OPENLANE (KAR): Assessing Valuation Following the Launch of Audio Boost AI for Auto Dealers

OPENLANE (KAR) is turning heads again, this time with the launch of Audio Boost AI for its US marketplace. This new tool is designed to give auto dealers an edge when evaluating vehicles. By combining high-quality engine audio recordings with AI-generated highlights, OPENLANE’s latest move aims to make engine diagnostics easier and faster for buyers on its platform. If you’re watching this stock, you might be wondering whether this product launch signals just another incremental upgrade or something that could change the way wholesale vehicle sales operate.

Unveiling Audio Boost AI is not an isolated event for OPENLANE. It builds on the momentum from last year’s releases of Visual Boost AI and Code Boost IQ, all of which focus on using advanced data to give buyers and sellers more confidence. Investors have taken notice, as OPENLANE’s stock price has climbed nearly 79% over the past year, outpacing broader market averages and indicating growing optimism around its innovation pipeline.

With shares rallying strongly on the back of these advancements, some may wonder if future growth is already reflected in the current price, or if OPENLANE’s present valuation could still offer room for new buyers to benefit.

Most Popular Narrative: 4.2% Undervalued

OPENLANE is seen as undervalued by the most widely followed narrative, with analysts projecting a fair value above the current share price.

Ongoing investment in AI-driven products, process automation, and user experience enhancements, such as Absolute Sale and advanced inspection technology, is driving higher transaction values and operational efficiencies. These efforts are already resulting in significant margin expansion and are likely to further improve net margins over time.

Want to find out what’s propelling this valuation? A combination of future earnings growth, improved margins and bold projections are powering the narrative. The secret sauce behind these numbers might surprise you. Dive deeper to uncover exactly what’s fueling this bullish fair value.

Result: Fair Value of $30.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising competition in digital auctions and potential share dilution could challenge OPENLANE’s margin growth and long-term share price prospects.

Find out about the key risks to this OPENLANE narrative.Another View: Valuation by Earnings Ratio

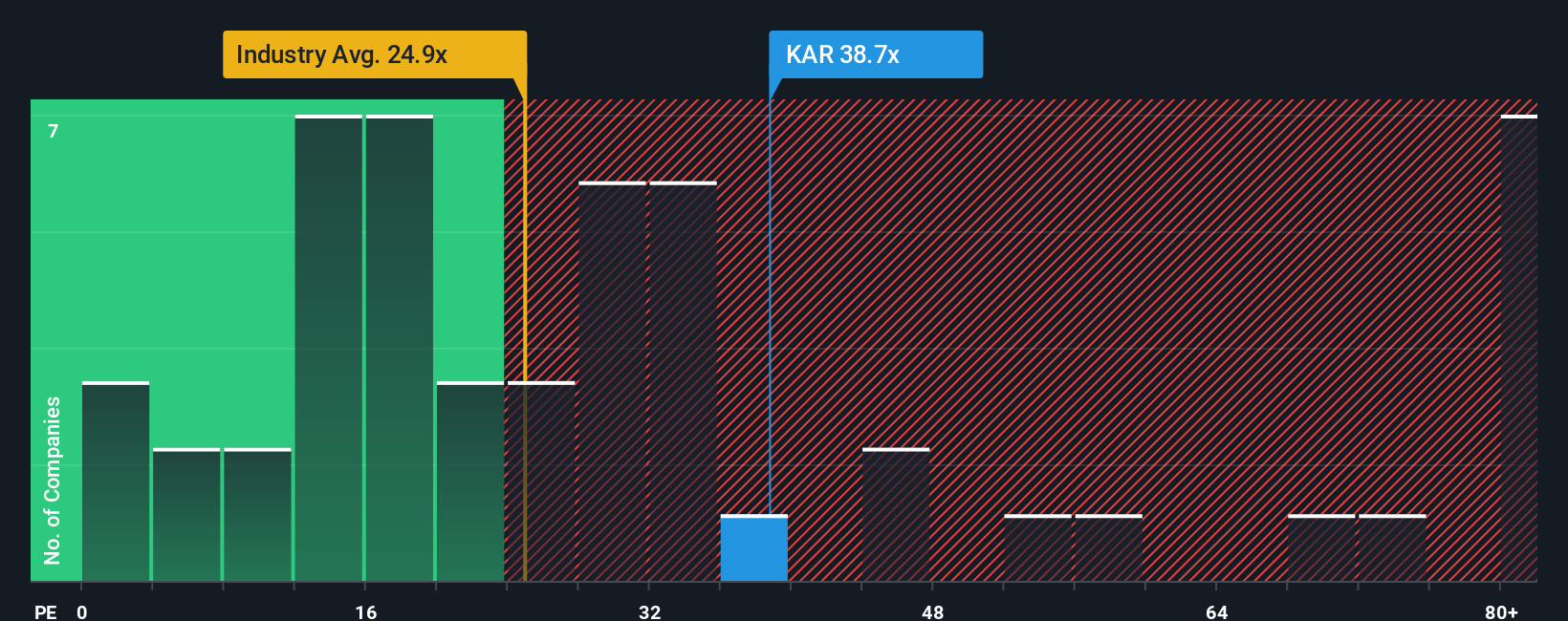

While the fair value estimate suggests OPENLANE is undervalued, a quick look at its earnings multiple presents a different perspective, as shares currently trade above the industry average. Is the market already pricing in future growth?

See what the numbers say about this price — find out in our valuation breakdown.For more details on how this price compares within the industry, see our in-depth valuation breakdown below.

Build Your Own OPENLANE Narrative

If this outlook doesn’t match your own, or you’d like to see what the data tells you, it’s simple to craft your own narrative in just a few minutes. Do it your way.

A great starting point for your OPENLANE research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Use the Simply Wall Street Screener to quickly find stocks with the features that matter most to you and put your money to work smarter.

- Target value by finding market underdogs trading well below their intrinsic worth with our powerfully simple undervalued stocks based on cash flows.

- Spot future leaders tapping into artificial intelligence breakthroughs using our forward-thinking AI penny stocks.

- Pursue reliable yields for your portfolio by scanning companies offering competitive cash returns with the dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal