Why Evolution Mining (ASX:EVN) Is Up 6.3% After Strong FY25 Production and Dividend Hike And What's Next

- Evolution Mining Limited recently reported strong full-year operating results, with gold production rising to 750,512 ounces and copper output reaching 76,261 ounces for the year ended June 30, 2025, alongside a significant increase in revenue and net income compared to the previous year.

- Following these robust results, the company increased its fully franked dividend to A$0.13 per security and reaffirmed its production guidance for fiscal 2026, highlighting continued confidence in its operational outlook.

- We'll examine how Evolution Mining’s surging gold and copper production underpins its investment narrative and future growth expectations.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Evolution Mining Investment Narrative Recap

To own Evolution Mining shares today, an investor needs to believe that the company’s strong gold and copper operations, low-cost structure, and ongoing project delivery will continue to support reliable cash flow and steady dividends, while managing the risk of rising operating costs and mine reserve depletion. The latest financial results reinforce its positive momentum, but they do not materially change the main short-term catalyst, continued high-margin production, or the main risk, which remains around cost pressures and long-term ore quality.

Among the recent announcements, the reaffirmed production guidance for fiscal 2026 stands out as most relevant. This underlines management’s confidence that strong resource extraction and cost control can be sustained, supporting the narrative of robust free cash flow and stakeholder returns, even as investors weigh the risk of margin compression from future cost or regulatory pressures.

But while management has again projected solid performance, investors should be aware that persistent labor and input cost inflation could still eat into future margins...

Read the full narrative on Evolution Mining (it's free!)

Evolution Mining's outlook forecasts A$5.0 billion in revenue and A$1.3 billion in earnings by 2028. Achieving this requires annual revenue growth of 5.1% and an earnings increase of A$373.8 million from the current A$926.2 million.

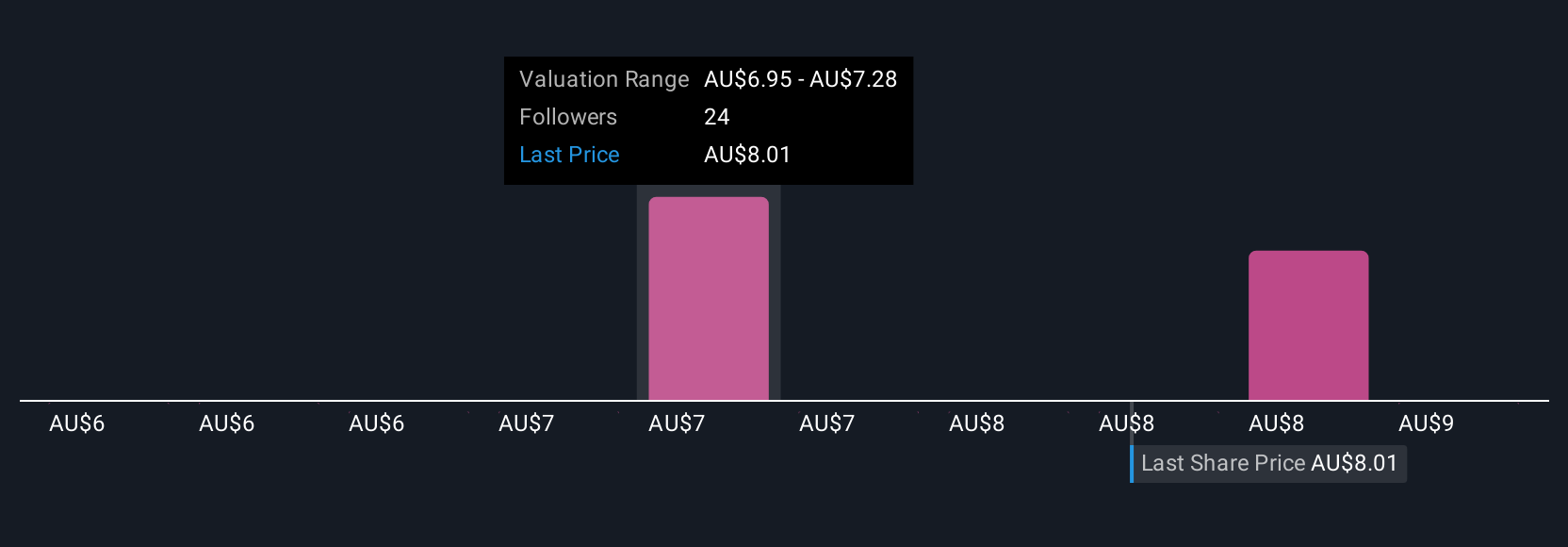

Uncover how Evolution Mining's forecasts yield a A$7.12 fair value, a 15% downside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community valued Evolution Mining between A$5.65 and A$8.90 per share. While many expect high-margin operations to persist, some highlight that rising costs could challenge earnings forecasts ahead. Compare these viewpoints and form your own assessment.

Explore 5 other fair value estimates on Evolution Mining - why the stock might be worth as much as 6% more than the current price!

Build Your Own Evolution Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evolution Mining research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Evolution Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evolution Mining's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal