After a 222% Surge, Is SoFi Stock Headed Even Higher?

Shares of SoFi Technologies (SOFI) are on a strong run, rising over 222% in a year. This meteoric rise in SoFi stock reflects the fintech’s ability to consistently deliver strong financial results. With top-line growth accelerating, diversification efforts paying off, and disciplined credit risk management, SoFi has captured the market’s confidence.

The company’s latest quarterly results underline why investors have been so enthusiastic. In the second quarter, SoFi reported record revenue of $854.9 million, representing a 44% increase from the same period last year. Profitability metrics were equally impressive, with adjusted EBITDA climbing 84% to $249.1 million, representing a healthy 29% margin. Net income came in at $97 million, translating to an 11% margin, while earnings per share increased to $0.08 from just $0.01 a year earlier.

A significant part of this growth stemmed from SoFi’s expansion beyond its traditional lending business. Non-lending operations, which include fee-based services, generated $472 million in revenue, representing a 74% year-over-year increase. Fee-based income alone hit a record $378 million, climbing 72% and reflecting the value of SoFi’s diversified model.

The company’s Financial Services segment performed well. Second-quarter net revenue more than doubled to $363 million, while contribution profit nearly tripled to $188 million, with margins expanding to 52% from 31% a year ago. Net interest income rose 39% to $193 million, driven by a growing base of member deposits, while noninterest income jumped more than fourfold to $169 million. On an annualized basis, that equates to more than $650 million in high-quality, fee-based income, highlighting the sustainability of this growth.

Another encouraging sign for investors is the company’s improving monetization. Financial Services revenue per product rose from $64 in last year’s second quarter to $98 in this year’s second quarter, a growth of over 50%. With several of SoFi’s newer products still in the early stages of scaling, that number could climb even higher in the years ahead.

SoFi’s Growth Story Is Far From Over

SoFi is showing no signs of slowing down. The momentum in its business is supported by innovation across its core businesses, with its Loan Platform Business (LPB) and Tech Platform leading the charge. Together, these segments are shaping SoFi into a diversified financial services powerhouse while creating multiple streams of high-margin revenue.

The LPB leverages SoFi’s strength in customer acquisition, operations, and servicing to originate customized loan portfolios for third parties. What makes this model particularly attractive is its efficiency. SoFi typically moves loans off its balance sheet within days, meaning it doesn’t need additional capital, nor does it take on credit risk after the transfer. Instead, it collects a fee for each loan, generating consistent, high-return revenue.

In just one year, LPB has scaled to an annualized pace of over $9.5 billion in originations, producing more than half a billion dollars in fee-based revenue. With this trajectory, SoFi is inching closer to transforming LPB into a $1 billion business.

The Tech Platform is establishing itself as another powerful growth driver. Beyond helping SoFi reduce costs and accelerate innovation, it has also opened doors to a broader client base outside of traditional fintech.

Meanwhile, momentum in its Lending sending continues to remain solid. The fintech reported another strong quarter of originations in Q2 and sees room for further expansion across all loan types. By enhancing its offerings in this space, SoFi is proving that even its legacy business can deliver meaningful growth.

For investors, the story is clear: SoFi isn’t just a fintech riding on student loans or personal lending. It’s evolving into a multi-pronged platform that generates sustainable, high-margin revenue across lending, technology, and financial services. With LPB on track to reach $1 billion in revenue and its Tech Platform driving both innovation and diversification, SoFi appears well-positioned to sustain its momentum — and potentially reward shareholders who believe in its long-term vision.

Should You Buy SoFi Stock Now?

With record revenue, expanding margins, and a growing share of high-quality, fee-based income, SoFi has shown its ability to deliver sustainable growth. The success of its LPB and Tech Platform highlights its evolution into a diversified fintech capable of generating multiple streams of recurring, high-margin revenue.

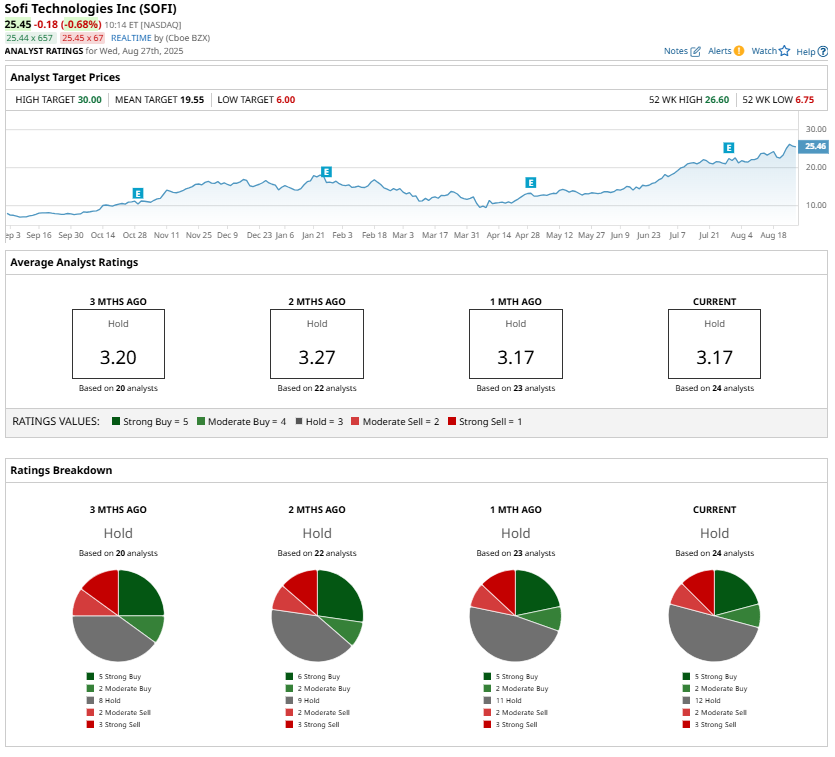

While the stock’s sharp rally has led Wall Street to adopt a cautious “Hold” stance, SoFi’s long-term growth story remains intact. Thus, for investors with a long-term outlook, SoFi’s trajectory suggests that its best days may still lie ahead.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Wall Street Journal

Wall Street Journal