Convano Inc. (TSE:6574) Stocks Shoot Up 225% But Its P/S Still Looks Reasonable

Convano Inc. (TSE:6574) shares have continued their recent momentum with a 225% gain in the last month alone. The last 30 days were the cherry on top of the stock's 1,716% gain in the last year, which is nothing short of spectacular.

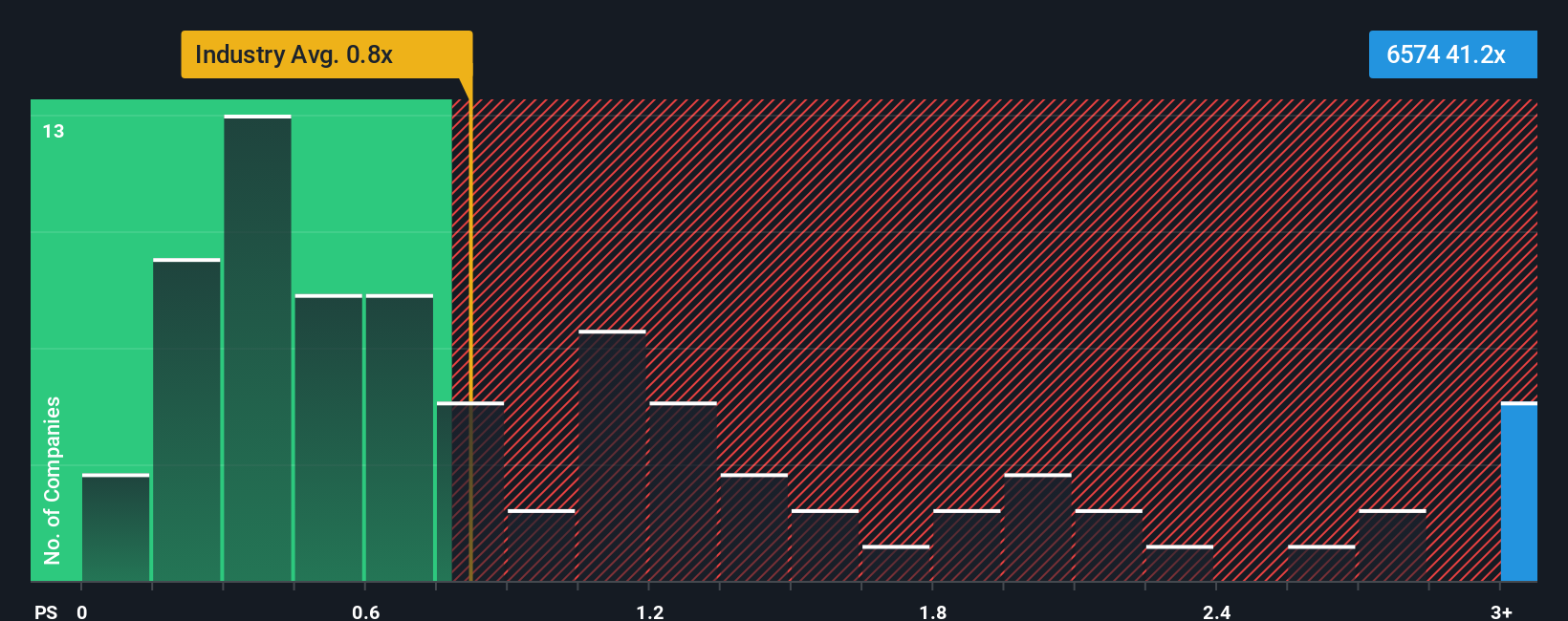

Following the firm bounce in price, when almost half of the companies in Japan's Consumer Services industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider Convano as a stock not worth researching with its 41.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Convano

How Has Convano Performed Recently?

Convano has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Convano will help you shine a light on its historical performance.How Is Convano's Revenue Growth Trending?

Convano's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. Pleasingly, revenue has also lifted 51% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 9.3%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Convano's P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Convano's P/S

The strong share price surge has lead to Convano's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Convano revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Convano that you need to take into consideration.

If these risks are making you reconsider your opinion on Convano, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal