strategies smart investors are using right now.

- Uncover small-cap companies with strong financials and growth momentum by checking out our penny stocks with strong financials that may be primed for outsized returns.

- Spot high-potential opportunities in next-generation medical innovation by using our healthcare AI stocks that zeroes in on breakthroughs at the intersection of technology and healthcare.

- Jump on undervalued gems overlooked by the market by exploring our undervalued stocks based on cash flows full of stocks offering attractive pricing based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal