It's Down 26% But Zevia PBC (NYSE:ZVIA) Could Be Riskier Than It Looks

Zevia PBC (NYSE:ZVIA) shares have had a horrible month, losing 26% after a relatively good period beforehand. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 145% in the last twelve months.

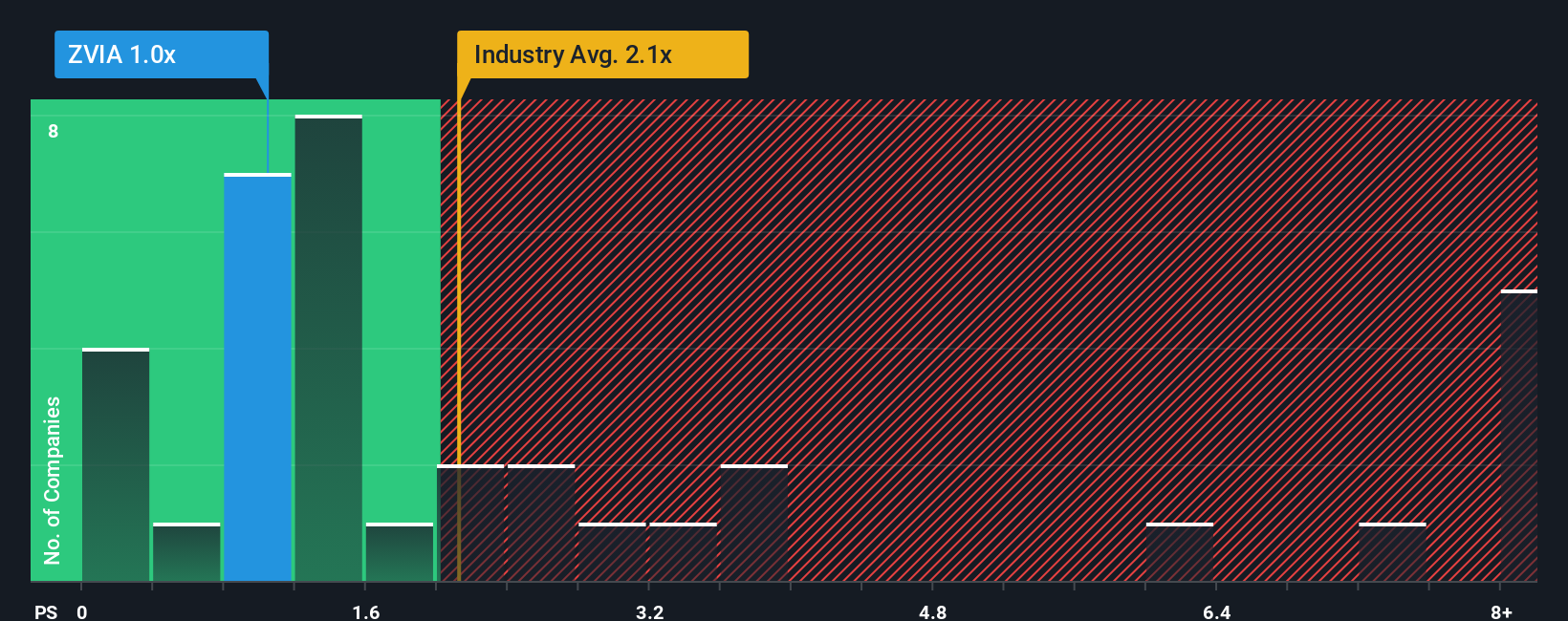

Since its price has dipped substantially, Zevia PBC's price-to-sales (or "P/S") ratio of 1x might make it look like a buy right now compared to the Beverage industry in the United States, where around half of the companies have P/S ratios above 2.1x and even P/S above 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Zevia PBC

What Does Zevia PBC's P/S Mean For Shareholders?

Zevia PBC could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Zevia PBC's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Zevia PBC?

The only time you'd be truly comfortable seeing a P/S as low as Zevia PBC's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 1.1% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 5.4% over the next year. That's shaping up to be similar to the 6.0% growth forecast for the broader industry.

In light of this, it's peculiar that Zevia PBC's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Zevia PBC's P/S Mean For Investors?

Zevia PBC's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Zevia PBC's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

You always need to take note of risks, for example - Zevia PBC has 1 warning sign we think you should be aware of.

If you're unsure about the strength of Zevia PBC's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal