China Yuchai International (CYD) Is Up 8.3% After Major Analyst Upgrade and Earnings Estimate Jump – Has The Bull Case Changed?

- In recent months, China Yuchai International received a significant boost in analyst sentiment, with its full-year earnings estimates rising by 37.2% and an upgrade to a top analyst rating. This increase in analyst confidence points to improved earnings expectations, signaling a more optimistic view of the company’s future prospects.

- These developments come amid a period when the company’s earnings outlook has been shaped by sector challenges, but momentum from higher consensus estimates could influence how investors view its growth resilience.

- We'll explore how the meaningful rise in analyst earnings forecasts could reshape China Yuchai International's investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

China Yuchai International Investment Narrative Recap

To be a shareholder in China Yuchai International, you need to believe in the company's ability to sustain export growth, broaden its engine portfolio, and remain competitive despite the ongoing evolution towards alternative energy vehicles. The sharp increase in analyst earnings estimates and upgraded ratings has brought short-term optimism, but this does not materially change the major catalyst, the durability of demand for China Yuchai’s engines, or the main risk, which is the potential for rapid regulatory or market shifts toward zero-emissions technologies that could curb future growth.

Among recent announcements, the half-year 2025 results highlight strong operational momentum, with significant year-over-year increases in both revenue (CNY 13,806.17 million) and net income (CNY 365.79 million). This aligns closely with the improved short-term outlook reflected in analyst sentiment, but does not diminish the significance of risks tied to future emissions regulations or shifts away from traditional internal combustion engines.

Yet despite these recent positive trends, investors should not overlook the fact that...

Read the full narrative on China Yuchai International (it's free!)

China Yuchai International is projected to achieve CN¥21.7 billion in revenue and CN¥408.9 million in earnings by 2028. This reflects a 1.4% annual revenue decline and a CN¥39.6 million decrease in earnings from the current level of CN¥448.5 million.

Uncover how China Yuchai International's forecasts yield a $20.70 fair value, a 34% downside to its current price.

Exploring Other Perspectives

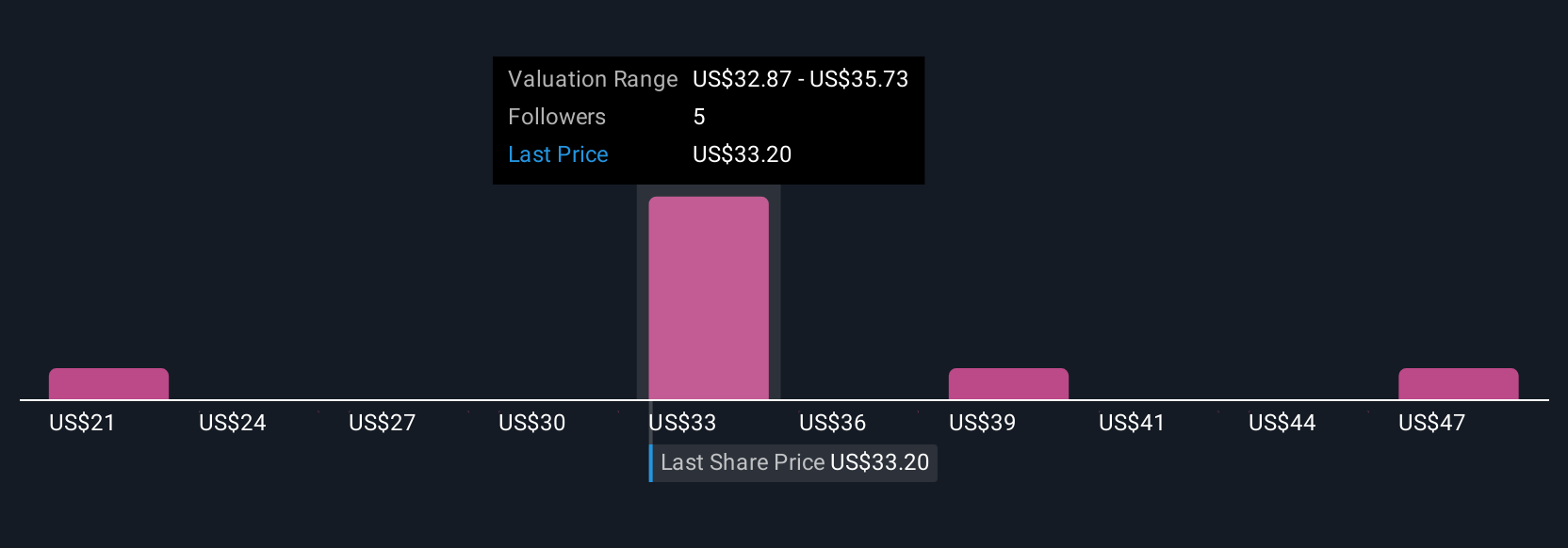

Five different fair value estimates from the Simply Wall St Community range from CNY 11.96 to CNY 50.01. Despite improved analyst expectations, the potential for swift changes in global vehicle emissions standards could play an outsized role in shaping upcoming performance, so be sure to compare these varied perspectives.

Explore 5 other fair value estimates on China Yuchai International - why the stock might be worth as much as 60% more than the current price!

Build Your Own China Yuchai International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Yuchai International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Yuchai International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Yuchai International's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal