These Analysts Boost Their Forecasts On Toro Following Q3 Results

The Toro Company (NYSE:TTC) posted mixed results for the fiscal third quarter on Thursday.

The company posted net sales of $1.13 billion, a 2% decline from a year earlier and short of the $1.16 billion analyst estimate.

Net earnings fell to $53.5 million from $119.3 million, with diluted earnings per share of 54 cents, including a noncash impairment charge of 62 cents per share, or $81 million pretax. Adjusted net earnings were $122.5 million compared with $123.7 million a year ago, while adjusted diluted earnings per share rose 5% to $1.24, beating the $1.22 estimate.

"We delivered third-quarter adjusted earnings that exceeded our expectations, with our Professional segment achieving 6 percent growth and 250 basis points of margin expansion," said Richard M. Olson, chairman and chief executive officer.

For fiscal 2025, Toro narrowed its guidance. Management now expects adjusted diluted earnings per share of about $4.15, versus prior guidance of $4.15 to $4.30 and below the $4.26 analyst estimate.

Net sales are expected to be $4.446 billion, compared with the prior $4.446 billion to $4.584 billion range and below the $4.532 billion estimate.

Toro shares gained 1.9% to trade at $82.18 on Friday.

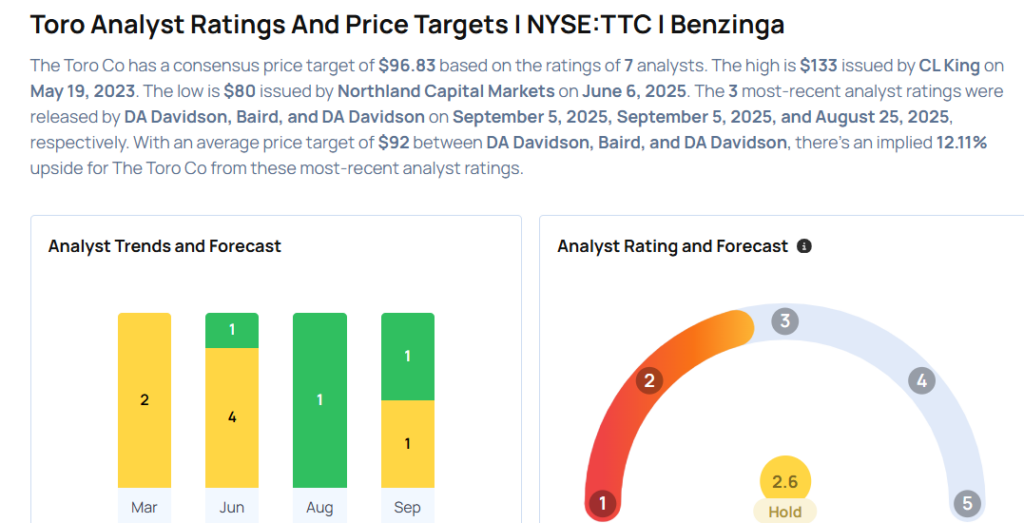

These analysts made changes to their price targets on Toro following earnings announcement.

- Baird analyst Timothy Wojs maintained Toro with a Neutral and raised the price target from $82 to $86.

- DA Davidson analyst Michael Shlisky maintained the stock with a Buy and raised the price target from $93 to $97.

Considering buying TTC stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Wall Street Journal

Wall Street Journal