Arbor Realty Trust (ABR): Valuation Update Following $1.05 Billion Securitization Deal

Arbor Realty Trust (ABR) has just closed the books on a $1.05 billion commercial real estate mortgage loan securitization, drawing a bright spotlight for investors tracking its next move. The company issued around $933 million in investment-grade notes and kept a $117 million slice of subordinate interests for itself, bolstering both its liquidity and financial flexibility. The deal’s proceeds are earmarked to pay down some of Arbor's current borrowings, cover transaction expenses, and, perhaps most importantly, fuel new loans and investments in the months ahead.

This fresh financing marks a substantial step at a time when capital markets can be unpredictable, especially in real estate. After a tough start this year for the stock, momentum has shifted: Arbor Realty Trust has rebounded 20% over the past three months, even as the yearly performance remains slightly negative. Past headline moves and this securitization suggest management is intent on preserving growth optionality, despite last year’s market challenges.

With the stock’s rebound and a major deal on the books, the pressing question becomes clear: Is Arbor Realty Trust trading at a bargain, or has the market already priced in its next phase of growth?

Most Popular Narrative: 1.8% Overvalued

According to community narrative, Arbor Realty Trust is considered slightly overvalued, with its share price trading just above the estimated fair value when discounting projected earnings and risk factors.

*A potential decrease in agency production by 10% to 20% in 2025 due to the high interest rate environment could lead to lower revenue streams and put pressure on net income. Arbor Realty Trust's resilience, strategic loan modifications, and diversified revenue streams help support shareholder confidence and offer a competitive advantage in a challenging environment.*

Interested in how higher interest rates and declining agency volumes could impact Arbor’s future? The real surprise may be found in the profit margin assumptions and long-term earnings outlook underlying this modest valuation premium. Want to understand what contributes to the narrow margin between price and fair value? The drivers may not be what you expect.

Result: Fair Value of $11.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a stronger than expected year or continued dividend stability could quickly change the outlook and challenge the current fair value narrative.

Find out about the key risks to this Arbor Realty Trust narrative.Another View: Discounted Cash Flow Puts the Spotlight on Value

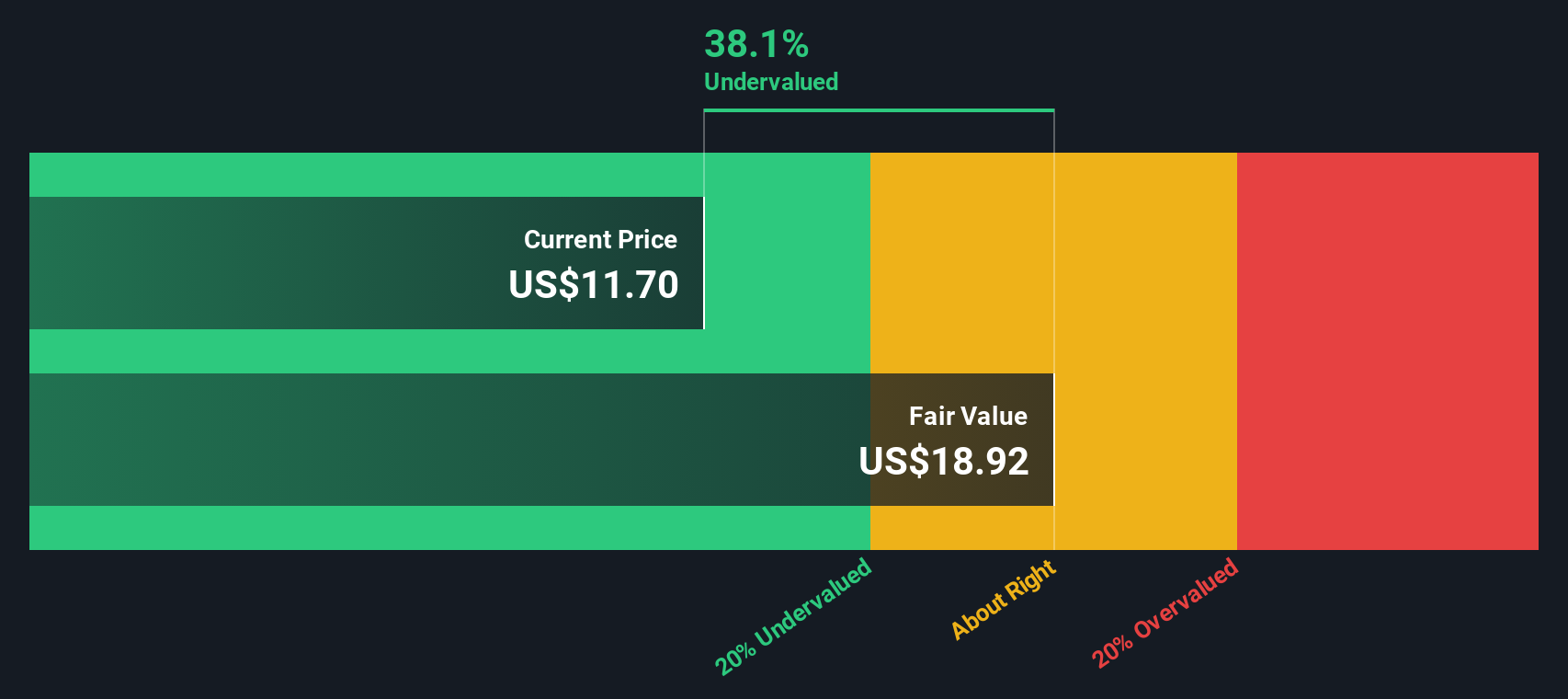

Our DCF model tells a different story and suggests that Arbor Realty Trust could actually be undervalued right now. This challenges the notion that shares are fairly or fully priced at today's level. Is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Arbor Realty Trust Narrative

If you want to dig deeper or draw different conclusions from the numbers and assumptions, you have the tools to craft your own view in just a few minutes. So why not do it your way.

A great starting point for your Arbor Realty Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why stop at one opportunity when Simply Wall Street’s powerful screeners can help you spot the stocks primed for potential? Let your search for the next standout portfolio addition start here. If you do not, you could miss the trends other investors are acting on right now.

- Zero in on value and balance by tracking companies offering robust dividend stocks with yields > 3% that may strengthen your income stream and portfolio resilience.

- Seize early advantage in the innovation race by uncovering AI penny stocks that are redefining growth and shaping tomorrow’s tech landscape today.

- Supercharge your portfolio potential with undervalued stocks based on cash flows and find shares that the market might be overlooking based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal