FuboTV’s Expanded Sports Streaming Deals Could Be a Game Changer for FUBO

- FuboTV and DAZN recently announced a multi-year partnership in Canada, expanding their content distribution to offer subscribers a bundled sports streaming experience, while Fubo’s French subsidiary, Molotov, secured streaming rights to France’s Ligue 1+ for the 2025/2026 season.

- This international expansion allows FuboTV to significantly broaden its premium live sports content offering across key markets, establishing a deeper foothold in global sports streaming and appealing to sports fans seeking consolidated access to marquee events.

- We’ll now examine how FuboTV’s new Canadian and French sports rights agreements could influence its subscriber growth and investment outlook.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

fuboTV Investment Narrative Recap

To be a shareholder in fuboTV today, you need to believe the company can translate its international content expansion into consistent subscriber and revenue growth, overcoming fierce competition and elevated churn rates. FuboTV’s recent partnerships with DAZN in Canada and Ligue 1+ rights for Molotov in France expand its premium sports streaming lineup, but the short-term impact on reversing subscriber decline and driving sustainable profitability remains unclear. The most immediate catalyst continues to be whether these premium rights deals can fuel concrete, near-term user growth; meanwhile, persistent cash burn and competitive threats from bundled streaming giants remain top risks. In contrast, investors should also be aware of...

Read the full narrative on fuboTV (it's free!)

fuboTV's narrative projects $1.8 billion in revenue and $200.3 million in earnings by 2028. This requires 3.8% annual revenue growth and a $112.6 million increase in earnings from $87.7 million today.

Uncover how fuboTV's forecasts yield a $4.50 fair value, a 29% upside to its current price.

Exploring Other Perspectives

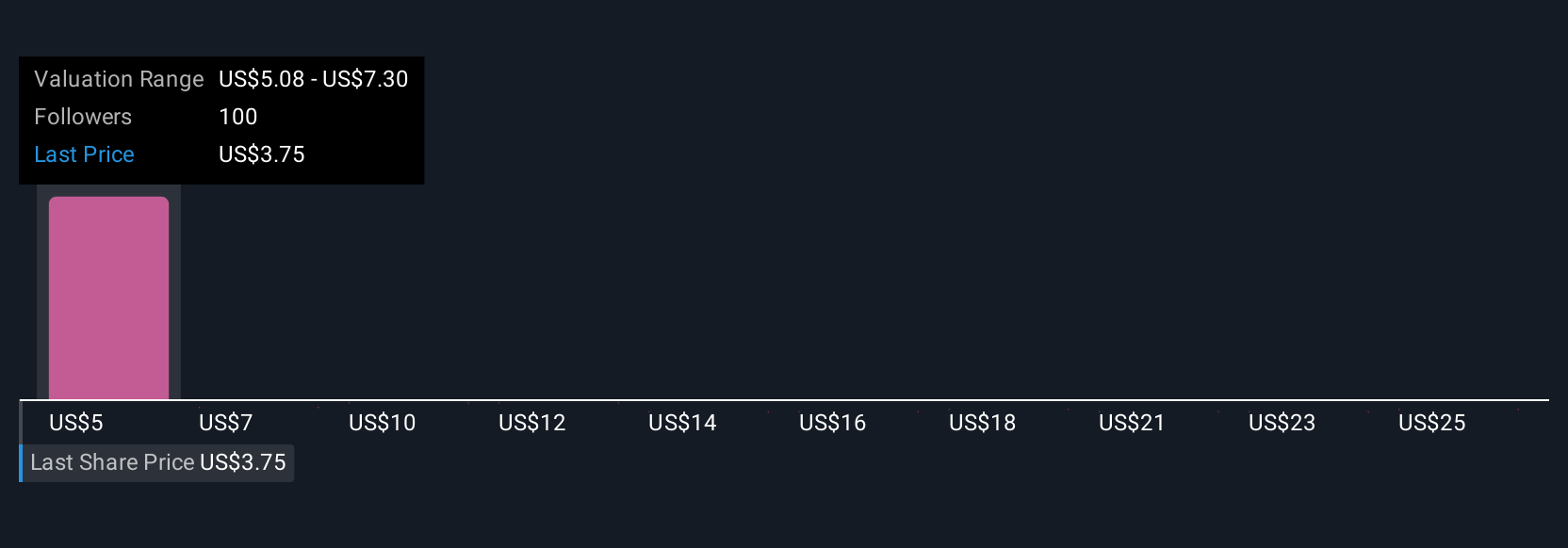

Seventeen fair value estimates from the Simply Wall St Community span a range from US$3.97 to US$18.62 per share. While many market participants see attractive content deals as a catalyst for subscriber growth, others caution about ongoing profitability challenges and competitive pressures that could weigh on results.

Explore 17 other fair value estimates on fuboTV - why the stock might be worth over 5x more than the current price!

Build Your Own fuboTV Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your fuboTV research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free fuboTV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate fuboTV's overall financial health at a glance.

No Opportunity In fuboTV?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal