A Look at Assurant’s (AIZ) Valuation Following Launch of HOIVerify Origination for Mortgage Lenders

Assurant (AIZ) just unveiled HOIVerify Origination, a new API-enabled product focused on streamlining insurance verification for mortgage lenders. It promises real-time policy data, support for multiple carriers, and automation that not only trims manual effort but also tightens compliance. Early traction is already clear, as one of the United States' fastest growing lenders, Spring EQ, is piloting the tool. This gives the launch more weight than the average product update.

This announcement lands after a year in which Assurant’s share price has climbed roughly 11%, outpacing broader market benchmarks, with growing momentum in recent months. The last quarter alone saw an 8% boost, while a strong 30-day rally hints that investors might be starting to price in fresh growth potential. It is not just about stock price, either. Recent partner integrations and new product rollouts show the company’s knack for keeping its footprint relevant in the changing insurance landscape.

So, is the market fully recognizing the value behind Assurant’s recent moves, or does HOIVerify signal upside still waiting to be unlocked?

Most Popular Narrative: 12% Undervalued

The widely followed analyst narrative views Assurant as undervalued, with its current share price trading well below consensus fair value. This underpins expectations for meaningful upside in the stock, if forecasts prove accurate.

Assurant is capitalizing on the proliferation of connected devices and increasing device protection needs. This is demonstrated by 2.4 million net new device protection subscribers, international acquisitions expanding repair capabilities, and strong new partnerships, which position the company for sustained revenue growth and improved recurring earnings in its Lifestyle segment.

Want to know what powers this bullish call? The narrative leans on a growth roadmap that pushes margins and profitability higher over time. What is the secret sauce in these valuations? Consider ambitious earnings momentum and a margin evolution many competitors would envy. Curious which strategic moves shape these bold projections? Discover what really drives that price target higher.

Result: Fair Value of $241 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing regulatory changes or heightened digital competition could disrupt these optimistic projections and challenge Assurant’s ability to sustain accelerating growth.

Find out about the key risks to this Assurant narrative.Another View: Looking Through a Different Lens

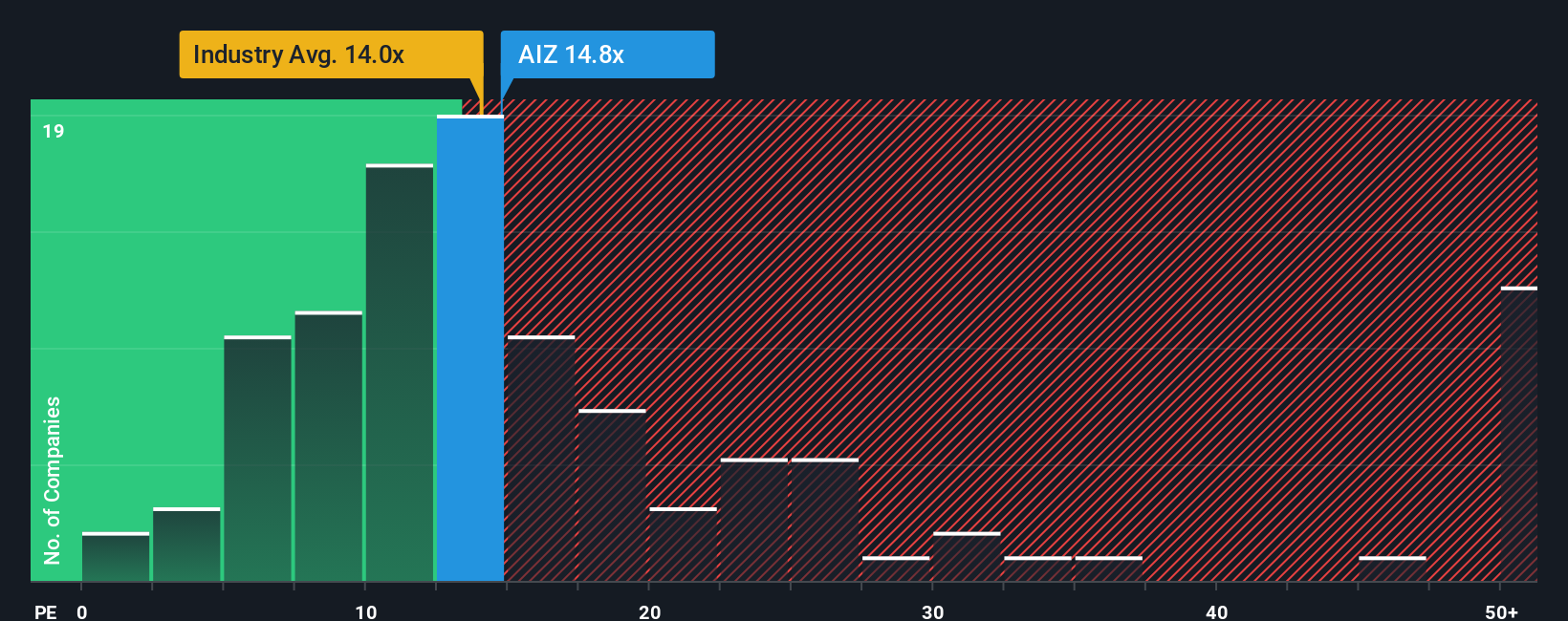

While analysts point to upside in Assurant’s shares, a look at traditional price-to-earnings ratios adds caution. The stock trades at a valuation above both industry and peer averages, raising questions about how much value is actually being overlooked. Could investor expectations already be built in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Assurant Narrative

If you see things differently or want to chart your own course using the latest numbers, you can shape a personalized view in just a few minutes with Do it your way.

A great starting point for your Assurant research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity when you can broaden your horizons with new smart picks? Take action now and find investment gems you do not want to miss.

- Uncover tomorrow's growth stories by tapping into penny stocks with strong financials, which deliver strong fundamentals at wallet-friendly prices.

- Ride the next tech boom and fuel your portfolio with potential from healthcare AI stocks, as it transforms patient care through advanced artificial intelligence.

- Supercharge your passive income strategy by adding dividend stocks with yields > 3%, which offers market-beating yields and solid financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal