American Financial Group (AFG): Assessing Valuation After Twentieth Consecutive Annual Dividend Increase

American Financial Group just announced a 10% boost to its regular annual dividend, a move that should catch the eye of anyone watching the stock. Longtime investors will know this marks the twentieth straight year of dividend increases, which signals real confidence from management about future earnings. With the new payout starting in October, shareholders can expect $3.52 per share annually, up from $3.20. This adds immediate income appeal to an already steady name in the property and casualty insurance space.

This dividend hike lands as American Financial Group’s share price has climbed nearly 10% over the past three months, even after a slow start to the year. The stock is up 24% in three years and has delivered more than 230% total return over five years, a stretch that included consistent earnings growth and visible insider buying. The dividend growth, paired with recent earnings updates and an active buyback plan, shows management is keen on rewarding shareholders and positioning for ongoing stability or growth.

With this positive momentum and a higher yield, the question now is whether American Financial Group offers genuine value from here, or if the market has already factored in its growth and resilience.

Most Popular Narrative: 3.1% Overvalued

According to community narrative, American Financial Group is judged to be modestly overvalued on a discounted cash flow basis. The calculated fair value is estimated to be about three percent below the recent share price. This perspective is based on a combination of core financial expectations and potential future catalysts.

Advancements in digital transformation and enhanced use of data analytics are supporting more disciplined underwriting and risk management at AFG. These improvements are expected to help improve net margins and operational profitability over the long term. Demographic trends, notably an aging population, are increasing the need for retirement and supplemental insurance, expanding AFG's addressable market and supporting higher revenue growth potential.

Interested in what drives this valuation? This narrative highlights strategic digital initiatives and demographic shifts that could influence AFG’s future profitability. Want to know which growth forecasts and profit margins inform this price target? Explore the key financial factors that shape this consensus fair value.

Result: Fair Value of $130.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent catastrophe losses and volatility in investment returns could limit profit growth and pose challenges for the optimistic outlook for American Financial Group.

Find out about the key risks to this American Financial Group narrative.Another View: Deep Discount Based on Cash Flows

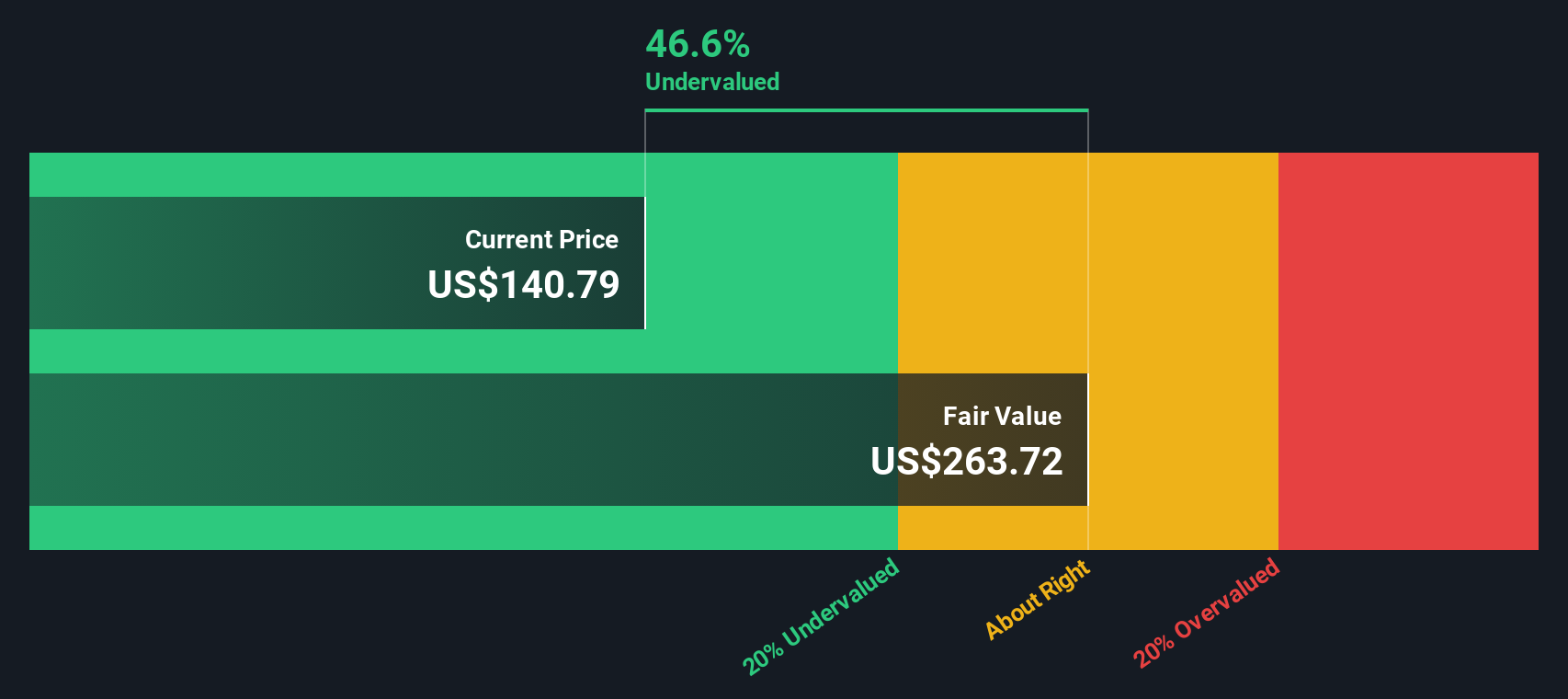

While community consensus points to American Financial Group being fairly valued, our DCF model suggests the shares may be significantly undervalued. This approach focuses on future cash flows rather than current earnings multiples. Could this signal a compelling opportunity, or is the market seeing risks that our model does not capture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Financial Group Narrative

If you have your own perspective or want to dig into the numbers further, you can build a custom narrative in just a few minutes. do it your way.

A great starting point for your American Financial Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop searching for their next big opportunity. Upgrade your strategy by uncovering stocks that match your goals and take advantage of trends you might be missing. Start building a watchlist with these targeted ideas before the crowd gets there.

- Tap into the income potential of steady payouts by checking out dividend stocks with yields > 3%, where you can access companies with reliable dividend yields above 3%.

- Catch the strongest performers in a fast-moving sector by exploring leading-edge picks in healthcare AI stocks and see which companies are transforming healthcare through artificial intelligence innovation.

- Step into tomorrow’s megatrend and pinpoint long-term opportunities with quantum computing stocks, highlighting companies at the forefront of quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal