American Financial Group (AFG): Revisiting Valuation After Q2 2025 Earnings and Insider Selling

American Financial Group (AFG) has just released its Q2 2025 earnings, and the results are giving investors plenty to chew on. The company’s strong underwriting margins and higher net investment income signal resilience, but a dip in core net operating earnings and weakness in alternative investments raise fresh concerns about what lies ahead. Adding to the swirl, director Amy Y Murray’s recent decision to sell shares is likely on investors’ radars. Analyst commentary also points to tightening reserve releases and an uptick in claims costs.

All this comes against the backdrop of a stock that has been on a steady trajectory. Over the past year, AFG shares have delivered an 8% return. The gains over the past month and past three months hint at renewed momentum. Insider selling and a slightly softer outlook may give some investors pause, but the company’s longer-term track record remains impressive and the broader story is far from static.

With mixed signals in the latest report and some shifts in sentiment, investors may be wondering if American Financial Group is trading at a bargain or if the market has already built in all the future growth it can expect.

Most Popular Narrative: 4.6% Overvalued

According to the most widely followed narrative, American Financial Group is regarded as slightly overvalued compared to the calculated fair value. While there are promising catalysts for future growth, the stock price currently trades at a modest premium, suggesting that much of the good news may be already reflected.

The ongoing accumulation of wealth among U.S. households is expected to drive greater demand for insurance and annuity products, positioning AFG for continued premium growth and positive impacts on revenue. Advancements in digital transformation and enhanced use of data analytics are supporting more disciplined underwriting and risk management at AFG, which should help improve net margins and operational profitability over the long term.

The growth story is full of intrigue, hinging on a roadmap packed with aggressive margin expansion, disciplined cost moves, and a bold bet on future cash flows. Want to know what optimistic profit forecasts, falling revenue projections, and a future multiple rarely seen in insurance all add up to? Explore the factors that drive this overvalued call and see if you agree with this consensus verdict.

Result: Fair Value of $132.6 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent catastrophe losses or a faltering investment environment could quickly undermine the optimistic outlook that is currently priced into American Financial Group’s shares.

Find out about the key risks to this American Financial Group narrative.Another Perspective: Our DCF Model Sees Things Differently

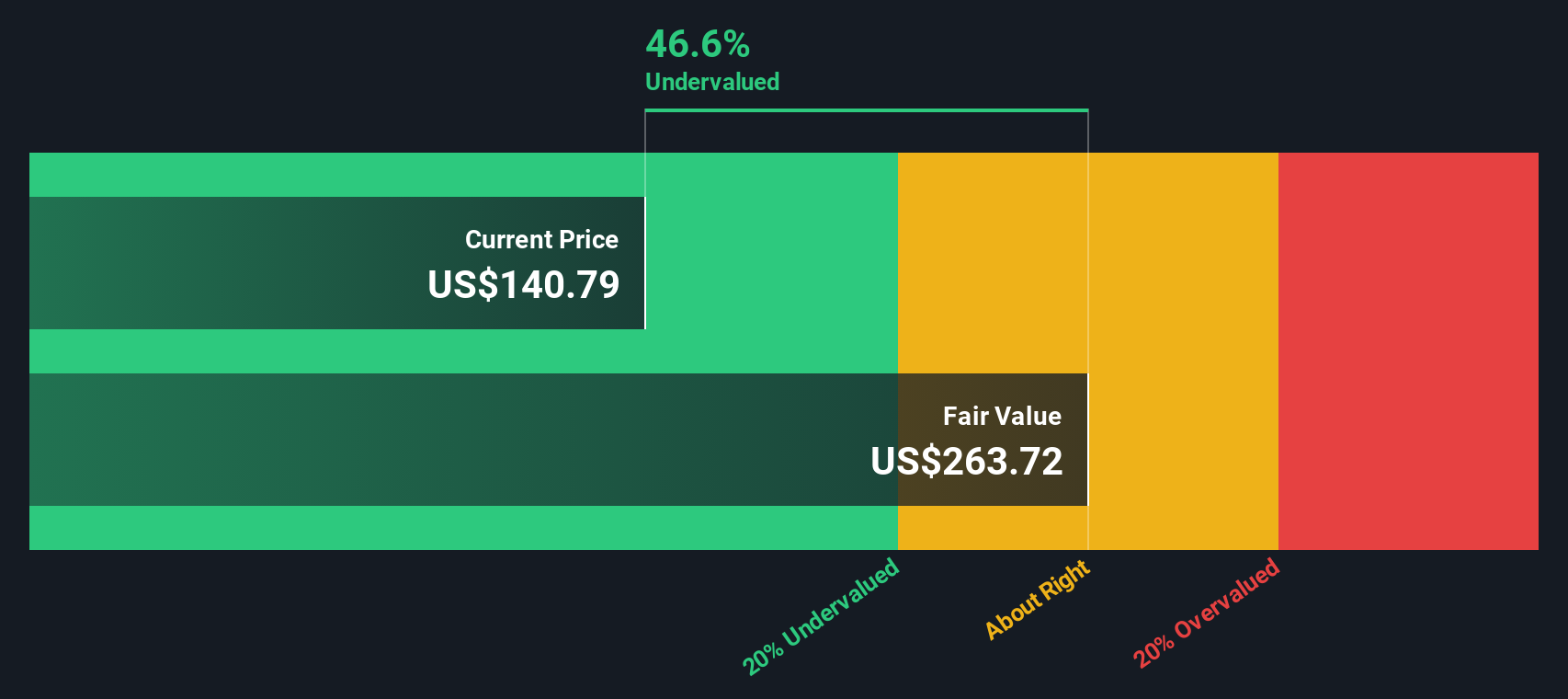

Interestingly, our DCF model paints a much more optimistic picture. It suggests American Financial Group could be trading well below its true worth. Does this mean the consensus may be underestimating the company?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Financial Group Narrative

If you have a different perspective or enjoy digging into the details, you can craft your own view in just a few minutes. Do it your way.

A great starting point for your American Financial Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Level up your investing journey and make smarter moves by tapping into fresh, under-the-radar opportunities. Let the Simply Wall Street Screener show you where the next big stories are taking shape. These unique lists are your shortcut to what’s moving now.

- Uncover overlooked opportunities with strong fundamentals as you scan for value using undervalued stocks based on cash flows.

- Ride the wave of medical innovation by tracking companies reshaping patient care and diagnostics through healthcare AI stocks.

- Tap into payout potential and consistent returns by scanning for high-yield investments via dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal