What White Mountains Insurance Group (WTM)'s Leadership Transition Means for Shareholders

- White Mountains Insurance Group has announced a major leadership transition, with CEO Manning Rountree set to retire at the end of 2025, to be succeeded by current President and CFO Liam Caffrey; additional executive changes for the President and CFO roles are also scheduled for January 1, 2026.

- This wave of planned appointments draws from a pool of internal leaders and executives with extensive insurance and finance expertise, suggesting both continuity and the potential for fresh perspectives at the company's helm.

- We’ll explore how the upcoming CEO and executive transitions contribute to White Mountains Insurance Group’s evolving investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is White Mountains Insurance Group's Investment Narrative?

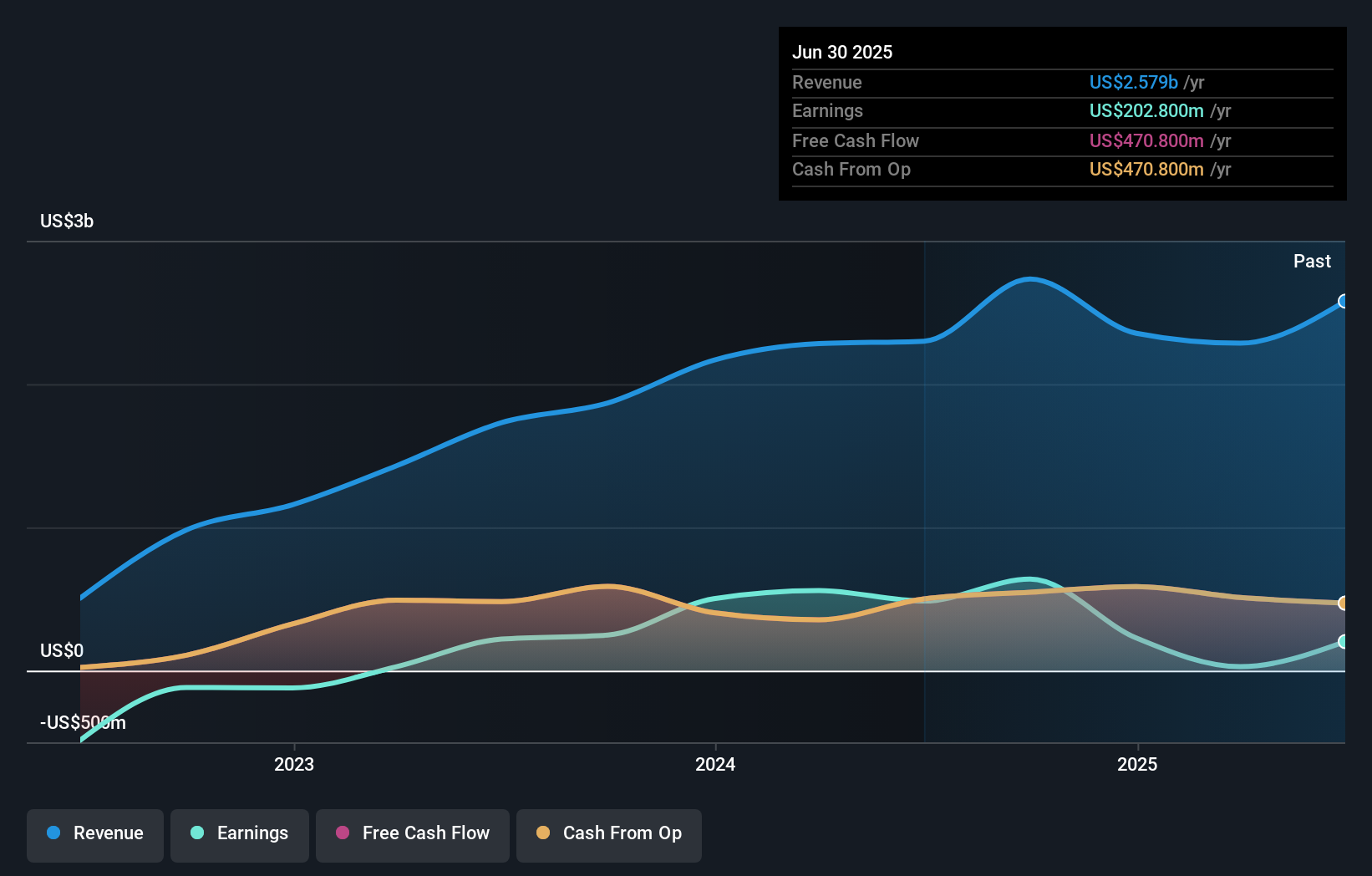

Owning White Mountains Insurance Group is often about believing in the team’s ability to steer through shifting insurance markets using capital discipline and opportunistic dealmaking. The incoming leadership changes, set for January 2026, won’t dramatically alter the near-term catalysts already under discussion, ongoing operational performance and one-off earnings adjustments are likely to remain central to the investment story. However, this transition introduces a heightened degree of uncertainty around execution risk, especially given the mixed recent performance, including modest returns and fluctuating earnings. With the new CEO, President, and CFO all hired internally and bringing relevant insurance and finance backgrounds but limited tenure at White Mountains, succession might offer both stability and the chance for new strategic angles. For now, unless unforeseen strategic shifts emerge, the biggest risks continue to be execution missteps, margin pressures, and uncertain growth prospects. Yet the risk profile could shift as new leadership beds in, something investors should be aware of.

White Mountains Insurance Group's share price has been on the slide but might be up to 27% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore another fair value estimate on White Mountains Insurance Group - why the stock might be worth as much as $1388!

Build Your Own White Mountains Insurance Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your White Mountains Insurance Group research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free White Mountains Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate White Mountains Insurance Group's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal