Is Resilient Premium Growth Amid Challenges Shifting the Investment Case for Erie Indemnity (ERIE)?

- Erie Indemnity recently reported significant growth in direct and assumed written premiums, highlighted by an increase in average premium per policy and continued optimism in its guidance despite headwinds.

- Operational challenges, such as a cybersecurity incident and higher weather-related losses, tested the company's resilience but did not alter its expectation of ongoing growth.

- To explore what this means for Erie Indemnity’s investment narrative, we'll consider how resilient premium growth factors into its outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Erie Indemnity's Investment Narrative?

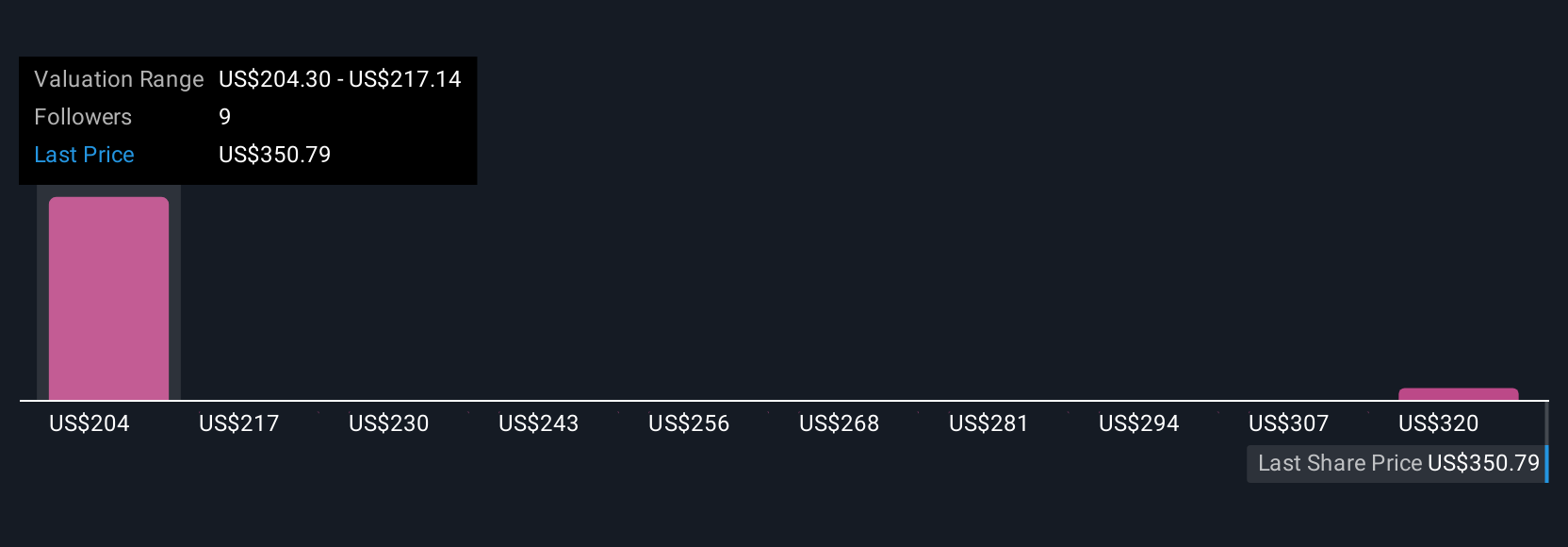

For anyone taking a serious look at Erie Indemnity, the investment story revolves around its track record of steady earnings growth, reliable dividends, and resilient revenue even as sector challenges evolve. The recent news of significant premium growth appears to reinforce the company's short-term appeal, especially as other insurers wrestle with volatility. Key catalysts now center around management’s ability to maintain strong underwriting results and deliver on its guidance for continued premium and operating income growth, despite operational hiccups such as the cybersecurity incident and higher weather-related losses. So far, these headwinds haven’t materially shifted the outlook or the main risk factors identified prior to the news, particularly high valuations and lagging stock performance. The latest developments keep attention on execution, not a structural shake-up of the investment narrative. Yet, against that positive momentum, investors should not overlook the impact of valuation risk in today’s market.

Erie Indemnity's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on Erie Indemnity - why the stock might be worth as much as $332.66!

Build Your Own Erie Indemnity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Erie Indemnity research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Erie Indemnity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Erie Indemnity's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal