Undervalued Small Caps With Insider Action To Watch In September 2025

As the U.S. markets experience a slight dip after reaching new highs, driven by underwhelming job growth and anticipation of potential interest rate cuts, investors are closely watching small-cap stocks for opportunities amid these shifting economic conditions. In this environment, identifying promising small-cap stocks often involves looking at companies with strong fundamentals and recent insider activity, which can signal confidence in their future prospects despite broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.1x | 3.0x | 31.65% | ★★★★★☆ |

| Angel Oak Mortgage REIT | 6.4x | 4.1x | 30.43% | ★★★★★☆ |

| Tandem Diabetes Care | NA | 0.8x | 49.84% | ★★★★★☆ |

| Citizens & Northern | 11.7x | 2.9x | 39.74% | ★★★★☆☆ |

| Limbach Holdings | 35.5x | 2.3x | 39.98% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 30.20% | ★★★★☆☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 17.78% | ★★★★☆☆ |

| Shore Bancshares | 10.5x | 2.7x | -90.43% | ★★★☆☆☆ |

| Auburn National Bancorporation | 14.1x | 3.0x | 20.03% | ★★★☆☆☆ |

| Farmland Partners | 7.0x | 8.5x | -44.48% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

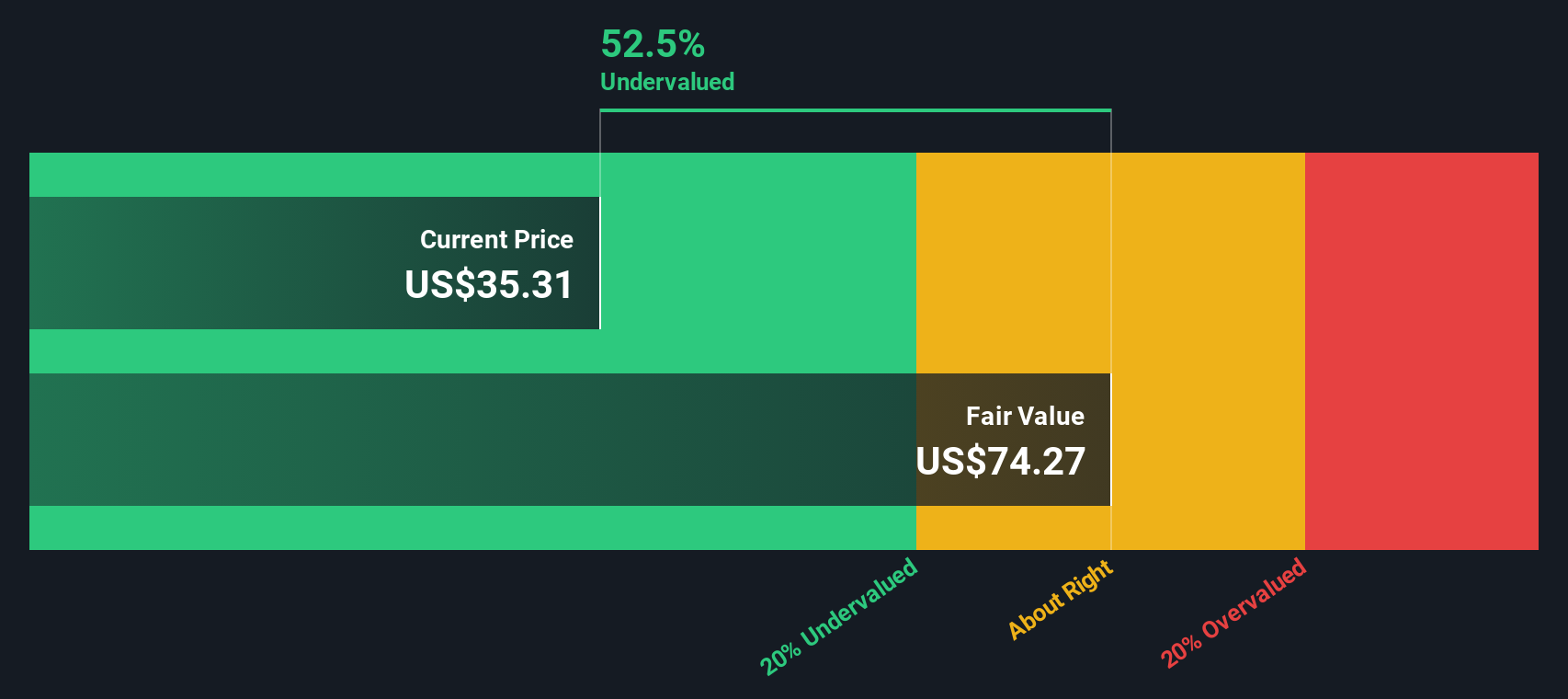

Monro (MNRO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Monro operates a chain of auto repair centers with a market capitalization of approximately $1.88 billion, focusing on providing automotive maintenance and repair services.

Operations: Monro's revenue primarily comes from its auto repair centers, with a recent figure of $1.20 billion. The company's cost structure is significantly impacted by the cost of goods sold (COGS), which was $787.82 million in the latest period. Over time, Monro's gross profit margin has shown variability, most recently at 34.52%.

PE: -25.9x

Monro, a smaller U.S. company, recently reported first-quarter sales of US$301 million, up from US$293 million the previous year. Despite this increase, they experienced a net loss of US$8 million compared to last year's net income of US$5.9 million. The company's funding is entirely through external borrowing, adding risk but also potential for growth as earnings are projected to increase significantly in the coming years. Insider confidence is evident with recent share purchases by executives.

- Delve into the full analysis valuation report here for a deeper understanding of Monro.

Examine Monro's past performance report to understand how it has performed in the past.

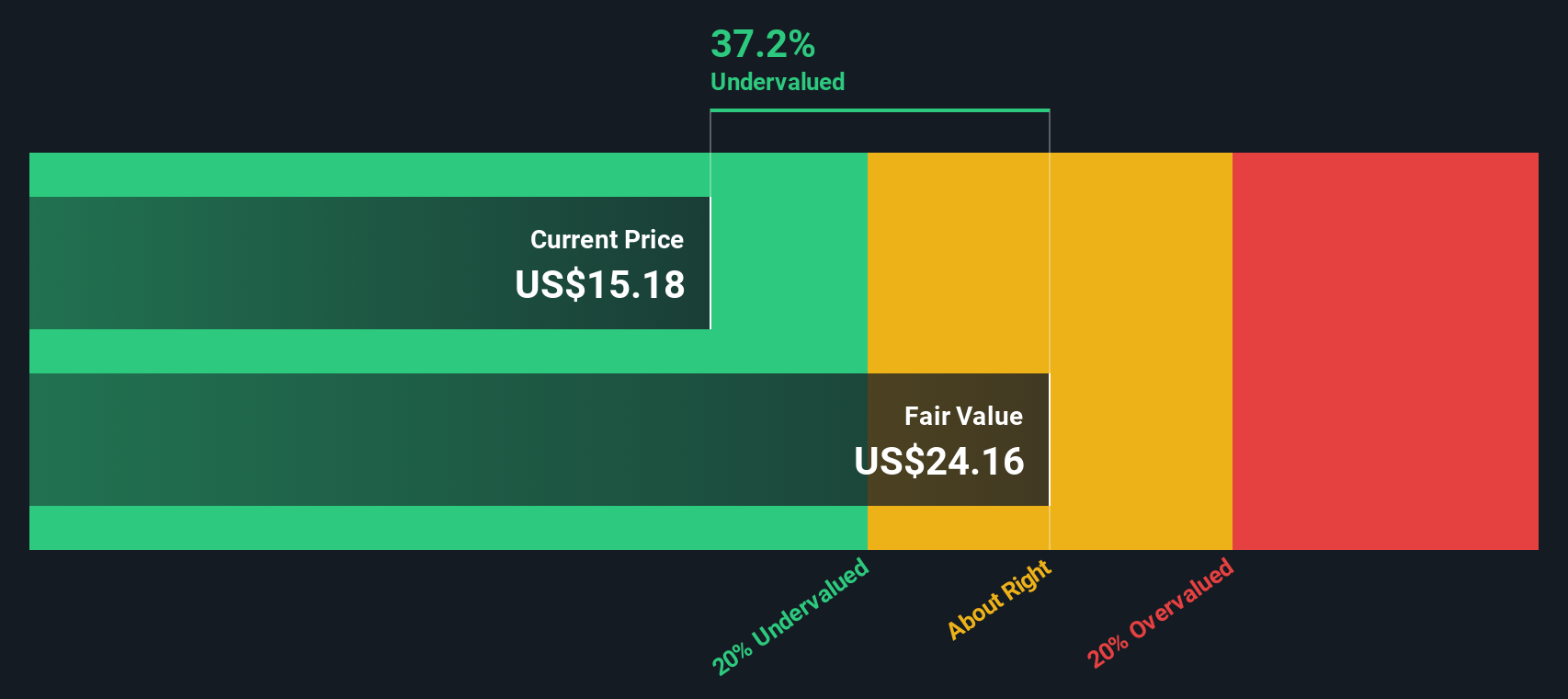

First Commonwealth Financial (FCF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: First Commonwealth Financial operates as a financial services company primarily focused on banking, with a market cap of approximately $1.5 billion.

Operations: FCF primarily generates revenue from its banking segment, with recent figures showing $454.63 million. The company has consistently achieved a gross profit margin of 100%, indicating no cost of goods sold in the reported periods. Operating expenses have been a significant component, with general and administrative expenses being the largest contributor at $217.68 million recently. Net income margin showed variability but was noted at 29.48% in the latest period, reflecting profitability after accounting for all expenses.

PE: 13.9x

First Commonwealth Financial, a smaller U.S. financial entity, is capturing attention with its strategic moves and insider confidence. Recently, they announced a $25 million share repurchase program, showcasing commitment to shareholder value. Despite net income dipping to US$33.4 million for Q2 2025 from US$37.09 million the previous year, net interest income rose to US$106.24 million from US$94.99 million, indicating operational resilience. Leadership changes are on the horizon with key retirements and promotions planned for early 2026.

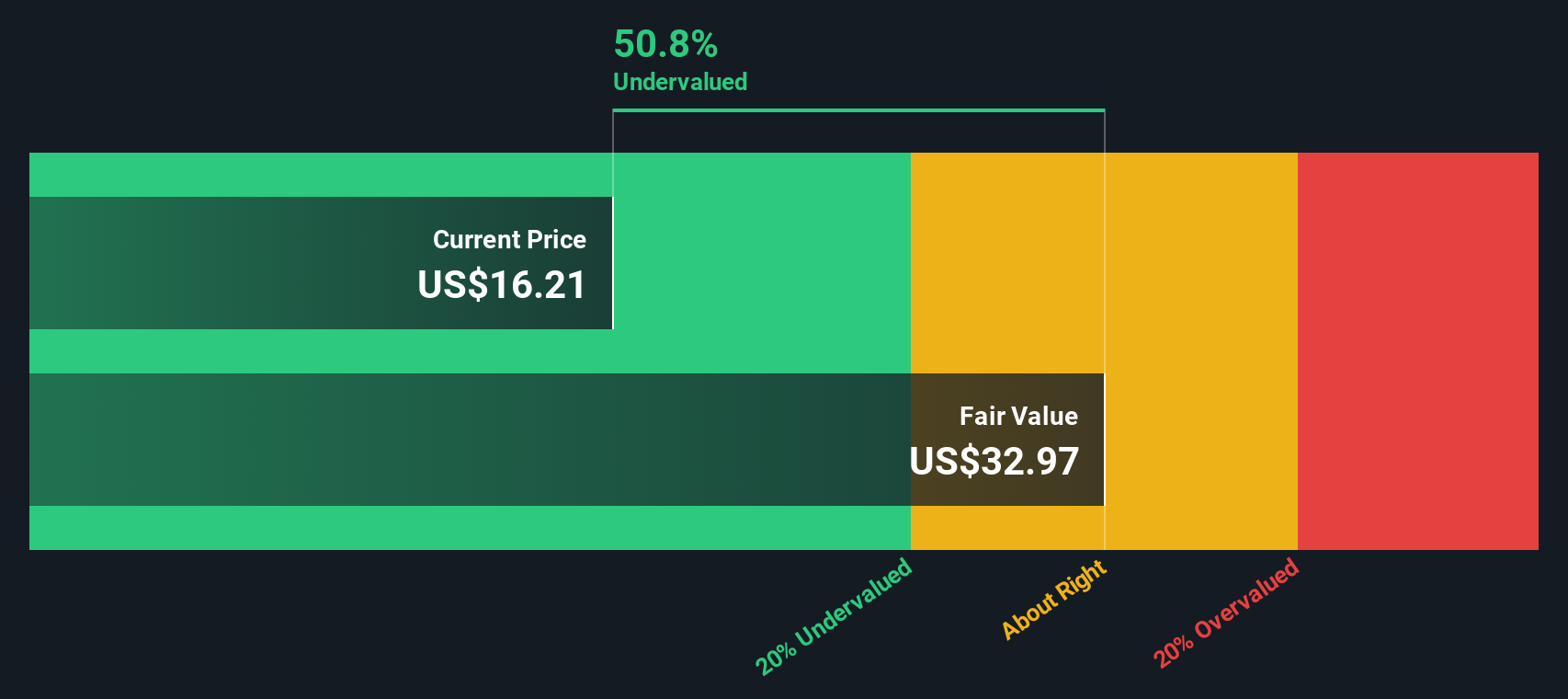

LTC Properties (LTC)

Simply Wall St Value Rating: ★★★★★☆

Overview: LTC Properties is a real estate investment trust that primarily invests in senior housing and healthcare properties, with a market capitalization of approximately $1.50 billion.

Operations: LTC Properties generates revenue primarily through its operations, with a notable gross profit margin trend reaching as high as 99.98% in some periods but showing fluctuations over time, such as a decrease to 86.43%. The company incurs costs related to operating expenses and non-operating expenses, including depreciation and amortization. General and administrative expenses are consistently part of the cost structure, impacting net income margins which have varied significantly from 29.61% to 92.72%.

PE: 20.4x

LTC Properties, a small-cap stock in the healthcare real estate sector, showcases potential for growth despite recent financial challenges. With Q2 2025 revenue climbing to US$60.24 million from US$50.12 million a year ago, the company is navigating through lower net income of US$15.09 million compared to last year's US$19.36 million. Insider confidence is apparent with recent share purchases, suggesting optimism about future prospects. The firm has refinanced its credit agreement to enhance liquidity and raised its earnings guidance for 2025, indicating strategic positioning for growth amidst current market conditions.

- Navigate through the intricacies of LTC Properties with our comprehensive valuation report here.

Understand LTC Properties' track record by examining our Past report.

Next Steps

- Gain an insight into the universe of 79 Undervalued US Small Caps With Insider Buying by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal