Did Lindsay's (LNN) ESOP-Linked Stock Shelf Registration Signal a New Shift in Capital Strategy?

- Earlier this week, Lindsay Corporation filed a shelf registration for a potential US$117.93 million common stock offering related to its Employee Stock Ownership Plan (ESOP), involving 824,281 shares.

- The ESOP-related shelf registration highlights Lindsay’s ongoing commitment to employee ownership while signaling possible changes to its capital structure in the coming periods.

- Next, we'll consider how this potential equity issuance tied to the ESOP offering may influence Lindsay's investment narrative and outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 22 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Lindsay Investment Narrative Recap

To be a Lindsay shareholder, you generally need to believe in the long-term opportunity for growth in global irrigation and infrastructure markets, while accepting near-term uncertainties in core North American irrigation and the timing of large project wins. The recent ESOP-related shelf registration, although reflecting a continued focus on employee ownership, doesn't appear to materially affect the main near-term catalysts, like international project execution, or shift the most significant risks around tariff exposure and softness in domestic demand.

One recent announcement that intersects with key catalysts is the launch of TowerWatch™, a technology bolstering Lindsay's SmartPivot™ irrigation solutions. This product innovation can enhance value for customers and could help offset tepid North American market conditions by attracting new growers, signaling continued emphasis on technology-led competitive advantages.

On the other hand, investors should keep in mind how tariff uncertainties and rising steel prices could impact Lindsay’s ability to manage its cost base if...

Read the full narrative on Lindsay (it's free!)

Lindsay's narrative projects $751.5 million in revenue and $86.5 million in earnings by 2028. This requires 3.5% yearly revenue growth and a $10.5 million earnings increase from the current $76.0 million.

Uncover how Lindsay's forecasts yield a $153.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

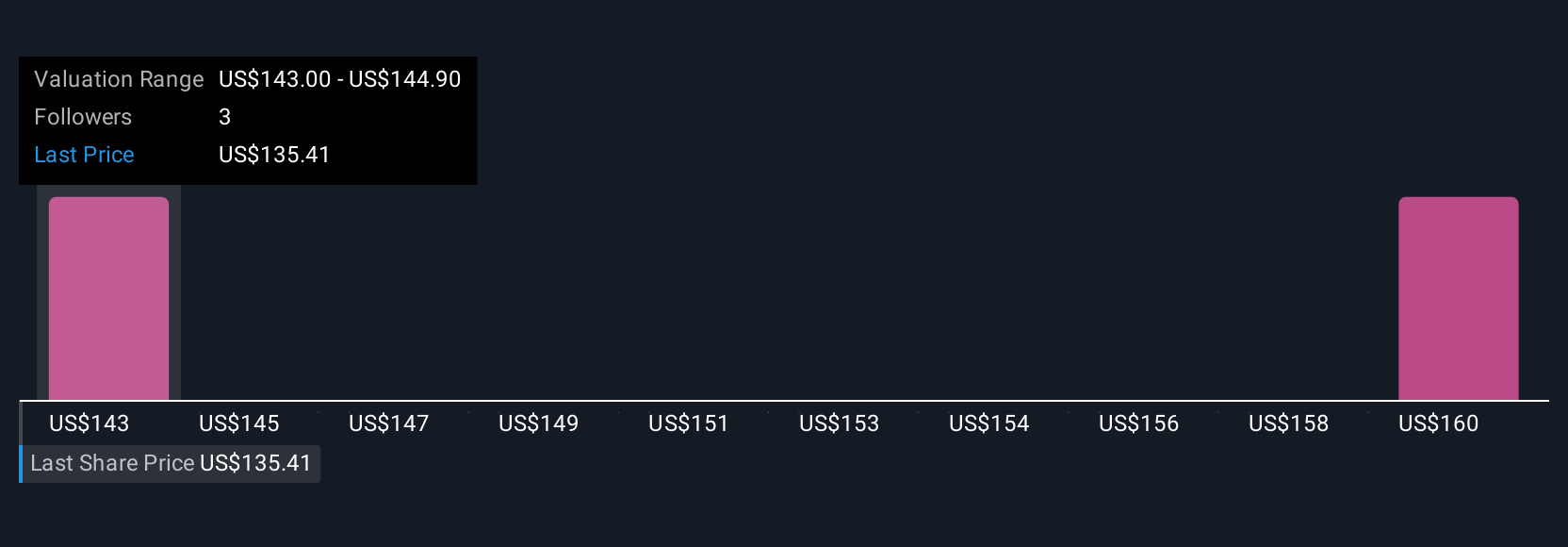

Two unique fair value opinions from the Simply Wall St Community placed Lindsay’s worth tightly between US$151.13 and US$153. Ongoing cost challenges like tariffs and steel prices may lead to wide differences in your return expectations.

Explore 2 other fair value estimates on Lindsay - why the stock might be worth just $151.13!

Build Your Own Lindsay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lindsay research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lindsay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lindsay's overall financial health at a glance.

No Opportunity In Lindsay?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal