How Tariff-Driven Supply Shocks at Alcoa (AA) Have Changed Its Investment Story

- In August 2025, U.S. aluminum tariffs triggered record price spikes and stressed supply chains, disrupting both American and European markets.

- The resulting shortage of scrap metal and the EU's consideration of emergency measures signal significant risks to clean-energy projects and crucial manufacturing sectors.

- We'll explore how tariff-driven supply chain instability could alter Alcoa's outlook and influence its investment appeal.

Find companies with promising cash flow potential yet trading below their fair value.

Alcoa Investment Narrative Recap

Owning Alcoa shares means believing in aluminum’s central role in decarbonization, electric vehicles, and infrastructure growth, while trusting in the company’s ability to manage margin volatility and uncertain end-market demand. With U.S. tariffs now fueling record aluminum prices and sparking supply chain stress, near-term pricing power has surged, but the biggest short-term catalyst, tight global supply, also brings a heightened risk of cost inflation if material shortages persist.

Among Alcoa’s recent updates, the July 2025 dividend declaration stands out, reaffirming the company’s commitment to returning cash to shareholders despite new headwinds from market instability. This continuity in capital returns could support shareholder confidence, even as the tariff-driven volatility presents new challenges for margin reliability.

Yet, in contrast to stable dividends, investors should be aware that cost pressures from supply chain disruptions could...

Read the full narrative on Alcoa (it's free!)

Alcoa's narrative projects $13.6 billion in revenue and $592.1 million in earnings by 2028. This requires 2.0% yearly revenue growth and a $396.9 million decrease in earnings from $989.0 million today.

Uncover how Alcoa's forecasts yield a $33.55 fair value, a 4% upside to its current price.

Exploring Other Perspectives

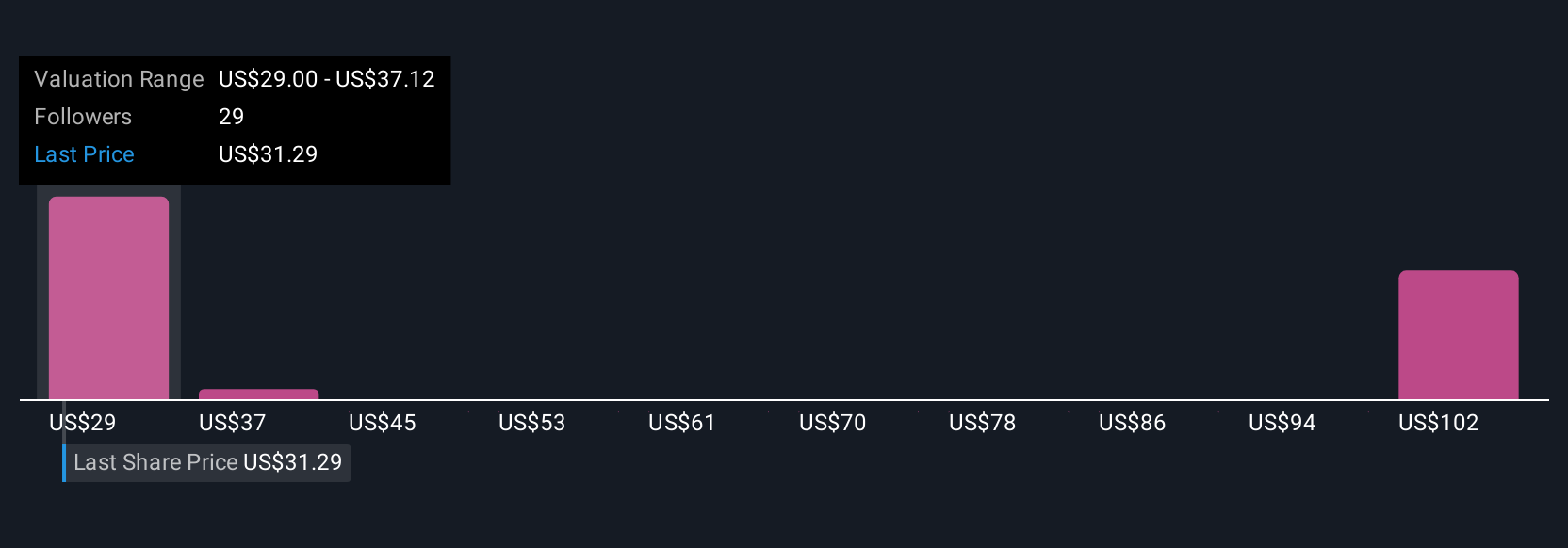

Five individual members of the Simply Wall St Community placed Alcoa’s fair value between US$29 and US$110, a span reflecting major differences in outlook. With volatility from supply chain risks now in focus, these varied perspectives invite you to see how others assess the long term prospects and challenges for Alcoa today.

Explore 5 other fair value estimates on Alcoa - why the stock might be worth 10% less than the current price!

Build Your Own Alcoa Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alcoa research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alcoa research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alcoa's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal