Will Kinsale Capital Group’s (KNSL) New Shelf Registration Signal a Shift in Growth Strategy?

- In late August 2025, Kinsale Capital Group filed an omnibus shelf registration, enabling the company to offer common stock, preferred stock, depositary shares, and warrants in the future.

- This move creates additional financial flexibility for Kinsale, allowing it to swiftly access capital markets for potential growth initiatives or balance sheet management.

- We'll review how this enhanced capital-raising capacity may shape Kinsale's investment narrative and long-term growth prospects.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Kinsale Capital Group Investment Narrative Recap

To be a shareholder in Kinsale Capital Group, you need to believe in the continued expansion of the excess and surplus (E&S) insurance market and the company’s ability to efficiently capture new business through technological efficiency and disciplined underwriting. While the recent omnibus shelf registration gives Kinsale more financial leeway, it does not materially change the pivotal short term catalyst, continued growth in small business and homeowners segments, or the ongoing risk from mounting competition in commercial property, where margin pressure remains significant. Among Kinsale’s recent developments, its July dividend declaration stands out as a relevant signal of continued shareholder returns even as the company prepares for potentially greater capital needs. The regularity and growth of its dividends offer some reassurance that the company’s fundamentals have remained solid, though evolving capital needs could impact future payout decisions if market conditions change. In contrast to steady dividend growth, investors should be aware of the persistent risk that heightened competition in key segments...

Read the full narrative on Kinsale Capital Group (it's free!)

Kinsale Capital Group's narrative projects $2.3 billion revenue and $546.8 million earnings by 2028. This requires 9.5% yearly revenue growth and a $100.1 million earnings increase from $446.7 million.

Uncover how Kinsale Capital Group's forecasts yield a $499.11 fair value, a 10% upside to its current price.

Exploring Other Perspectives

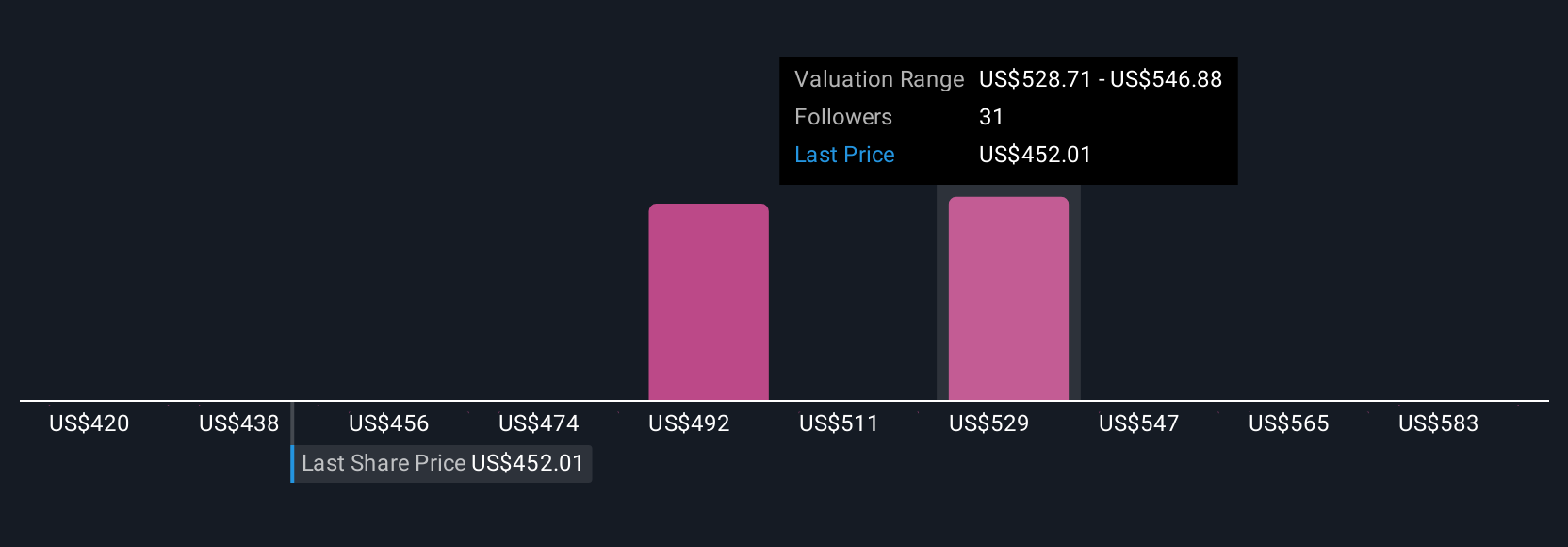

Six members of the Simply Wall St Community estimate Kinsale’s fair value between US$419.65 and US$601.41 per share. While many see opportunity in the company’s specialized E&S focus, risks from shrinking commercial property premiums and market competition could weigh on future performance, so explore the range of viewpoints before deciding.

Explore 6 other fair value estimates on Kinsale Capital Group - why the stock might be worth as much as 32% more than the current price!

Build Your Own Kinsale Capital Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinsale Capital Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Kinsale Capital Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinsale Capital Group's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal