A Fresh Look at New Jersey Resources (NJR) Valuation Following $200 Million Senior Notes Sale

New Jersey Resources (NJR) just made a major move that should catch investors’ attention. The company announced it is raising $200 million by selling senior notes to institutional investors. The fresh capital is slated for refinancing debt, funding capital expenditures, and bolstering corporate finances. While a note sale is not as flashy as a large acquisition, it signals management’s intention to prioritize stability and operational flexibility as markets adjust to shifting rates and economic conditions.

This financing step comes after a period of steady but unspectacular gains for New Jersey Resources. The stock climbed 8% over the last year and is up just over 3% year-to-date, suggesting that momentum is stable but not accelerating quickly. Recent years have been kinder to long-term shareholders, with a total return above 17% for the past three years and 90% over five years. More recently, price action has been relatively tame, reflecting cautious optimism as the company balances growth with prudent financial management.

With the latest capital raise and shares holding their ground, the question for investors is whether New Jersey Resources is undervalued or if the market has already priced in its growth potential from this point forward.

Most Popular Narrative: 10.6% Undervalued

According to community narrative, New Jersey Resources is considered undervalued, with the consensus view holding the company’s fair value above its current share price. Analysts point to key business trends and future growth initiatives that justify a higher valuation, even though forecasts indicate modest declines in revenue and earnings over the coming years.

“A multi-year pipeline of solar and clean energy projects at Clean Energy Ventures, supported by flexible, risk-adjusted capital deployment, offers upside to future revenues and margin diversification as demand for renewable infrastructure accelerates.”

Why might New Jersey Resources be valued higher than what the market currently reflects? The core element in this narrative is the company’s strategy to reshape its earnings mix and take advantage of growing demand for renewables. Interested in what growth and profit projections are driving this ambitious price target? There is more behind this perspective than may be immediately apparent.

Result: Fair Value of $53.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing reliance on traditional gas and the risk of policy changes around decarbonization could significantly alter New Jersey Resources’ long-term outlook.

Find out about the key risks to this New Jersey Resources narrative.Another View: What Does Our DCF Model Say?

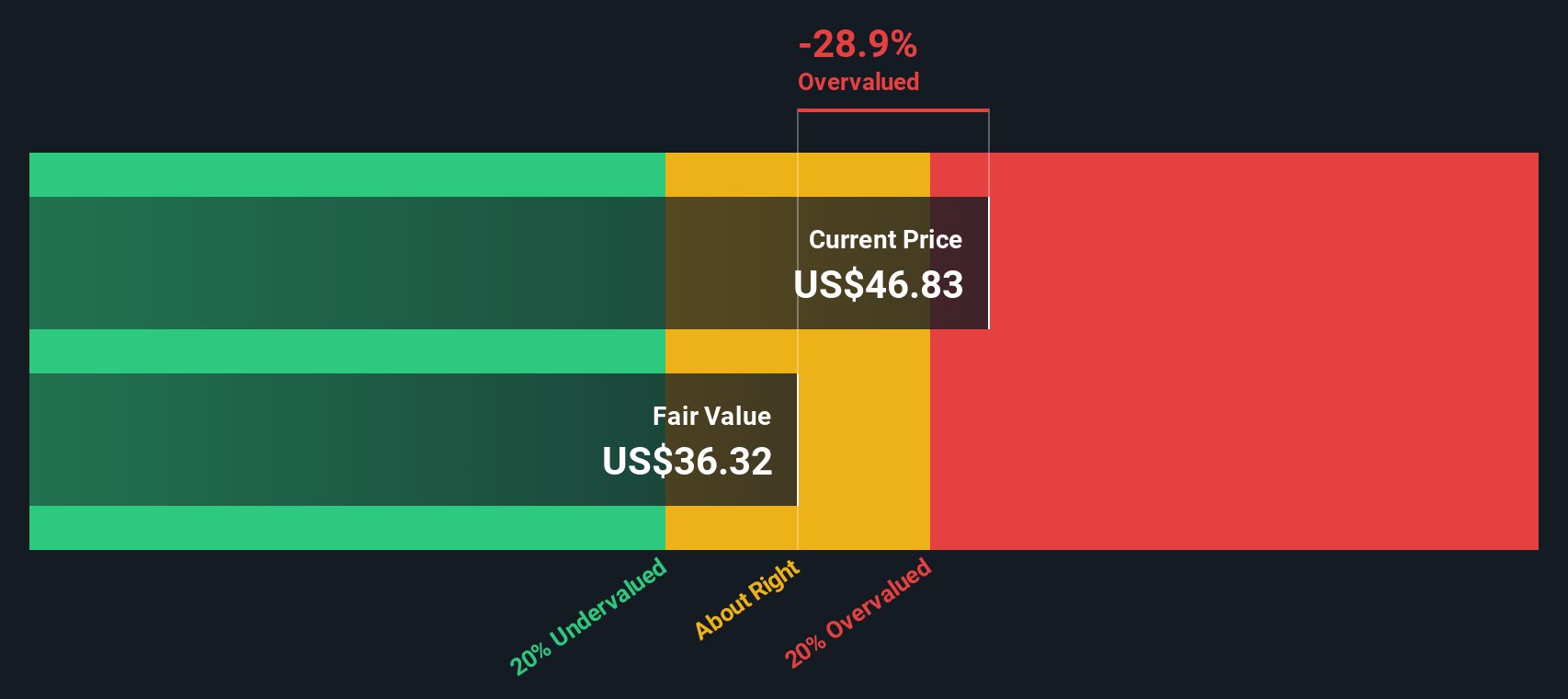

Looking at New Jersey Resources through the lens of our DCF model paints a different picture. This approach suggests the shares may actually be overvalued, which challenges the idea that the market is missing hidden value here. Which method reveals the true story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own New Jersey Resources Narrative

If you are not convinced by the perspectives above or prefer to dig into the data and form your own conclusions, it's fast and straightforward to craft your own narrative in just a few minutes. do it your way.

A great starting point for your New Jersey Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Investment Inspiration?

Smart investing is all about keeping your options open and spotting next-level opportunities before the crowd does. If you are looking to step up your portfolio with fresh ideas, explore these standout stock themes selected for their unique potential. Your next strategic move could be just a click away.

- Uncover reliable income streams by browsing dividend stocks with yields > 3% to see which companies consistently deliver yields above 3% for long-term stability.

- Tap into the fast-growing world of healthcare innovation with healthcare AI stocks featuring pioneers at the intersection of artificial intelligence and medicine.

- Catch early-stage momentum by checking out penny stocks with strong financials for small-cap stocks that combine strong financial health with compelling potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal