DigitalBridge Group (DBRG): Valuation Spotlight as Vantage Data Centers Unveils $25B Texas AI Campus

DigitalBridge Group (DBRG) is turning heads this month, and not just because of a miss on recent earnings. The real spark has been news of its portfolio company, Vantage Data Centers, launching an ambitious $25 billion hyperscale AI data center campus in Texas. For investors weighing their options, the move signals a bold strategy. DigitalBridge is staking a claim at the heart of fast-growing demand for AI infrastructure, even as revenue numbers lagged expectations this quarter.

Interestingly, the market reaction has leaned optimistic. Although DigitalBridge underperformed on revenues and posted the weakest result among specialty finance stocks, the stock price has actually climbed more than 32% since those lackluster earnings. That is a stark contrast to its negative 10% return over the past year and a much steeper three-year decline. With renewed momentum tied to large-scale digital infrastructure bets and supportive headlines from the Vantage announcement, sentiment has clearly shifted, at least for now.

So after this year’s swing from weak results to big-picture growth bets, is DigitalBridge still undervalued at current levels, or is the market already pricing in all that future AI-fueled upside?

Most Popular Narrative: 32% Undervalued

According to community narrative, DigitalBridge Group is viewed as significantly undervalued, with a fair value estimate well above its current trading price.

The explosion in AI workloads and hyperscale/cloud CapEx is driving unprecedented demand for data centers and power. This is fueling a substantial multi-year leasing and development pipeline for DigitalBridge, which supports long-term revenue, FEEUM, and EBITDA growth as the company monetizes these trends through new asset deployment and leasing.

Curious how a digital infrastructure pure-play could justify such a large gap between price and fair value? This narrative leans on a bold combination of supercharged future growth, an upgraded business mix, and stronger margins ahead. Want the details behind these assumptions and just how high forecasts could go over the next few years? You may want to look more closely at what analysts are projecting here.

Result: Fair Value of $16.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heightened competition or unexpected technological changes could limit DigitalBridge’s margin gains and long-term growth trajectory, which may put pressure on the company’s underlying bullish narrative.

Find out about the key risks to this DigitalBridge Group narrative.Another View: Market Ratios Tell a Different Story

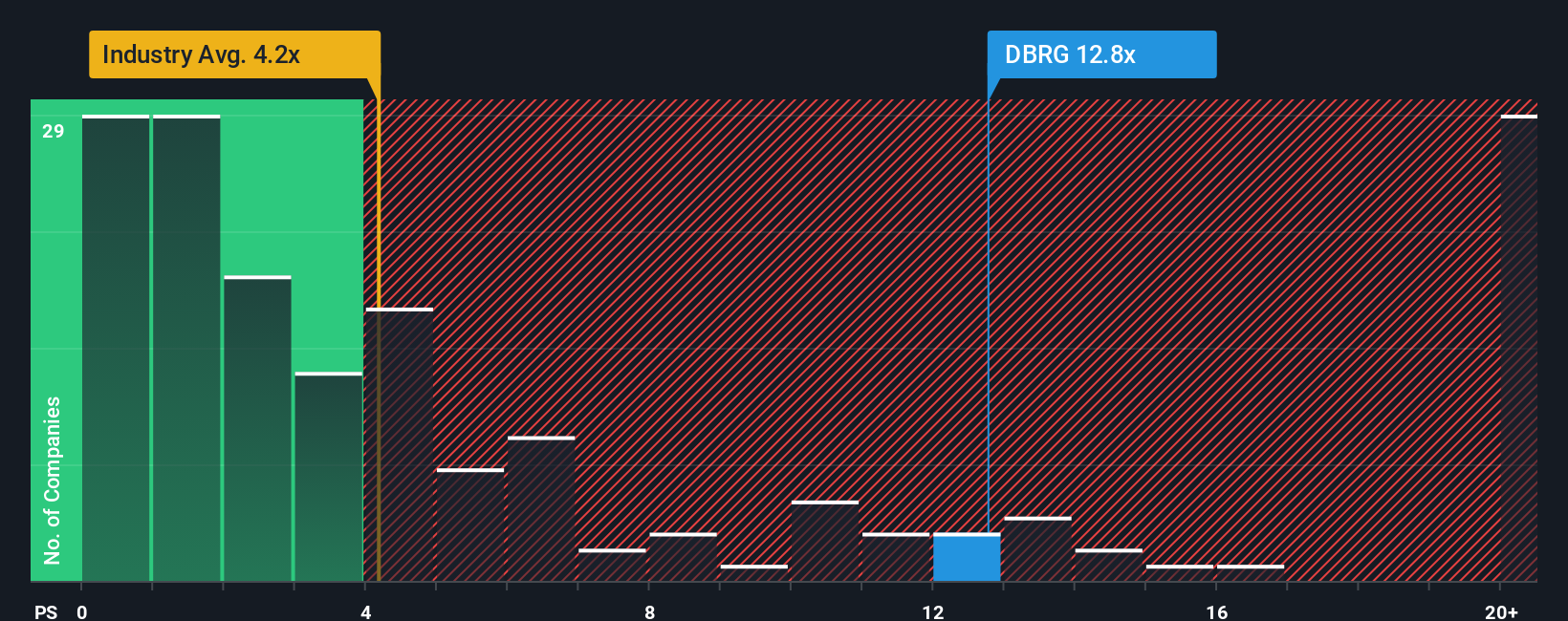

Looking from the angle of market ratios, DigitalBridge is priced much higher than what you would see across the rest of its industry. This suggests that the shares might actually be expensive, not undervalued. Are these elevated expectations justified by future growth? Or could they be setting up investors for disappointment down the line?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DigitalBridge Group Narrative

If you see things differently or want to dig deeper into the numbers for yourself, you can quickly build your own DigitalBridge narrative in just a few minutes. do it your way.

A great starting point for your DigitalBridge Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Your next winning stock could be just a click away. Don’t settle for the ordinary when you can immediately put bigger trends and smarter opportunities on your radar. Broaden your investment playbook by browsing handpicked ideas tailored for forward-thinking investors:

- Uncover dependable income streams by checking out dividend stocks with yields > 3%, which consistently deliver robust yields above 3%.

- Get ahead of emerging tech curves by tapping into AI penny stocks. These companies are reshaping tomorrow’s markets with artificial intelligence breakthroughs.

- Find surprising value among companies set to benefit from tomorrow’s trends by exploring undervalued stocks based on cash flows. These stocks could be trading well below their actual worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal