How Investors May Respond To Carnival Corporation & (CCL) Redeeming $322 Million of 2027 Senior Notes

- In late August 2025, Carnival Corporation & plc announced the completion of its redemption of approximately US$322 million in 5.750% senior unsecured notes due 2027, emphasizing efforts to strengthen its balance sheet and optimize capital structure.

- This proactive reduction in debt highlights management’s focus on financial health, which could improve market confidence in the company’s long-term resilience.

- We’ll examine how this debt redemption may reinforce Carnival’s investment narrative and its commitment to reducing financial risk.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Carnival Corporation & Investment Narrative Recap

To invest in Carnival Corporation & plc, you need to believe in the continued recovery of leisure travel and the company’s ability to convert demand into higher earnings while actively managing financial risk. The recent redemption of approximately US$322 million in senior notes marks another step in Carnival’s balance sheet improvement, but it does not materially change the company’s short-term catalysts, such as demand for new destinations, or the prevailing risk tied to its still-heavy debt burden.

Among the recent announcements, Carnival’s Q2 and first-half 2025 earnings report stands out. The report highlighted a strong profit rebound, year-over-year revenue growth, and improved margins, offering context for the company’s increased focus on reducing debt and optimizing capital structure, as reflected in the latest debt redemption.

However, investors should also be mindful that, despite this progress, Carnival’s sizable debt load could still affect its financial flexibility and amplify risks when...

Read the full narrative on Carnival Corporation & (it's free!)

Carnival Corporation & is projected to reach $29.1 billion in revenue and $3.7 billion in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 3.8% and represents an earnings increase of $1.2 billion from the current level of $2.5 billion.

Uncover how Carnival Corporation &'s forecasts yield a $33.36 fair value, a 6% upside to its current price.

Exploring Other Perspectives

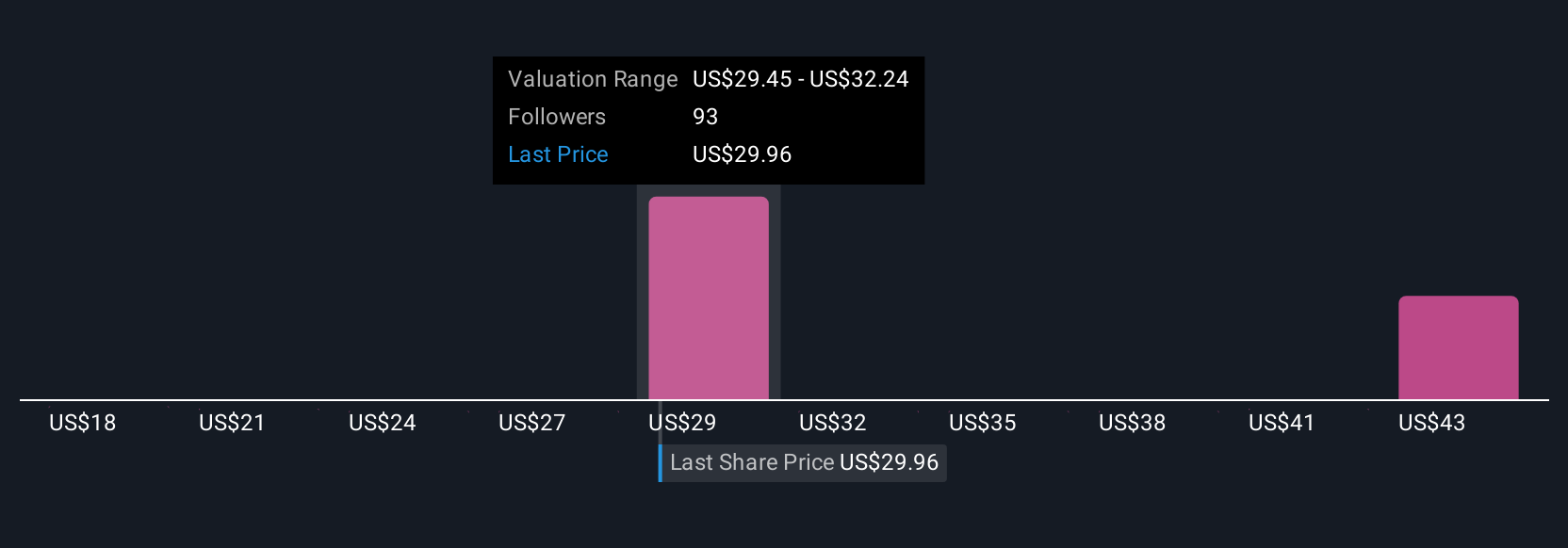

Simply Wall St Community members provided eight fair value estimates for Carnival ranging from US$18.30 to US$34, revealing wide variation in outlook. While optimism on cost control and new offerings exists, debt remains a critical focus that may influence future returns.

Explore 8 other fair value estimates on Carnival Corporation & - why the stock might be worth 42% less than the current price!

Build Your Own Carnival Corporation & Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carnival Corporation & research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Carnival Corporation & research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carnival Corporation &'s overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal