Did Verisk’s Carbon Claims Calculator Just Shift the ESG Narrative for Verisk Analytics (VRSK)?

- Earlier this week, Verisk announced the launch of the insurance industry’s first Carbon Trust Assured Model for property claims in the UK, introducing the Property Claims Carbon Calculator to help insurers measure, benchmark, and reduce the carbon footprint of their claims.

- This collaboration with the Carbon Trust positions Verisk at the forefront of ESG compliance, offering an industry-ready solution for Scope 3 emissions reporting as sustainability disclosures become more urgent for insurers.

- Now, we’ll explore how Verisk’s new carbon calculator could influence its investment narrative and standing within the insurance solutions market.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Verisk Analytics Investment Narrative Recap

For investors considering Verisk Analytics, the central premise is belief in the company’s ongoing ability to deliver essential data analytics to insurers amid regulatory changes and sustainability pressures. While the launch of the Property Claims Carbon Calculator helps Verisk address the growing urgency around ESG and Scope 3 reporting, its immediate impact on the most important short term catalyst, broadening insurance client relationships through product adoption, may not be material unless industry-wide uptake accelerates. Key risks, such as ongoing inflation and volatile insurance markets, continue to frame the outlook for Verisk’s revenue growth and spending trends among clients.

Among recent announcements, Verisk’s new partnership with OneClick Data, integrating building code data into Xactware, is particularly relevant. This initiative further cements Verisk’s position as a provider of indispensable claims and compliance tools for insurers, a focus aligned with its efforts to drive revenue growth through innovative solutions and maintain resilience in a risk-intensive sector.

However, in contrast to product innovation, information that investors should be aware of relates to...

Read the full narrative on Verisk Analytics (it's free!)

Verisk Analytics is projected to reach $3.9 billion in revenue and $1.2 billion in earnings by 2028. This outlook assumes a 9.1% annual revenue growth rate and an earnings increase of approximately $290 million from the current $909.3 million.

Uncover how Verisk Analytics' forecasts yield a $307.31 fair value, a 14% upside to its current price.

Exploring Other Perspectives

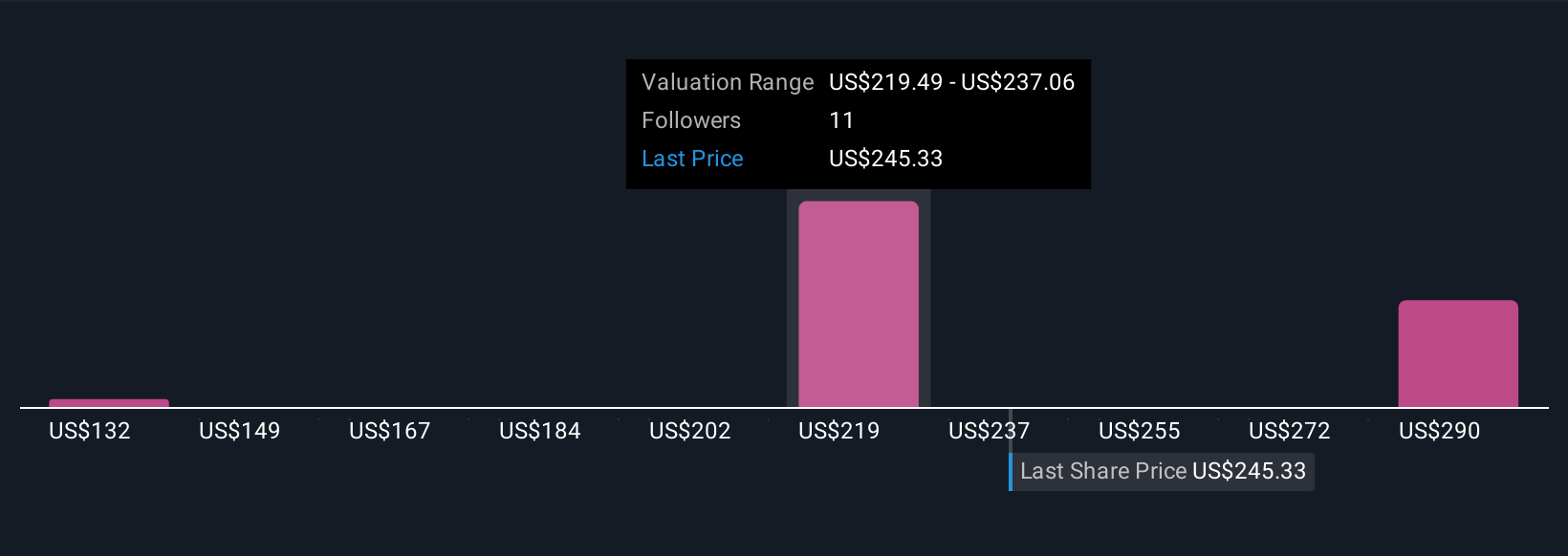

Four fair value estimates from the Simply Wall St Community range widely, from US$131.67 to US$307.31 per share. While many see opportunity, persistent concerns about insurers’ spending in the face of inflation and higher reconstruction costs could influence future performance, explore multiple views to round out your outlook.

Explore 4 other fair value estimates on Verisk Analytics - why the stock might be worth less than half the current price!

Build Your Own Verisk Analytics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verisk Analytics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Verisk Analytics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verisk Analytics' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal