Examining Bloom Energy After Shares Surge 308% and US Hydrogen Funding Announcement

If you have been watching Bloom Energy’s stock lately, you know there is a lot to talk about. After all, this is a company whose share price has soared an eye-popping 308.9% over the past year, and a remarkable 210.0% over the last five years. Even zooming out to the last three years, investors have seen an 88.6% return. These are not gains you see every day, and naturally, that kind of performance grabs attention, whether you are a longtime shareholder or just looking for your next investment idea.

Much of this surge seems tied to the broader excitement around clean energy and innovative fuel cell technology. The market's renewed interest in climate-focused solutions has certainly played a part, pushing stocks like Bloom Energy to new highs as investors hunt for growth stories that could thrive in a changing energy landscape. That excitement has also come alongside increased volatility and some shifts in how investors view the risks and opportunities involved.

But let’s cut to the chase. Are these gains backed up by value, or is all this movement just market optimism? When we put Bloom Energy through six standard valuation checks, the company did not score as undervalued on any of them. Its valuation score sits at 0 out of 6. That fact might surprise you after such impressive price moves. Wondering what these valuation checks are, and if they tell the full story? Let’s dig into the different ways to measure value. There may even be a better approach than the usual methods we are about to examine.

Bloom Energy scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Bloom Energy Cash Flows

A Discounted Cash Flow (DCF) model is one of the most widely used ways to estimate what a company is truly worth. It works by projecting Bloom Energy’s expected future cash flows and then discounting those amounts back to today, giving an estimate of the company’s intrinsic value.

Bloom Energy’s most recent Free Cash Flow (FCF) stands at just over $1.2 million. Analysts expect FCF to grow significantly in the next few years, with projections ramping up sharply. By 2029, FCF is expected to reach $461 million. Looking further out, Simply Wall St extrapolates these growth rates and shows FCF rising to more than $800 million per year over the next decade.

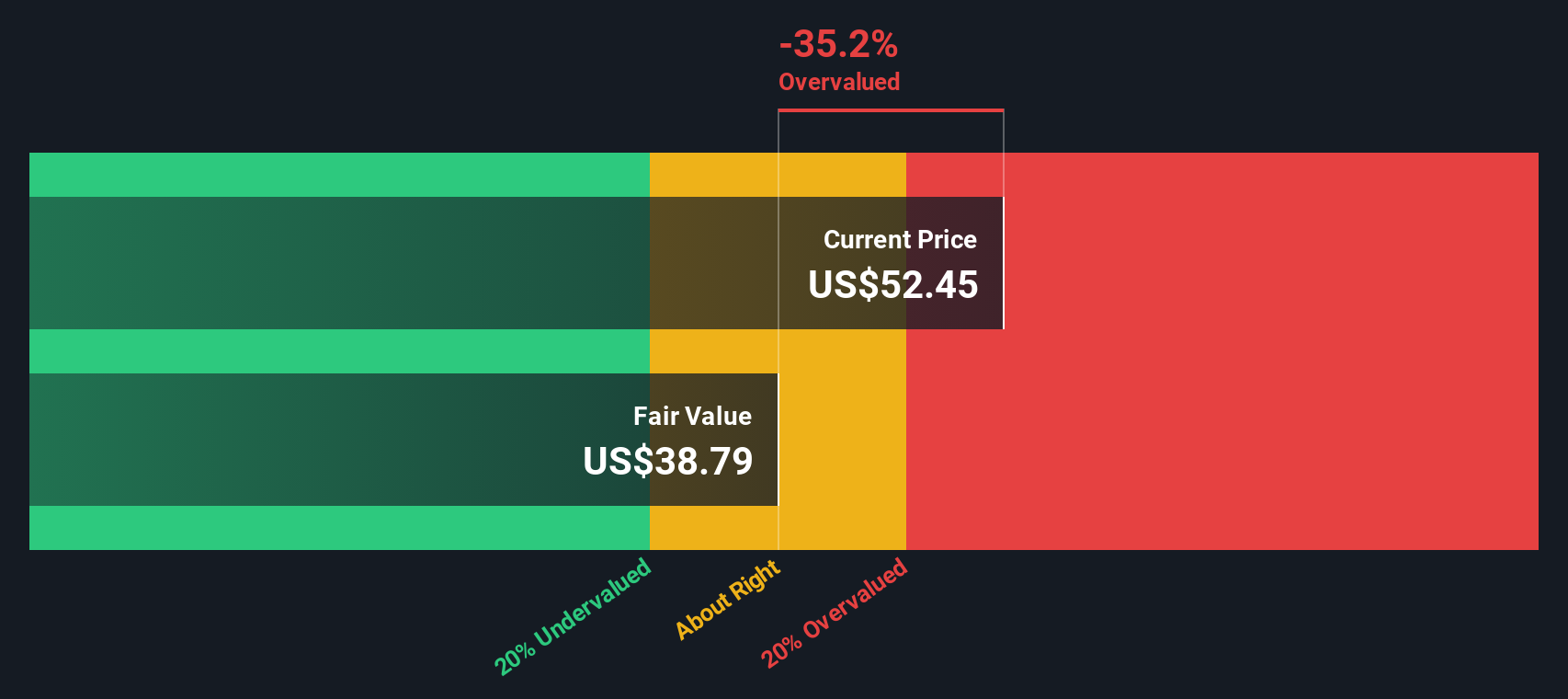

Based on all these projected cash flows and standard discounting, Bloom Energy’s calculated intrinsic value comes in at $38.65 per share. However, when comparing this fair value to the current share price, the model shows the stock is trading at a discount of -25.6%, meaning it is 25.6% overvalued compared to what the DCF model indicates.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Bloom Energy.

Approach 2: Bloom Energy Price vs Sales

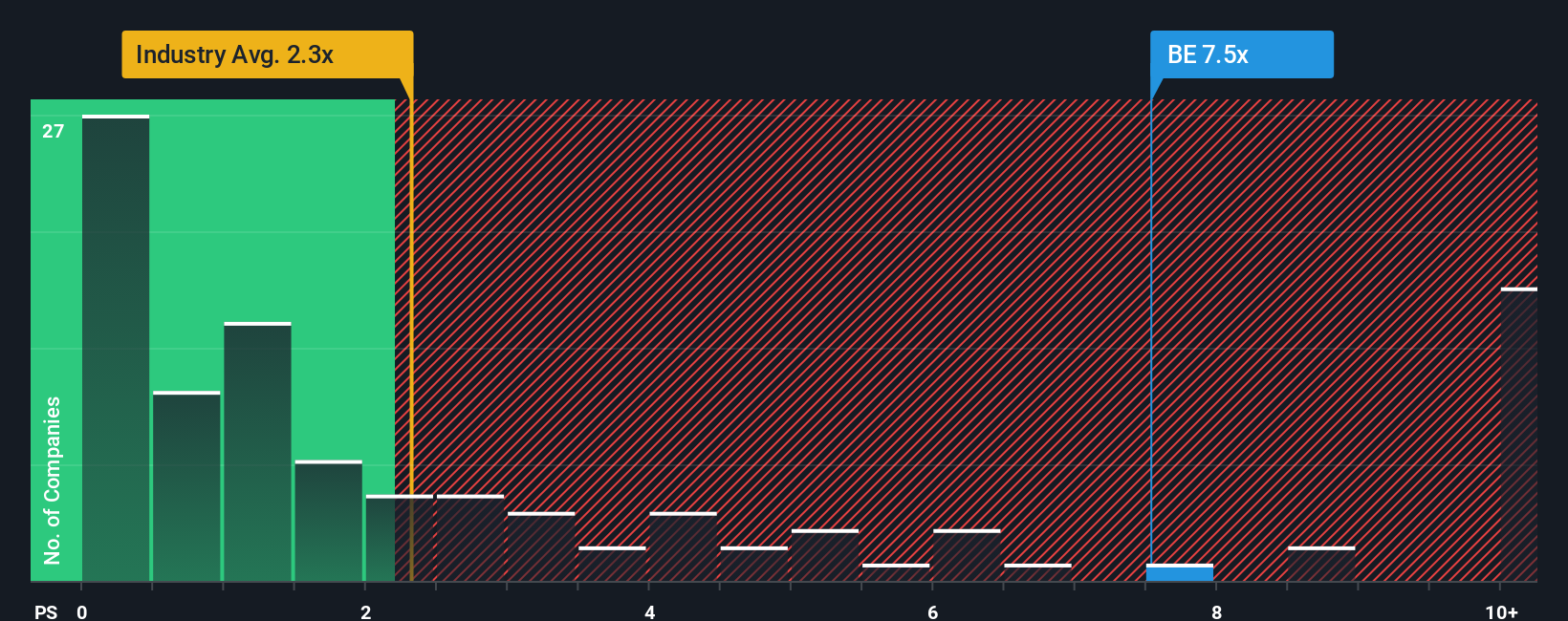

For companies like Bloom Energy, which are not yet consistently profitable, the Price-to-Sales (P/S) ratio is often a more useful valuation tool than earnings-based multiples. The P/S ratio gives investors a way to value the business based on its actual sales, sidestepping some of the volatility that comes with early-stage profitability swings. Investors often look for a reasonable P/S ratio as a sign the stock's price fairly reflects both the company's growth potential and its risks.

Bloom Energy’s current P/S ratio stands at 7.0x. This is notably higher than the Electrical industry average of 2.3x and its peer group’s average of 3.7x. At first glance, this suggests the market has priced in a premium for Bloom’s expected growth, innovation, or business model strength.

However, Simply Wall St’s proprietary Fair Ratio for Bloom Energy is 4.0x. This Fair Ratio is tailored to the company based on a mix of factors including expected growth, profit margin, industry dynamics, market capitalization, and risk profile. Unlike a simple peer or industry comparison, this custom approach aims to capture the nuances that could justify a higher or lower multiple for Bloom specifically. This makes it a more refined benchmark for fair value.

With the company’s P/S at 7.0x and its Fair Ratio at 4.0x, there is a noticeable gap. This suggests that Bloom Energy’s shares currently trade at a significant premium compared to what might be justified by its fundamentals.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Bloom Energy Narrative

Earlier, we mentioned there might be a better way to make sense of value, so let’s introduce Narratives, a powerful, accessible tool for investors on Simply Wall St that goes beyond numbers alone.

A Narrative is simply your own story about a company, built around your view of its future revenue, earnings, and profit margins, and how you think these numbers lead to a fair value and a recommendation to buy, hold, or sell. Narratives turn the big picture, including market trends, risks, and business strengths, into a clear financial forecast and target price, making your investment rationale both personal and easy to revisit as things evolve.

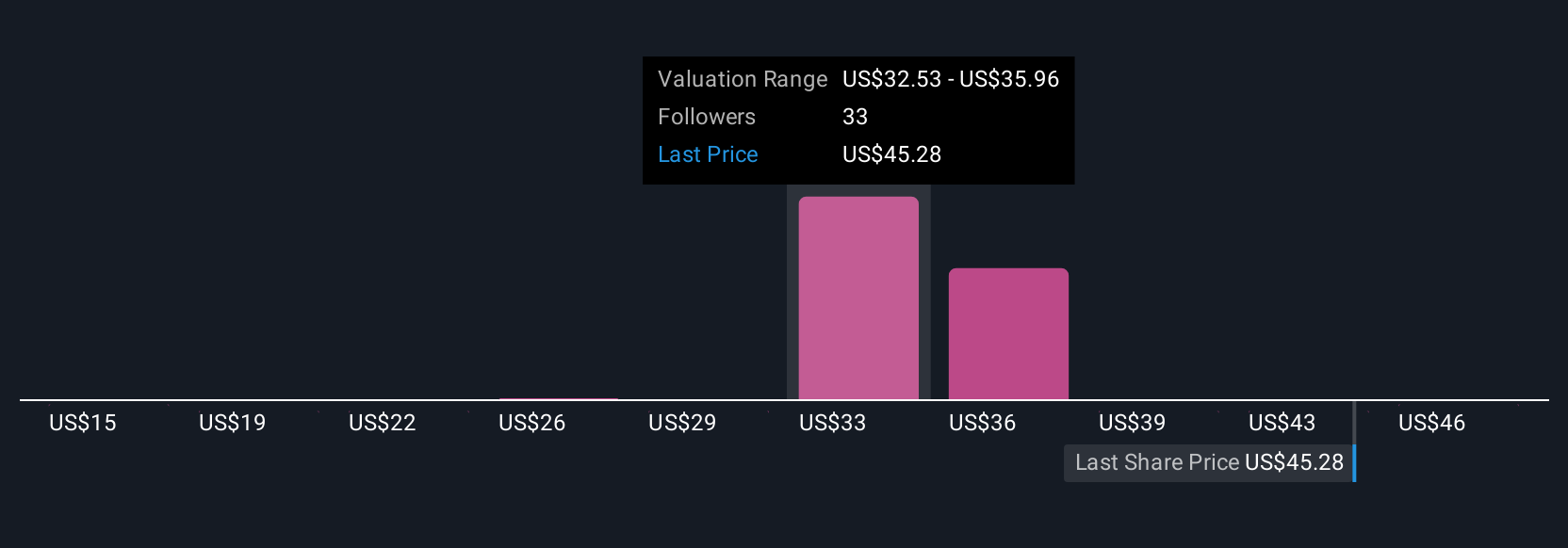

What makes Narratives especially useful is that they update in real time. Whenever news breaks or new results are released, the numbers and story adapt automatically. This gives you a dynamic and transparent way to compare your valuations with other investors in the Community, seeing who leans bullish or cautious, and why. For example, some investors currently see Bloom Energy as worth up to $48.00 per share based on rapid growth and tech leadership, while others value it closer to $10.00 due to competitive or execution risks.

With Narratives, you gain a structured, flexible approach that ties the company’s evolving story directly to investment decisions, all in one place.

Do you think there's more to the story for Bloom Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal