Assessing Andersons (ANDE) Valuation as Industry Veteran Steven Oakland Joins the Board

If you’ve been watching Andersons (ANDE), the company just added a new heavyweight to its board: Steven Oakland, best known for leading TreeHouse Foods in North America. With nearly four decades of experience shaping some of the biggest names in food and beverage, Oakland’s appointment signals a clear push by Andersons to bring fresh expertise to its leadership bench. While it might not grab headlines like a blockbuster merger, moves like this can quietly influence a company’s future direction, especially when it comes to navigating industry complexity and thinking strategically about growth.

Oakland’s arrival comes at an interesting time for Andersons. The company has announced its 116th consecutive dividend, underscoring a pattern of reliability for shareholders. Yet, the stock itself has presented a mixed bag. It is down 18% over the past year, even with a 17% rebound in the past three months. Momentum has started to pick up again after a period of underperformance, suggesting that investor sentiment could be in flux as leadership changes take shape.

With these shifts on the table, it’s worth asking: Is Andersons setting the stage for long-term value, or has the market already factored such future growth into the current price?

Most Popular Narrative: 12.3% Undervalued

According to community narrative, Andersons is considered undervalued compared to its fair value estimate, with analysts projecting notable upside driven by future earnings and margin improvements.

Recent acquisition of 100% ownership of ethanol plants positions Andersons to fully capture cash flow, tax credits, and margin upside from regulatory support for renewable fuels and low-carbon intensity ethanol. This directly supports future increases in earnings and net margins. Expansion of the Port of Houston for soybean meal exports, along with ongoing large U.S. harvests, is expected to increase grain volumes and create new international market opportunities. This is anticipated to improve top-line revenue and asset utilization.

Curious about what is powering this bullish outlook? The fair value hinges on a growth plan that bets on rising profits, bigger margins, and a re-rating that could change how investors size up Andersons. Eager to learn the detailed projections and bold assumptions that help justify this price target? You will want to dig into the full breakdown to see why analysts see so much room to run.

Result: Fair Value of $46.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, uncertainties such as volatile grain markets and rising debt from recent expansions could present challenges to the optimistic long-term outlook for Andersons.

Find out about the key risks to this Andersons narrative.Another View: Discounted Cash Flow Puts a Different Spin on Value

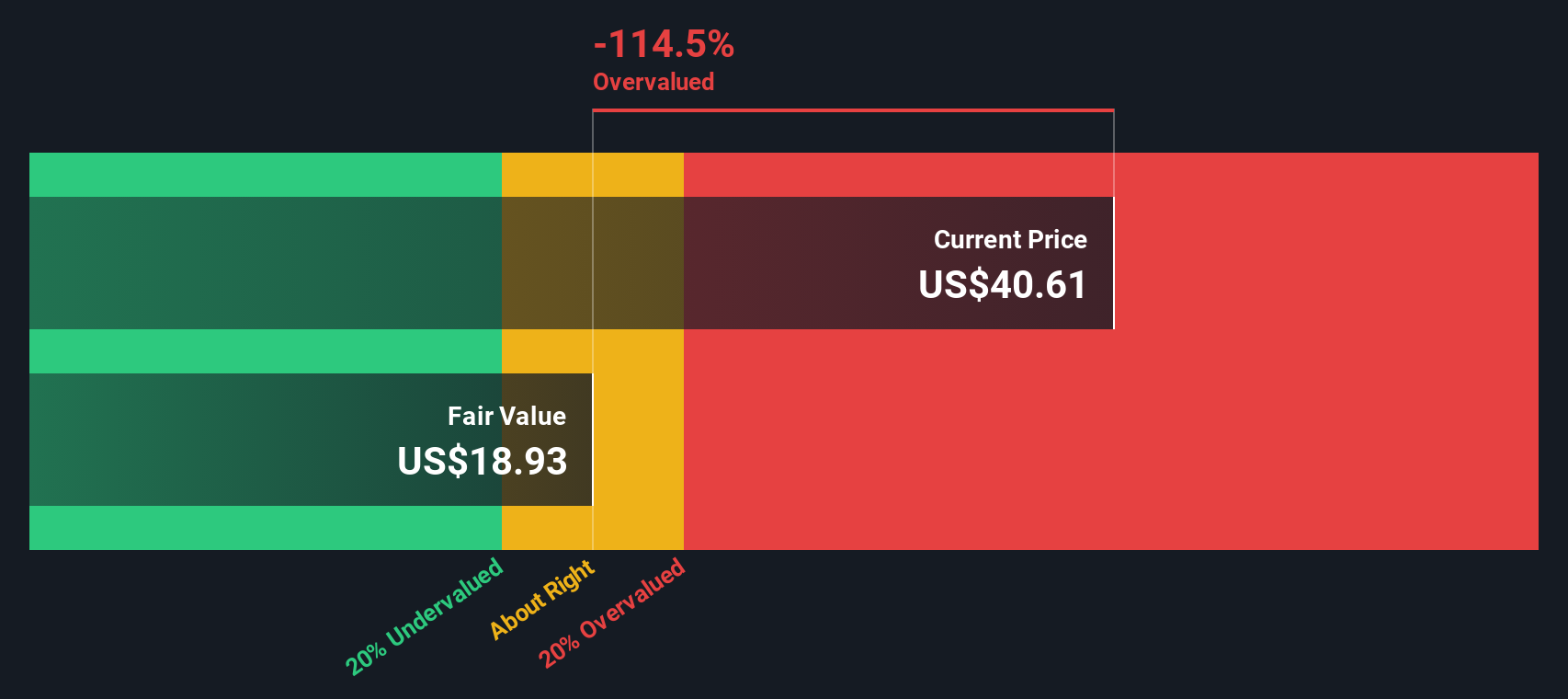

While analysts' price targets signal upside, our DCF model paints a far less optimistic picture. This suggests Andersons might be trading well above its intrinsic worth. So, which approach truly captures the company's future potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Andersons Narrative

If you see things differently, or want to dive deeper into the numbers on your own terms, you can easily shape your own analysis in just a few minutes and do it your way.

A great starting point for your Andersons research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Keep your portfolio fresh and future-ready by searching pockets of the market where innovation intersects with reliable growth. If you want to put your money to work beyond Andersons, here are some exciting places to start your search:

- Find reliable income by exploring companies with strong cash flow and dividend stocks with yields > 3% for dependable payouts above 3%.

- Identify value opportunities by discovering undervalued stocks based on cash flows that the market may have overlooked, offering potential for early entry.

- Access medical breakthroughs and emerging trends by exploring healthcare AI stocks leading innovation in the healthcare sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal