Could Group 1 Automotive’s (GPI) Next-Gen Dealership Reveal a Shift in Its Long-Term Growth Priorities?

- Earlier this month, Group 1 Automotive held a grand opening celebration for its newly acquired Mercedes-Benz of South Austin facility, which features the brand’s next-generation luxury layout, 80,000 square feet of showroom space, forty service bays, and 28 EV charging stations across 10 acres.

- This modern dealership not only expands Group 1’s luxury footprint but also highlights the company's increasing investment in sustainable automotive technologies and customer experience innovation.

- With the South Austin dealership’s advanced design and extensive EV infrastructure, we'll examine how this expansion could influence Group 1 Automotive's growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 22 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Group 1 Automotive Investment Narrative Recap

To be a shareholder in Group 1 Automotive, you need to believe in the long-term viability of traditional dealership operations, disciplined expansion in luxury and EV infrastructure, and the company's capacity to balance acquisition-driven growth against competitive and integration risks. The recent grand opening of the Mercedes-Benz of South Austin dealership signals a commitment to innovative customer experiences and EV readiness; however, this addition is unlikely to materially shift the most important short-term catalyst, continued growth in high-margin aftersales and service throughput, nor does it address the risk that accelerating digital competition poses to showroom sales and margin resilience.

Among recent announcements, the acquisition of Mercedes-Benz of Buckhead stands out for its alignment with Group 1’s expansion in luxury markets, contributing an anticipated US$210 million in annual revenue. This development links directly to the current catalyst of leveraging dealership growth to drive aftersales revenue and customer retention, but also reinforces exposure to the integration and leverage risks associated with ongoing portfolio additions.

In contrast, investors should be aware of how digital-only competitors could still impact Group 1’s...

Read the full narrative on Group 1 Automotive (it's free!)

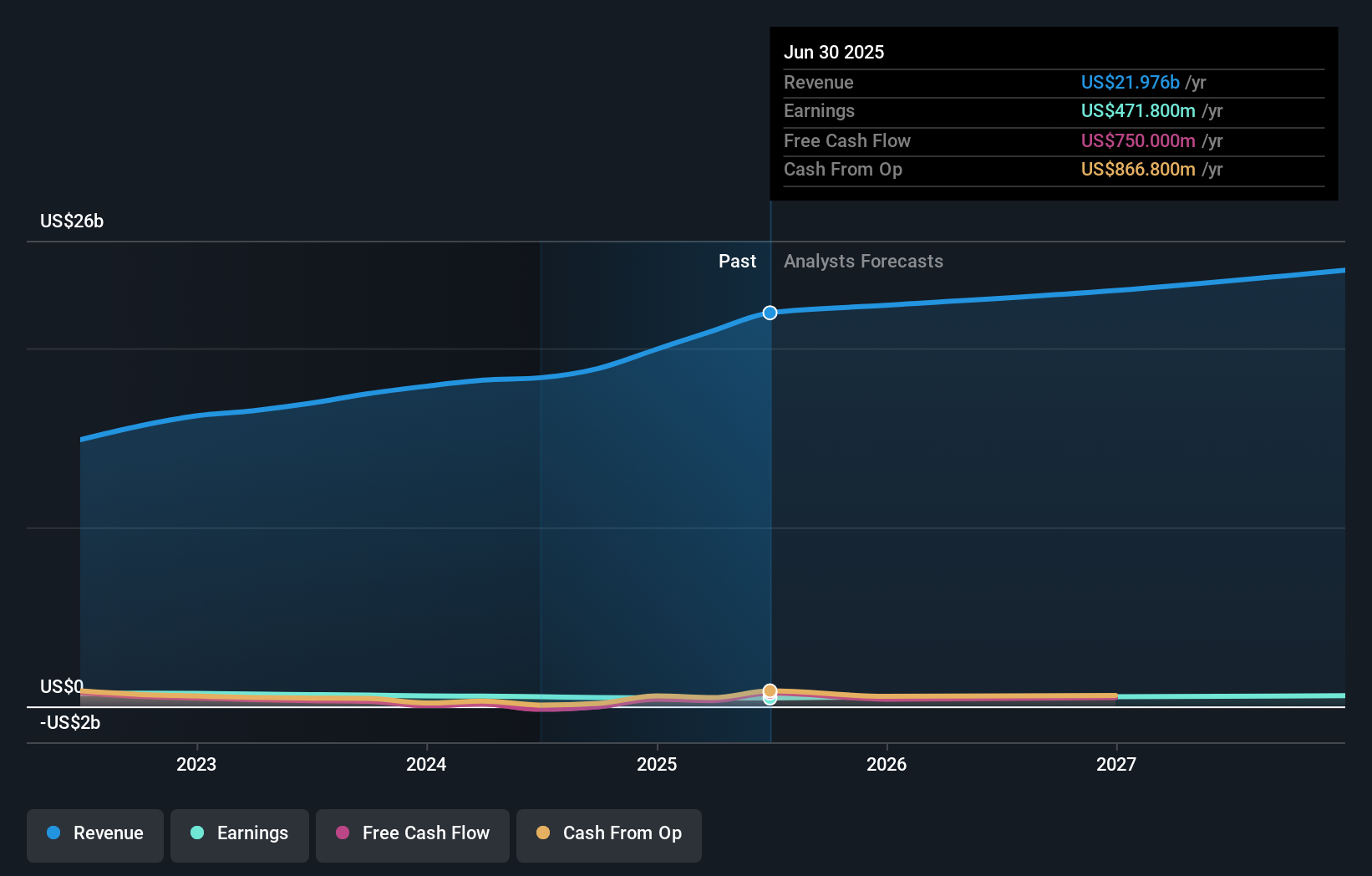

Group 1 Automotive's outlook anticipates $25.0 billion in revenue and $636.6 million in earnings by 2028. This scenario assumes a 4.4% annual revenue growth rate with earnings rising by $164.8 million from the current level of $471.8 million.

Uncover how Group 1 Automotive's forecasts yield a $478.25 fair value, in line with its current price.

Exploring Other Perspectives

Two community members from Simply Wall St estimate fair value for Group 1 Automotive between US$375.83 and US$490.66 per share. While these views differ considerably, the ongoing expansion in aftersales services remains central to the company’s financial outlook, explore these alternative assessments to see how your view compares.

Explore 2 other fair value estimates on Group 1 Automotive - why the stock might be worth as much as $490.66!

Build Your Own Group 1 Automotive Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Group 1 Automotive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Group 1 Automotive research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Group 1 Automotive's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal