Assessing Assurant (AIZ) Valuation After Expanding Holman Partnership in Auto Dealership Services

Most Popular Narrative: 10.4% Undervalued

According to community narrative, Assurant's current share price is seen as undervalued by 10.4%. Analysts see strong long-term catalysts that could justify a higher fair value.

Assurant is capitalizing on the proliferation of connected devices and increasing device protection needs. This is demonstrated by 2.4 million net new device protection subscribers, international acquisitions expanding repair capabilities, and strong new partnerships. These factors position the company for sustained revenue growth and improved recurring earnings in its Lifestyle segment.

Curious how Assurant could transform from steady performer to breakout market leader? One bold financial assumption in this narrative points to profit margins and top-line expansion that are not typically seen in this sector. The fair value calculation here is built around surprising earnings and revenue projections. Interested in what those numbers could mean for your portfolio? There are some eye-opening quantitative beliefs behind that price target.

Result: Fair Value of $241 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory changes or rising competition from tech-driven insurance disruptors could challenge Assurant’s growth story. These factors may potentially limit its upside in the years ahead.

Find out about the key risks to this Assurant narrative.Another View: What About Cash Flows?

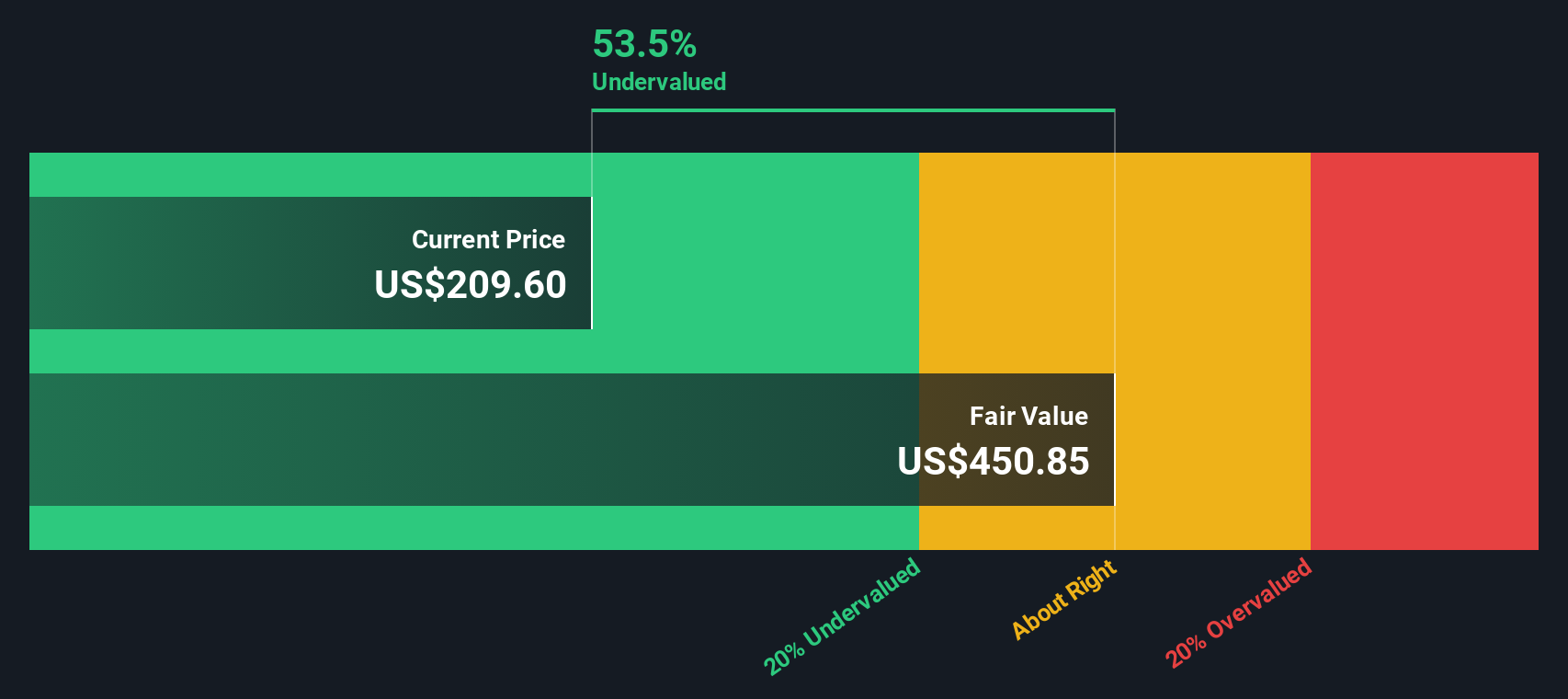

While the first take focuses on where the market might be heading, our DCF model looks instead at future cash flows to estimate value. This approach currently sees Assurant as significantly undervalued. Could this be the deeper story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Assurant Narrative

If you think there is another angle or want to dive into the numbers on your own terms, you can build a personalized narrative in just a few minutes, so why not do it your way?

A great starting point for your Assurant research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Investment Opportunities?

Seize your edge in the market by checking out targeted stock ideas matched to your interests. Don’t let standout opportunities pass you by while others act. Make smarter moves by tapping into these curated lists:

- Capture the upside of stable returns with stocks offering attractive income potential when you browse the latest dividend stocks with yields > 3%.

- Spot undervalued gems ready to reward patient investors by exploring undervalued stocks based on cash flows that score highly on future cash flow prospects.

- Uncover growth powered by innovation by checking out leading AI penny stocks that are pushing boundaries in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal