Innodata (INOD): Assessing Valuation Following Raised Growth Targets and Major AI Project Wins

Innodata (INOD) just unveiled its plans for 2025, raising its organic growth target to at least 45%, up from 40%. This announcement comes alongside a significant 79% year-over-year revenue increase and news of major project wins with leading tech customers. The company’s clear emphasis on generative and Agentic AI, supported by a strong funding base, highlights its ambition to remain at the forefront as AI evolves.

This update builds on momentum that has been gathering for some time. Over the past year, Innodata’s stock has surged more than 120%, outpacing broader markets and reflecting investor enthusiasm for rapid revenue increases and a series of high-profile customer wins. Even with a modest dip over the past month, the broader context shows sustained interest as the company pursues new opportunities with fresh contracts and an upgraded outlook.

With these developments, the key question emerges: is Innodata’s current price already reflecting all this anticipated growth, or could there still be opportunities for investors entering at this stage?

Most Popular Narrative: 39.3% Undervalued

According to community narrative, Innodata's shares are considered to be significantly undervalued based on assumptions of strong future earnings and revenue expansion, balanced by the risks associated with its current business model.

Increasing adoption of AI across industries requires curated and high-quality datasets. Innodata's evolving role from simple data provider to strategic partner, working closely with clients' data scientists, is likely to support premium pricing, recurring contracts, and market share gains. This may have a positive impact on both revenue stability and net margins.

How does a company leap from niche provider to dominant force in AI? This narrative hints at bold earnings projections, aggressive margin bets, and a multiple more often reserved for industry icons. Want to know the assumptions fueling a fair value that is far above today's price? The drivers behind this target may surprise you.

Result: Fair Value of $64.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant dependency on a handful of major tech clients, along with aggressive investment ahead of revenue, could quickly undermine this bullish outlook.

Find out about the key risks to this Innodata narrative.Another View: Different Models, Different Stories

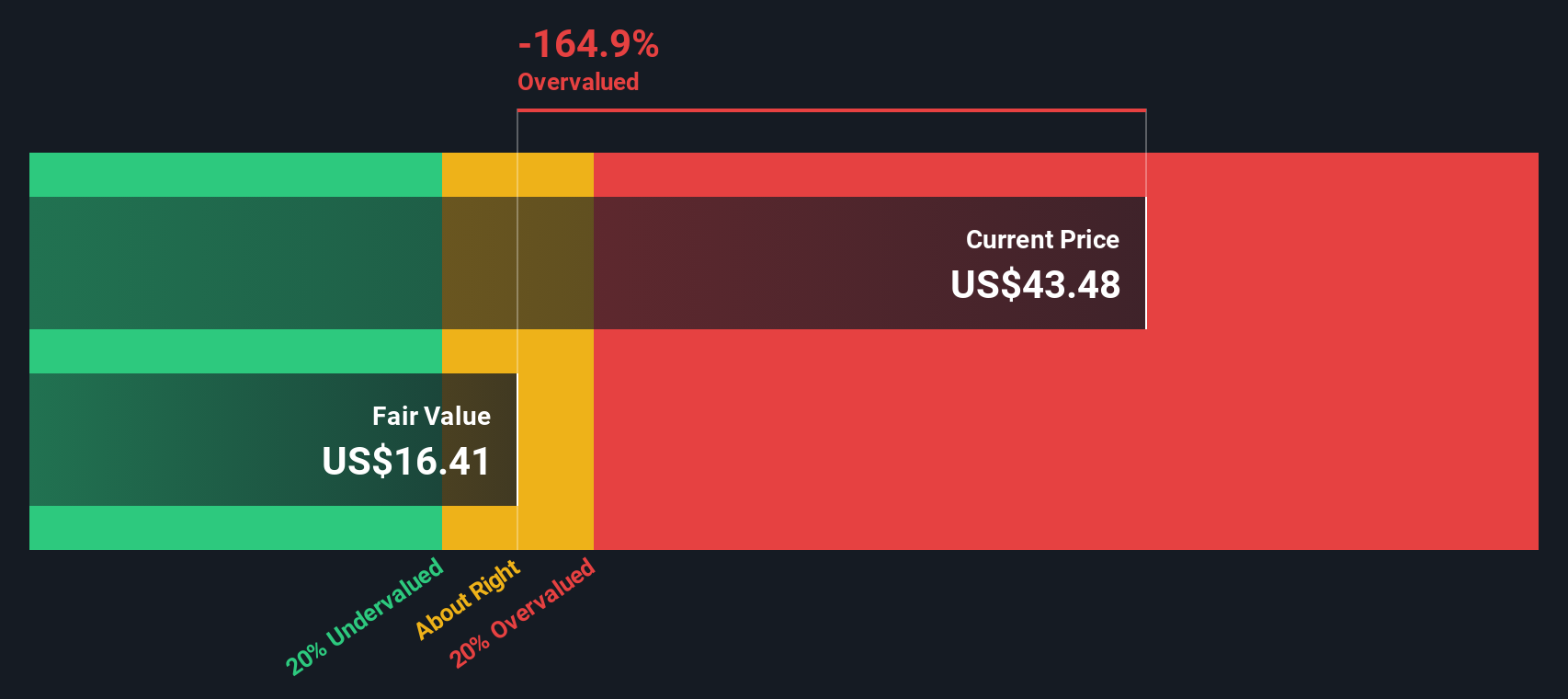

Looking at Innodata with our DCF model gives a very different perspective, suggesting the company may actually be overvalued. Could these two approaches be reflecting diverging realities about Innodata’s future?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Innodata Narrative

If you have a different perspective or want to explore on your own, you can shape your own Innodata story in just a few minutes. Do it your way

A great starting point for your Innodata research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Winning Investment Ideas?

Don’t just watch from the sidelines while others spot tomorrow’s standouts. Take charge with Simply Wall Street’s expert tools and put yourself in the driver’s seat. Here are three powerful ways you can uncover the next great stock opportunity before everyone else does:

- Maximize your returns by targeting fast-growing opportunities in small-cap companies. Just check out the potential in penny stocks with strong financials to see where early momentum is building.

- Capture the upside of artificial intelligence and position yourself alongside breakthrough innovators by browsing top up-and-coming picks within AI penny stocks.

- Secure value and peace of mind by focusing on companies that could be overlooked by others. Let undervalued stocks based on cash flows help you pinpoint bargains that the market hasn’t fully recognized.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal