How Does Erie Indemnity’s (ERIE) Strong Return on Equity Reflect Its Competitive Edge?

- Erie Indemnity, which serves as the attorney-in-fact for Erie Insurance Exchange, has reported a history of consistent long-term revenue growth and high return on equity compared to its peers.

- This financial track record highlights the company's strong competitive position and its ability to capture opportunities in the insurance sector.

- We’ll explore how Erie Indemnity’s industry-leading return on equity strengthens its investment narrative in the current environment.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Erie Indemnity's Investment Narrative?

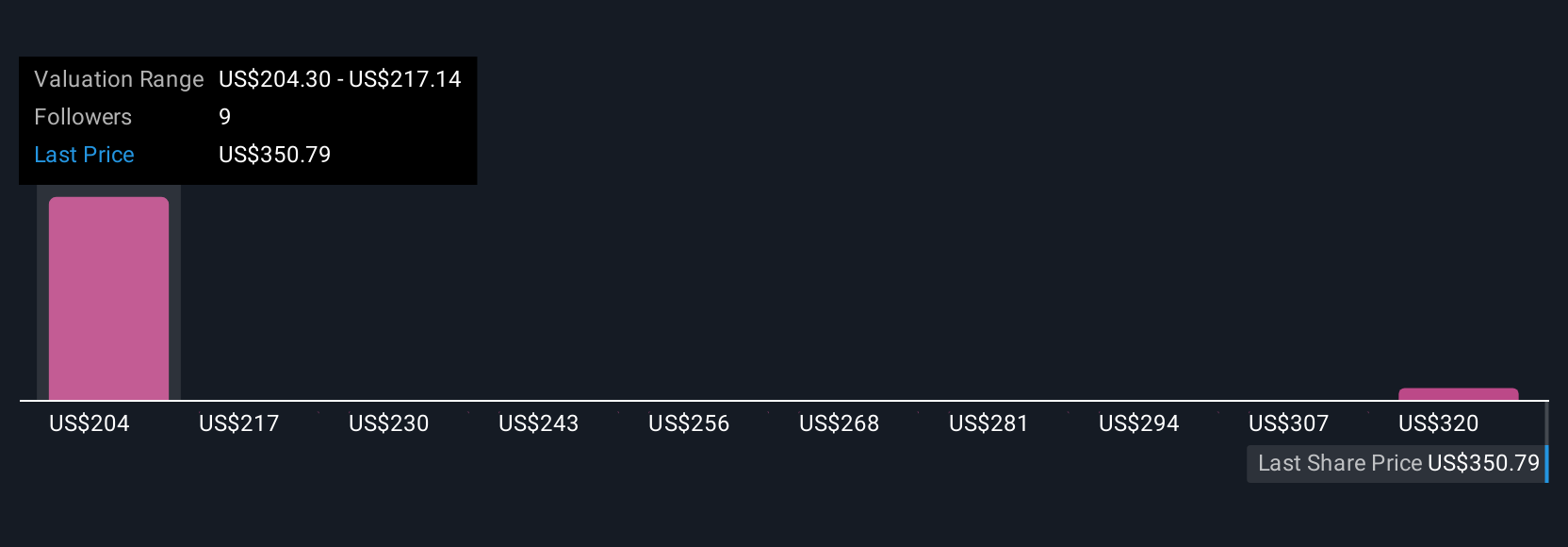

For anyone considering Erie Indemnity, the investment case starts with a belief in the company's established position managing Erie Insurance Exchange and its consistent delivery of strong profitability. The recent news, spotlighting a five-year streak of double-digit revenue growth and a return on equity topping industry peers, confirms the business's enduring strengths rather than signaling a radical shift. In the short term, this performance is likely to reinforce the company's appeal among income and quality-focused investors, especially as the latest financials and stable dividend policy show little sign of disruption. Yet, risks remain: Erie is trading at a premium to its peers, which could make current valuations more sensitive to any growth slowdown or sector-wide sentiment shifts. The latest update does not appear to materially change these short-term catalysts or risks, based on recent price action and company fundamentals.

But investors should keep a close eye on that price-to-earnings premium as expectations build. Erie Indemnity's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Erie Indemnity - why the stock might be worth as much as $332.66!

Build Your Own Erie Indemnity Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Erie Indemnity research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Erie Indemnity research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Erie Indemnity's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal