How Strong Revenue and Profit Growth At Copart (CPRT) Has Changed Its Investment Story

- Copart reported its fourth quarter and full year 2025 earnings, posting revenue of US$1.13 billion for Q4 and US$4.65 billion for the year, both higher than the prior year, with net income and earnings per share also increasing.

- Copart’s stronger quarterly and annual profit margins, alongside steady earnings per share growth, point to ongoing improvements in its business operations.

- We’ll examine how Copart’s robust increases in both revenue and net income shape its investment narrative and future outlook.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Copart Investment Narrative Recap

Copart’s investment story rests on confidence that its growing share of the vehicle auction and salvage market will continue driving revenue and margin expansion. The company’s latest financial results, which delivered strong increases in both revenue and net income, reinforce this narrative and support the primary near-term catalyst: expanding contributions from insurance and non-insurance sellers. The biggest risk remains potential macroeconomic uncertainty slowing vehicle volumes, but these earnings do not materially alter that factor.

Against the backdrop of improving operational efficiency and margin gains, the May 2024 announcement on Copart’s partnership with Hi Marley to develop Total Loss Assist stands out. This product aims to streamline total loss claims for insurance carriers, directly addressing a core driver of Copart’s growth, its ability to enhance services for insurance partners and potentially capture more auction volume.

However, investors should also consider the effects if sellers grow more cautious due to shifting economic conditions and ...

Read the full narrative on Copart (it's free!)

Copart's outlook anticipates $6.6 billion in revenue and $2.1 billion in earnings by 2028. This implies a 13.1% annual revenue growth rate and an earnings increase of $0.6 billion from the current $1.5 billion level.

Uncover how Copart's forecasts yield a $59.38 fair value, a 22% upside to its current price.

Exploring Other Perspectives

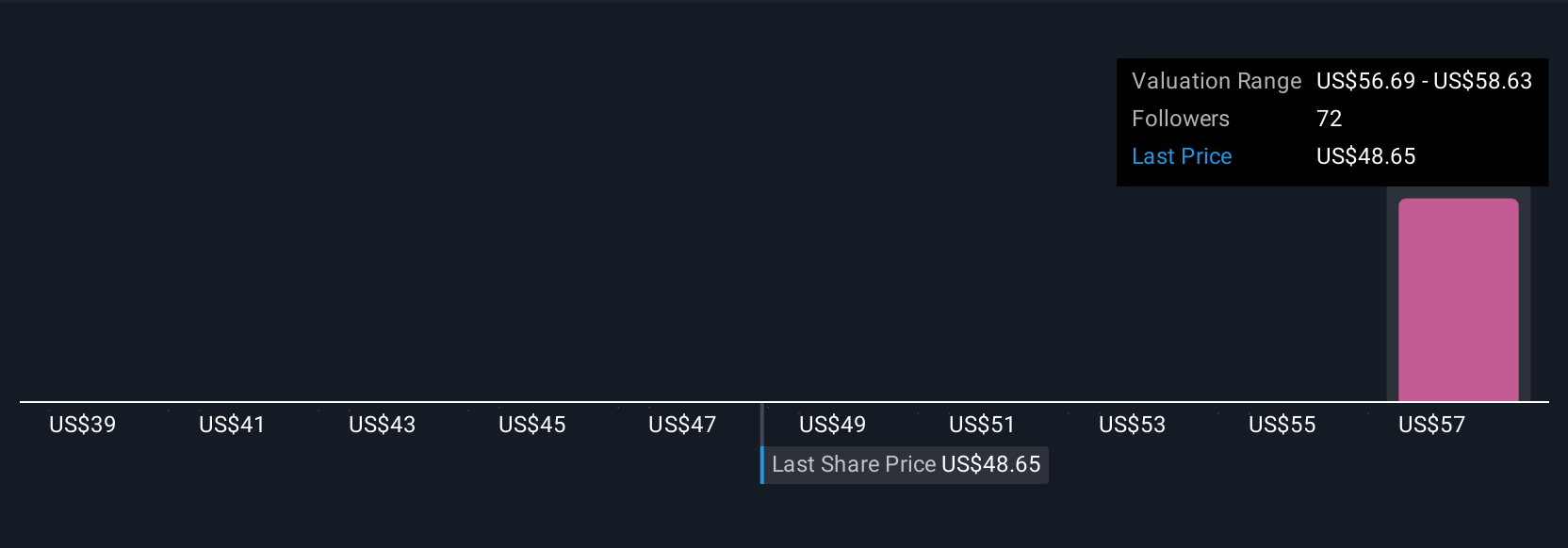

Simply Wall St Community members submitted nine fair value estimates for Copart, ranging widely from US$39.26 to US$59.38 per share. While these views reflect sharply different expectations for future performance, keep in mind that broader volume risks tied to economic uncertainty could weigh on auction revenue and investor sentiment alike.

Explore 9 other fair value estimates on Copart - why the stock might be worth as much as 22% more than the current price!

Build Your Own Copart Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Copart research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Copart research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Copart's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal