Markel Group’s (MKL) Reinsurance Exit Could Be a Game Changer for Its Specialty Insurance Focus

- Recently, Markel Insurance completed the sale of renewal rights for its Global Reinsurance business to Nationwide, with associated policy management delegated to Ryan Re Underwriting Managers and the division entering runoff over the next two to three years.

- This move reflects Markel Group's commitment to streamlining its operations and sharpening its focus on high-growth specialty insurance markets while phasing out less profitable segments.

- We’ll explore how exiting the Global Reinsurance business signals a material shift in Markel’s specialty insurance strategy and future outlook.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Markel Group Investment Narrative Recap

To own shares in Markel Group, investors need to believe in its ability to execute on a focused specialty insurance model and drive long-term value from operational streamlining. The sale of Global Reinsurance renewal rights to Nationwide is unlikely to shift the near-term catalyst of expense efficiency gains, but does reinforce the biggest current risk: the expected drag on revenue and potential reserve volatility from legacy runoff businesses over the next several years.

One recent company announcement closely tied to this transition is the appointment of Alain Paris to lead the Primary Casualty line in Canada. This highlights Markel’s continued expansion into bespoke specialty markets, aligning with the company’s push for disciplined underwriting and higher-margin growth as it exits lower-return business lines.

On the other hand, investors should be aware that as Markel exits reinsurance, the runoff could extend legacy exposure and create uncertainties for...

Read the full narrative on Markel Group (it's free!)

Markel Group's outlook forecasts $17.7 billion in revenue and $2.0 billion in earnings by 2028. This is based on an annual revenue growth rate of 2.5% and a $0.2 billion decrease in earnings from the current $2.2 billion level.

Uncover how Markel Group's forecasts yield a $1931 fair value, a 3% downside to its current price.

Exploring Other Perspectives

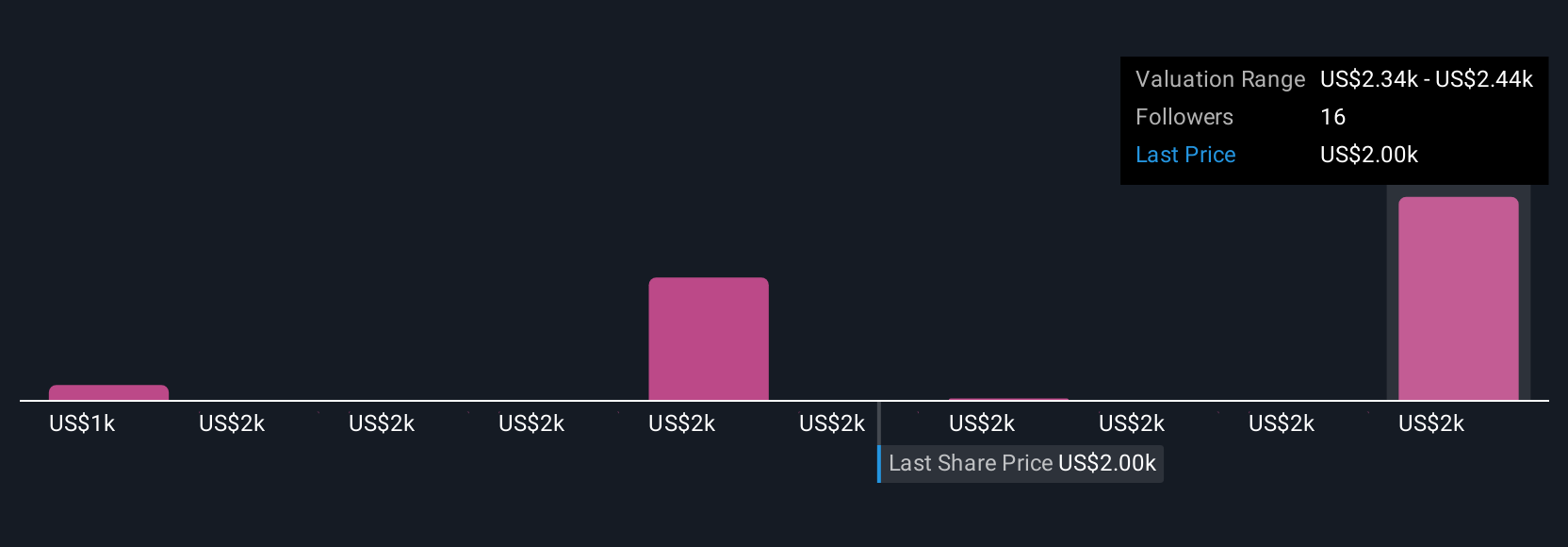

Six members of the Simply Wall St Community provide fair value estimates on Markel Group ranging widely from US$1,449.63 to US$2,403.04. These diverse views come as the company reallocates capital out of low-return segments, potentially affecting growth and returns in future periods.

Explore 6 other fair value estimates on Markel Group - why the stock might be worth 27% less than the current price!

Build Your Own Markel Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Markel Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Markel Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Markel Group's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal