Toro (TTC): Evaluating Valuation After Earnings Beat, Revenue Miss, and Revised 2025 Outlook

Toro (TTC) just gave investors a lot to consider with its latest earnings announcement. While adjusted earnings per share edged out forecasts, revenue missed the mark and declined from last year. In addition, management lowered the company’s full-year sales and earnings outlook, highlighting how macroeconomic pressures, changing consumer behavior, and tariffs are shaping business expectations for the rest of 2025. If you follow Toro, this combination of results offers fresh signals for where the business may be headed next.

Taking a step back, Toro’s stock has inched up only about 0.4% over the past year with a modest 2.9% gain year-to-date. Over the past month, though, shares have climbed over 10%, hinting that momentum might be building despite a more cautious long-term picture. Recent developments, like the company’s AMP cost savings program and mixed performance across different business segments, add further nuance for anyone weighing the potential upside versus risks.

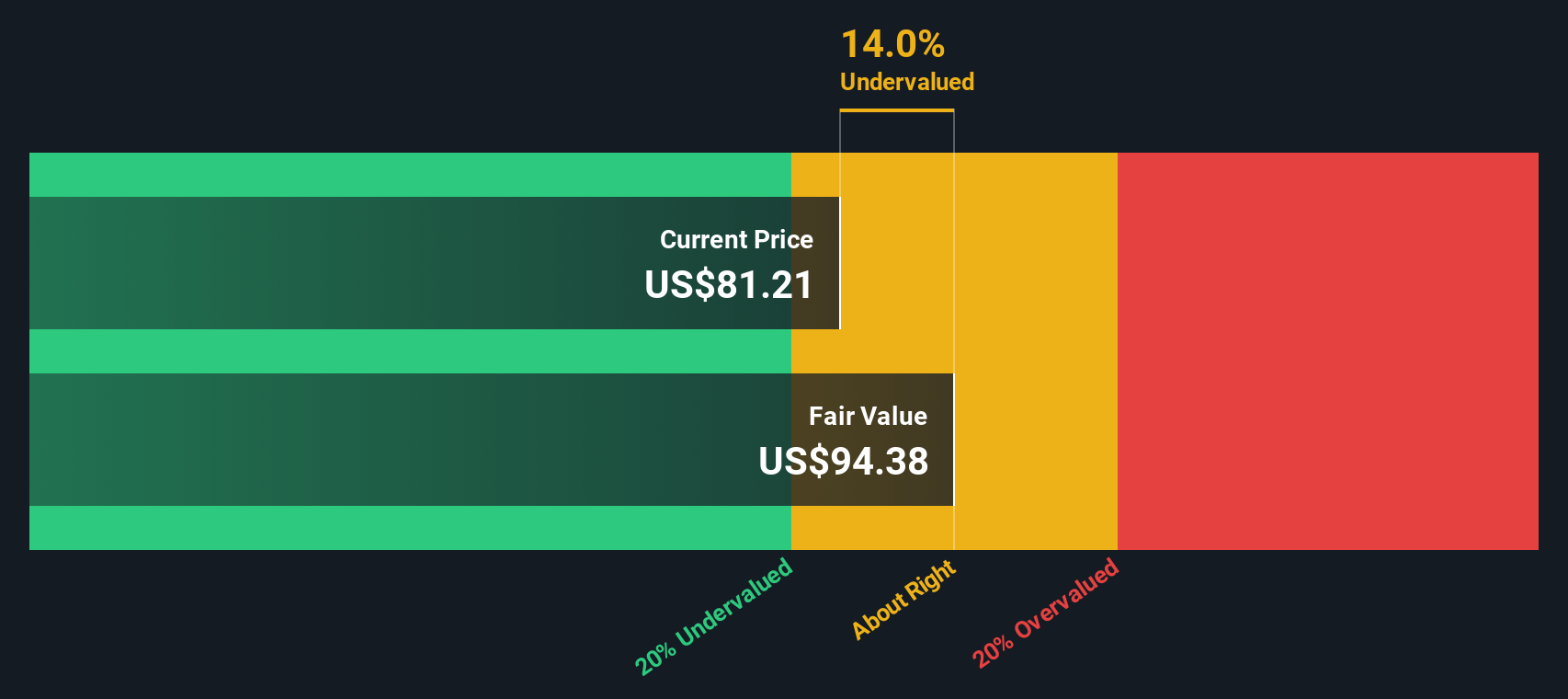

After a year of sluggish returns and this bump in the past month, is Toro’s current price a reflection of real value, or are investors still pricing in hopes of a rebound and future growth?

Most Popular Narrative: 8.6% Undervalued

A widely followed narrative suggests Toro is currently trading below its fair value, reflecting optimism for profitability and market recovery based on key strategic moves.

Toro is prioritizing innovation to address customer needs and align with market growth trends, which should support revenue growth. The introduction of cutting-edge products, such as autonomous mowers and smart connected solutions, aims to improve productivity and resource efficiency. This strengthens Toro's competitive position and has the potential to boost sales and profitability.

Curious about what is fueling this bullish outlook? There is a bold set of assumptions powering the upside, including future earnings increases, margin expansion, and significant investments in new technology. Want to see the numbers and what could make or break these forecasts? The narrative is built on projections that might surprise you.

Result: Fair Value of $89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, supply challenges and fluctuating raw material costs could stall Toro’s rebound and potentially undermine optimistic assumptions around profit margins or sales growth.

Find out about the key risks to this Toro narrative.Another View: SWS DCF Model Weighs In

Looking at Toro through the lens of our DCF model offers a different perspective. This method suggests the stock could be trading below its fair value. How do these approaches measure up? What should investors watch next?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Toro Narrative

If you see the story differently or want to dig into the details yourself, you can build your own case in just a few minutes. Do it your way

A great starting point for your Toro research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Uncover more promising stocks and keep your investing momentum strong. Shake up your strategy by checking out these handpicked themes before your next move.

- Boost your income by sizing up companies offering substantial yields with our quick route to dividend stocks with yields > 3%.

- Spot tomorrow’s disruptors in technology and algorithms by tapping into potential breakthroughs with quantum computing stocks.

- Strengthen your portfolio with smartly priced opportunities using top picks from our collection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal