Spadel And 2 Other European Small Caps With Strong Financials

As European markets experience a positive upswing, with the STOXX Europe 600 Index rising by 1.40% amid hopes of lower U.S. borrowing costs, investors are increasingly looking towards small-cap stocks as potential opportunities for growth. In this environment, identifying companies with strong financials and robust business activity can be crucial for those seeking to navigate the evolving economic landscape effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Freetrailer Group | 0.04% | 22.75% | 33.30% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Spadel (ENXTBR:SPA)

Simply Wall St Value Rating: ★★★★★★

Overview: Spadel SA is a company that produces and markets natural mineral water in Belgium, with a market capitalization of €863.27 million.

Operations: Spadel's primary revenue stream is from its non-alcoholic beverages segment, generating €379.35 million. The company has a market capitalization of €863.27 million.

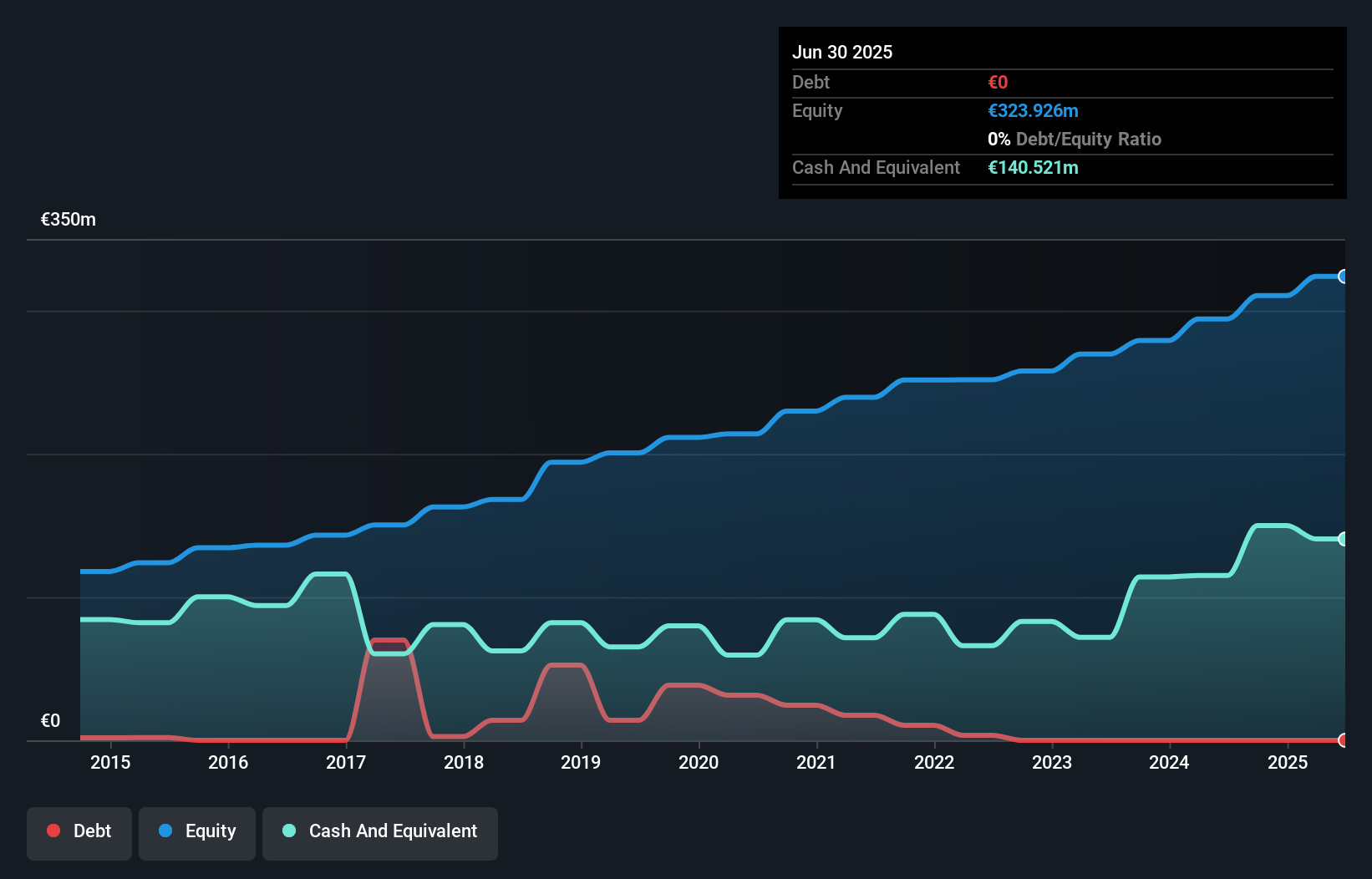

Spadel, a promising name in the beverage sector, showcases robust financial health with no debt and high-quality earnings. Over the past year, its earnings surged by 45.3%, outpacing the industry average of 5.9%. Trading at 36.6% below estimated fair value, it presents an attractive opportunity for investors seeking undervalued assets. The company recently announced an annual dividend of €2.24 per share payable in June 2025, highlighting its commitment to shareholder returns. With a history of reducing debt from a ratio of 18.2% five years ago to none today, Spadel's financial discipline is noteworthy in this small-cap space.

- Dive into the specifics of Spadel here with our thorough health report.

Gain insights into Spadel's past trends and performance with our Past report.

BTS Group (OM:BTS B)

Simply Wall St Value Rating: ★★★★★★

Overview: BTS Group AB (publ) is a professional services firm with a market capitalization of SEK3.84 billion.

Operations: BTS Group's revenue primarily comes from its operations in North America (SEK1.55 billion), Europe (SEK621.41 million), and Other Markets (SEK836.98 million), with an additional contribution from Advantage Performance Group at SEK145.18 million. The company experiences a segment adjustment of -SEK347.75 million, impacting the overall revenue figures.

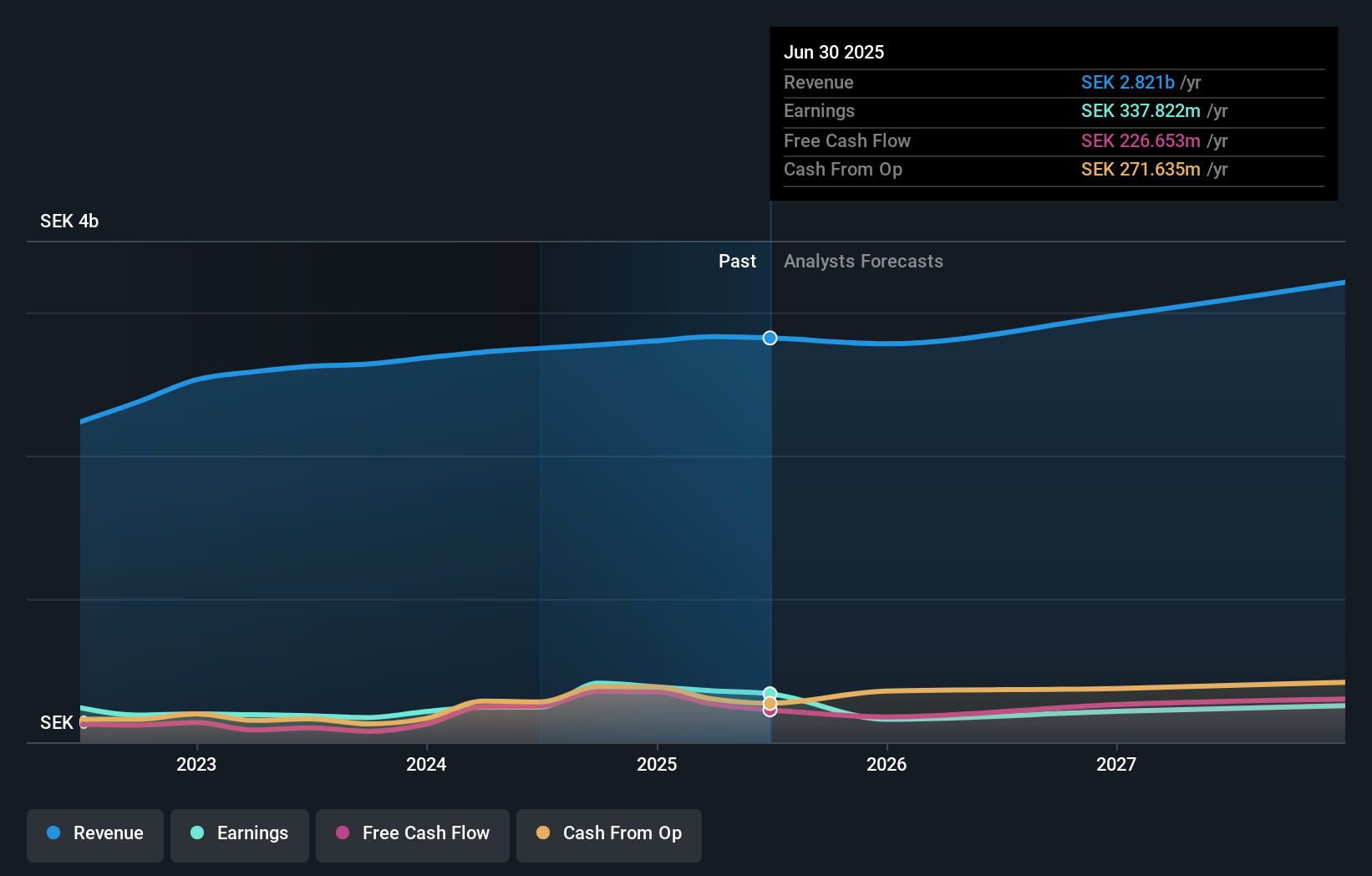

BTS Group, a professional services firm, has seen its earnings grow by 37.8% over the past year, outpacing the industry's 14.9% growth rate. The company's debt to equity ratio improved from 39.3% to 34.4% over five years, with a net debt to equity ratio of 8.3%, indicating strong financial health. Despite being valued at SEK167 million below fair value due to one-off gains impacting recent results, BTS faces challenges with declining profit margins and potential project delays in North America and Europe as it integrates AI solutions into its operations while expanding into new markets like Kenya's dynamic East African region.

Karnell Group (OM:KARNEL B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Karnell Group AB (publ) is a private equity firm that focuses on investments in add-on acquisitions, expansion, and small to medium-sized companies, with a market cap of SEK3.70 billion.

Operations: Karnell Group generates revenue primarily through its investments in add-on acquisitions and expansion of small to medium-sized companies. The firm's financial performance is reflected in its market capitalization of SEK3.70 billion.

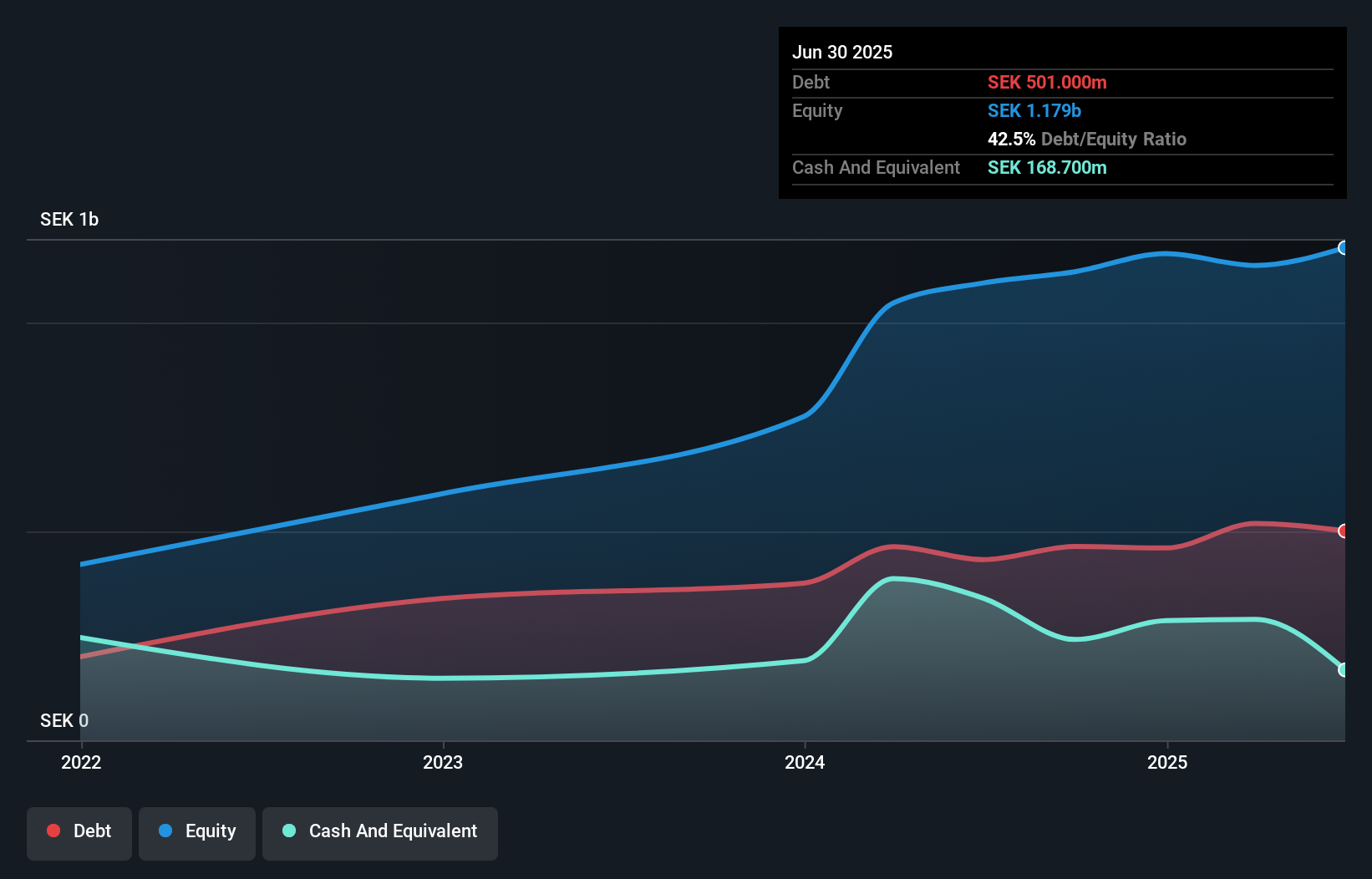

Karnell Group, a smaller player in the Industrials sector, has shown impressive growth with earnings up 94.1% over the past year, significantly outpacing the industry average of 5.9%. The company's net debt to equity ratio stands at a satisfactory 28.2%, and its interest payments are well covered by EBIT at 6.7 times coverage. Recent financials reveal strong performance with second-quarter sales reaching SEK 431 million from SEK 357 million last year and net income jumping to SEK 36.8 million from SEK 15.8 million previously, reflecting high-quality earnings and positive free cash flow trends despite recent executive changes in leadership roles.

- Unlock comprehensive insights into our analysis of Karnell Group stock in this health report.

Gain insights into Karnell Group's historical performance by reviewing our past performance report.

Key Takeaways

- Click this link to deep-dive into the 327 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal