How EastGroup Properties’ 10.7% Dividend Boost Will Impact EGP Investors

- On August 22, 2025, EastGroup Properties, Inc. announced its Board of Directors approved a 10.7% increase in its quarterly dividend to $1.55 per share, payable to shareholders on October 15, 2025.

- This marks the 183rd consecutive quarterly cash distribution by EastGroup Properties, signaling the company's continued focus on delivering shareholder returns.

- We'll explore how EastGroup's sizable dividend increase highlights its financial confidence and informs the company's investment narrative moving forward.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

EastGroup Properties Investment Narrative Recap

To be a shareholder in EastGroup Properties, investors must trust the ongoing demand for modern industrial and logistics real estate in high-growth US Sunbelt markets, and believe the company can maintain reliable growth despite regional challenges. The recent 10.7% dividend increase signals management's confidence, but does not materially alter the biggest short-term catalyst, which remains robust lease-up of new developments, or the primary risk from persistent high interest rates affecting capital access and development activity.

Of the recent company announcements, the July 2025 follow-on equity offering is most relevant here, as it directly supports funding for expansions and development opportunities that underpin future earnings and dividend growth. Maintaining consistent capital access will remain important as EastGroup navigates sector headwinds and pursues new projects amid varying real estate cycles.

By contrast, investors should also be aware that high interest rates continue to put pressure on access to affordable capital and new development plans, especially if growth slows…

Read the full narrative on EastGroup Properties (it's free!)

EastGroup Properties is projected to reach $918.9 million in revenue and $339.7 million in earnings by 2028. This outlook assumes a 10.7% annual revenue growth rate and a $103.2 million increase in earnings from the current $236.5 million level.

Uncover how EastGroup Properties' forecasts yield a $187.83 fair value, a 11% upside to its current price.

Exploring Other Perspectives

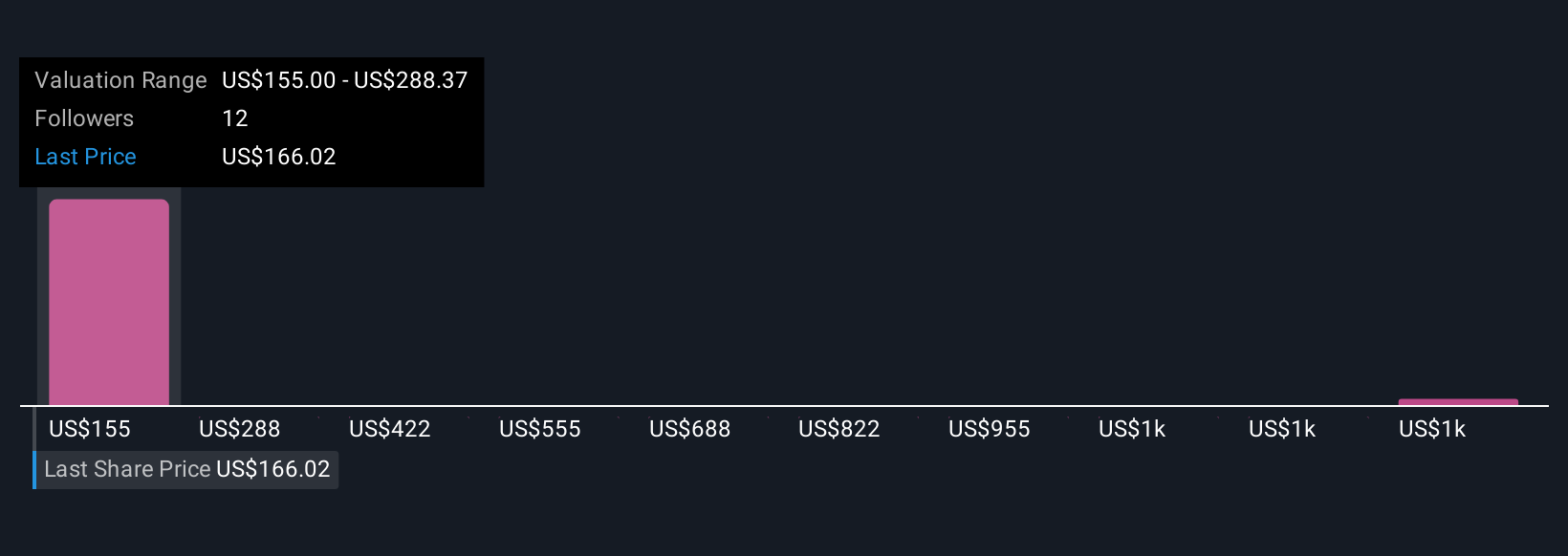

Simply Wall St Community members contributed five fair value estimates for EastGroup, spanning from US$155 to an outlier at US$1,488.67 per share. While views differ widely, persistent high interest rates remain a central concern, shaping both risks and the company’s ability to fund new growth in a changing market.

Explore 5 other fair value estimates on EastGroup Properties - why the stock might be worth 9% less than the current price!

Build Your Own EastGroup Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EastGroup Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free EastGroup Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EastGroup Properties' overall financial health at a glance.

No Opportunity In EastGroup Properties?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal