Kaiser Aluminum (KALU) Is Up 6.9% After Raising 2025 EBITDA Outlook on Higher Prices and Shipments – Has The Bull Case Changed?

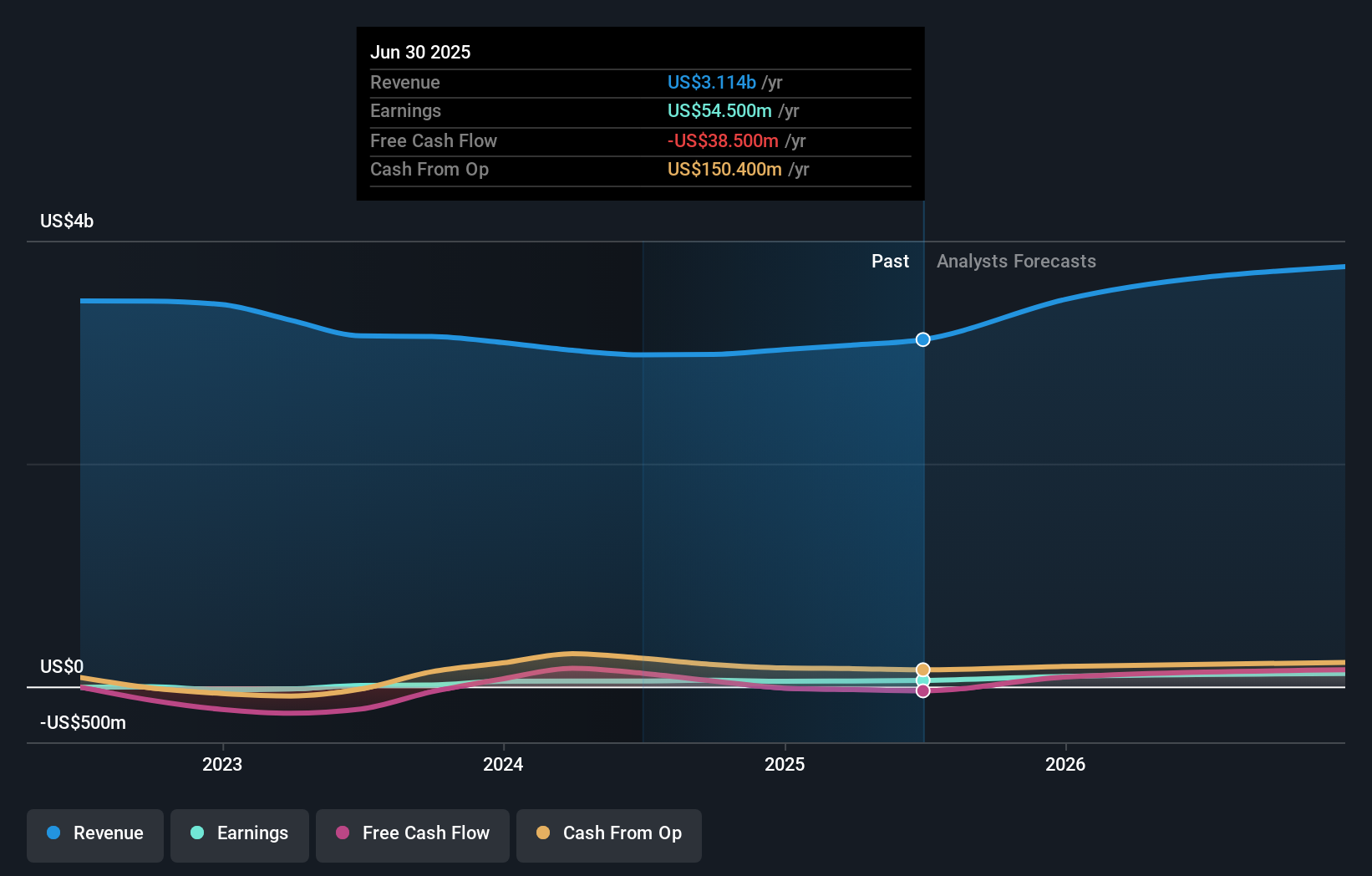

- Kaiser Aluminum Corporation recently reported that its second quarter of 2025 saw a 1% increase in net sales over the same period in 2024, with all segments benefiting from increased realized prices and shipments totaling 288.4 million pounds.

- CEO Keith A. Harvey raised the company's full-year adjusted EBITDA outlook, highlighting strengthened operational fundamentals, favorable metal pricing, and ongoing investments as drivers for the improved forecast.

- We’ll explore how the raised EBITDA guidance underscores Kaiser Aluminum’s confidence in its operational momentum and future prospects.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Kaiser Aluminum's Investment Narrative?

For someone considering Kaiser Aluminum as a potential addition to their portfolio, the big picture hinges on confidence in the company’s ability to translate stable operational performance and robust market pricing into sustained earnings growth. This quarter’s combination of higher shipments, an uptick in realized prices, and management’s upgraded EBITDA outlook brings renewed attention to near-term growth catalysts, such as further price recovery and volume expansion across its business lines. The positive revision to earnings guidance could reframe recent risk assessments, particularly around margin compression and demand volatility, at least in the short run. However, challenges like ongoing dividend unsustainability, interest coverage and the potential impact of board turnover remain at the forefront for the cautious investor. While recent price moves have been constructive, the durability of rising profits and improved guidance will continue to be tested by sector headwinds, metal market unpredictability, and the need for consistent execution from both management and the refreshed board.

On the other hand, dividend coverage remains a critical detail investors should not overlook. Kaiser Aluminum's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Kaiser Aluminum - why the stock might be worth over 3x more than the current price!

Build Your Own Kaiser Aluminum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kaiser Aluminum research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kaiser Aluminum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kaiser Aluminum's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal