Will Cal-Maine Foods' (CALM) New Leadership Bolster Its Strategy in a Shifting Food Industry?

- Cal-Maine Foods recently closed a shelf registration for approximately US$316.18 million in common stock and appointed two respected executives, Melanie Boulden to the Board of Directors and Keira Lombardo as its first Chief Strategy Officer.

- These developments signal the company’s intention to strengthen its capital structure and leadership bench, reflecting a strong focus on operational innovation and long-term strategy within the competitive food industry.

- We'll explore how the new Chief Strategy Officer role could shape Cal-Maine Foods' investment narrative amid evolving industry trends.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Cal-Maine Foods' Investment Narrative?

Cal-Maine Foods continues to present investors with a focused value proposition centered on scale, efficiency, and disciplined financial management, especially within the highly competitive food sector. The recent US$316 million shelf registration and key leadership appointments, including a new independent director with substantial food industry credentials and a first-ever Chief Strategy Officer, introduce resources and perspectives clearly aligned with innovation and enterprise transformation. These changes could broaden the company’s ability to respond to upcoming industry shifts but are not expected to materially shift the most significant short-term catalysts, which remain tied to egg prices, production volumes, and costs. However, the new strategic leadership could have longer-term implications for operational direction and risk management, potentially easing certain business pressures but not eliminating volatility tied to commodity cycles and unpredictable input costs.

On the flip side, investors should keep a close eye on declining earnings forecasts for the next few years.

Exploring Other Perspectives

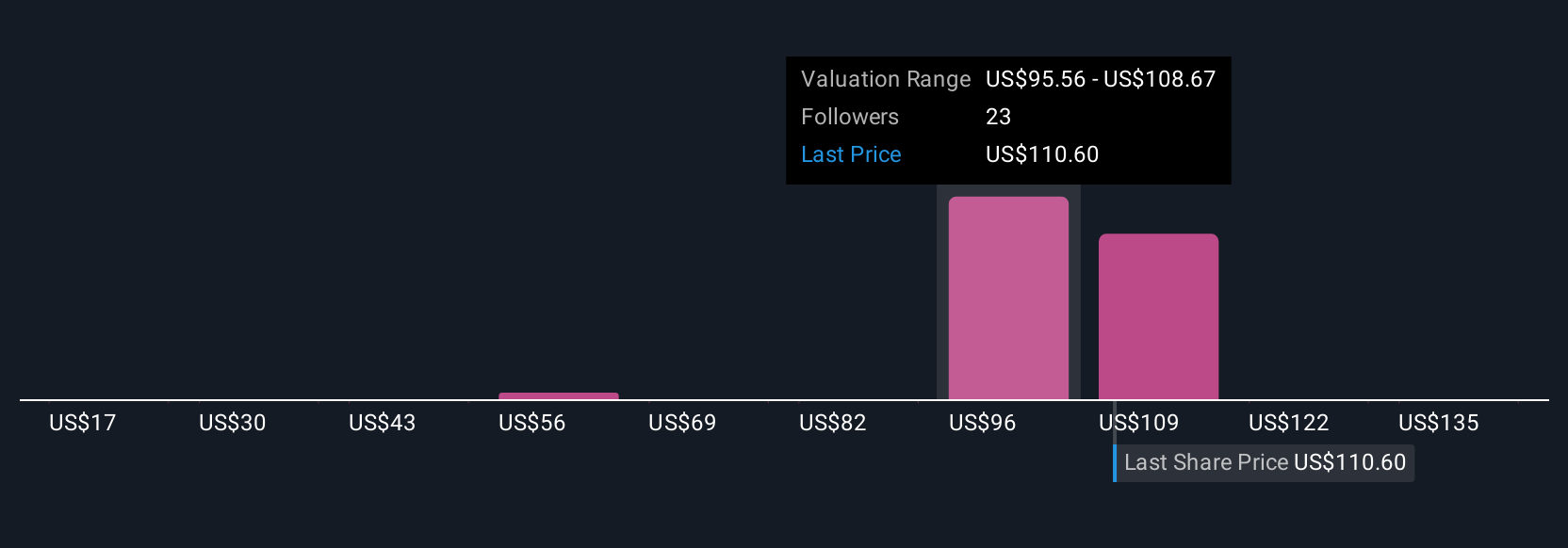

Explore 12 other fair value estimates on Cal-Maine Foods - why the stock might be worth less than half the current price!

Build Your Own Cal-Maine Foods Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cal-Maine Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cal-Maine Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cal-Maine Foods' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal