Will Assurant’s (AIZ) Arcadium Partnership Reveal the True Value of Its Digital Strategy?

- Assurant recently announced a partnership with Arcadium Technologies to integrate its Heavy Truck Extended Service Contract products into Arcadium’s dealership sales platform, streamlining quoting and contracting for truck dealerships by eliminating duplicate data entry and reducing errors.

- This collaboration highlights Assurant's focus on operational efficiency and digital enablement, which could boost dealer adoption and drive additional business in the automotive segment.

- To understand how the Arcadium partnership could support adoption of Assurant’s products, let’s assess its impact on the company’s investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Assurant Investment Narrative Recap

To be a shareholder in Assurant, you need to believe in its vision for digital innovation and operational efficiency to support growth across both Housing and Lifestyle segments. The recent Arcadium partnership aligns with this theme by simplifying heavy truck service contract sales, but it is unlikely to materially affect the company’s most immediate catalyst, sustained earnings growth from device protection, and does little to address the core risk of regulatory pressure on lender-placed insurance.

The August 20 announcement expanding Assurant’s relationship with Holman in automotive finance and insurance is particularly relevant, as it directly supports the company’s drive for recurring revenue in vehicle protection services, a segment increasingly central to near-term growth opportunities.

By contrast, investors also need to be aware that regulatory scrutiny on lender-placed insurance remains an unresolved concern for Assurant…

Read the full narrative on Assurant (it's free!)

Assurant's outlook anticipates $14.2 billion in revenue and $1.2 billion in earnings by 2028. This projection relies on a yearly revenue growth rate of 4.9% and an earnings increase of $483 million from the current $717 million.

Uncover how Assurant's forecasts yield a $241.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

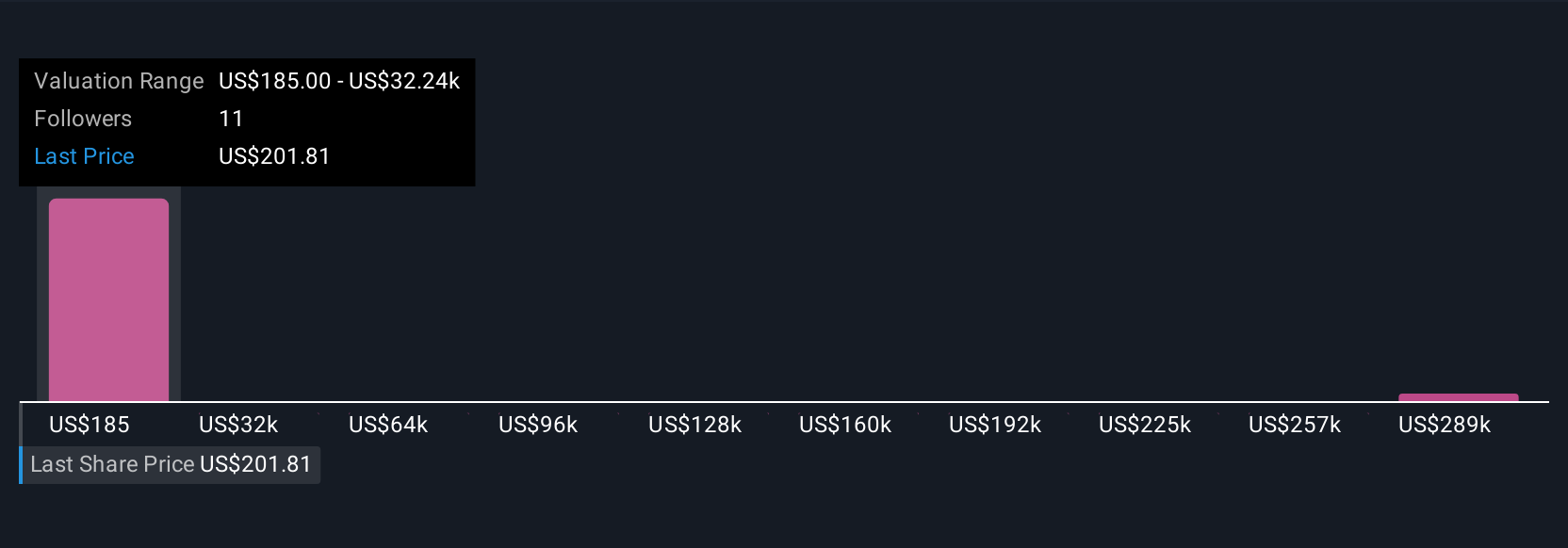

Four independent fair value estimates for Assurant from the Simply Wall St Community span from US$185 to an extreme US$320,700.23. While opinions diverge, many are closely watching the company’s ability to harness digital platforms to expand recurring premium growth in emerging segments.

Explore 4 other fair value estimates on Assurant - why the stock might be a potential multi-bagger!

Build Your Own Assurant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Assurant research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Assurant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Assurant's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal