Vanguard S&P 500 ETF (VOO): Examining Valuation After Recent Price Swings

Vanguard Index Funds: Vanguard S&P 500 ETF (VOO) has quietly moved onto the radar of investors once again, with recent price swings raising a few eyebrows. There is no major headline or single market-moving event driving these price changes. However, the shift is catching attention, as it comes amid an ongoing debate about the state of the broader market. When VOO sees a swing, whether small or large, it often sparks a discussion about value, risk, and timing, given its role as a bellwether for the largest U.S. companies.

Compared to earlier in the year, VOO has been building positive momentum, gaining 11% over the past month and nearly 16% over the last year, both outpacing broader index funds. Recent price action suggests steady optimism, with short-term dips quickly corrected, and a three-year return currently at 58%. While external events have influenced the overall market, VOO’s performance has largely tracked expectations, reflecting the strength and resilience of the S&P 500 constituents. There has been little drama or surprise in headlines recently.

After a period of steady gains, the question becomes whether VOO is still offering value, or if these returns suggest that the market has already priced in all future growth. Is now a smart entry point, or has the best opportunity already passed?

Price-to-Earnings of 6.5x: Is it justified?

Based on its Price-to-Earnings (P/E) ratio, VOO appears significantly undervalued compared to peers, trading at just 6.5 times earnings while the average for the US Capital Markets industry is 26 times. This suggests the fund may be priced well below the market’s expectations.

The Price-to-Earnings ratio measures how much investors are willing to pay for each dollar of earnings. In the case of index funds like VOO, a low P/E may reflect skepticism about future growth or overlooked opportunities. This makes the metric a key tool for assessing relative value in the sector.

VOO’s current valuation could mean the market is not fully appreciating the fund’s earnings power. With such a significant discount to the industry, this presents a potential value opportunity for investors willing to look beyond current sentiment and focus on fundamentals.

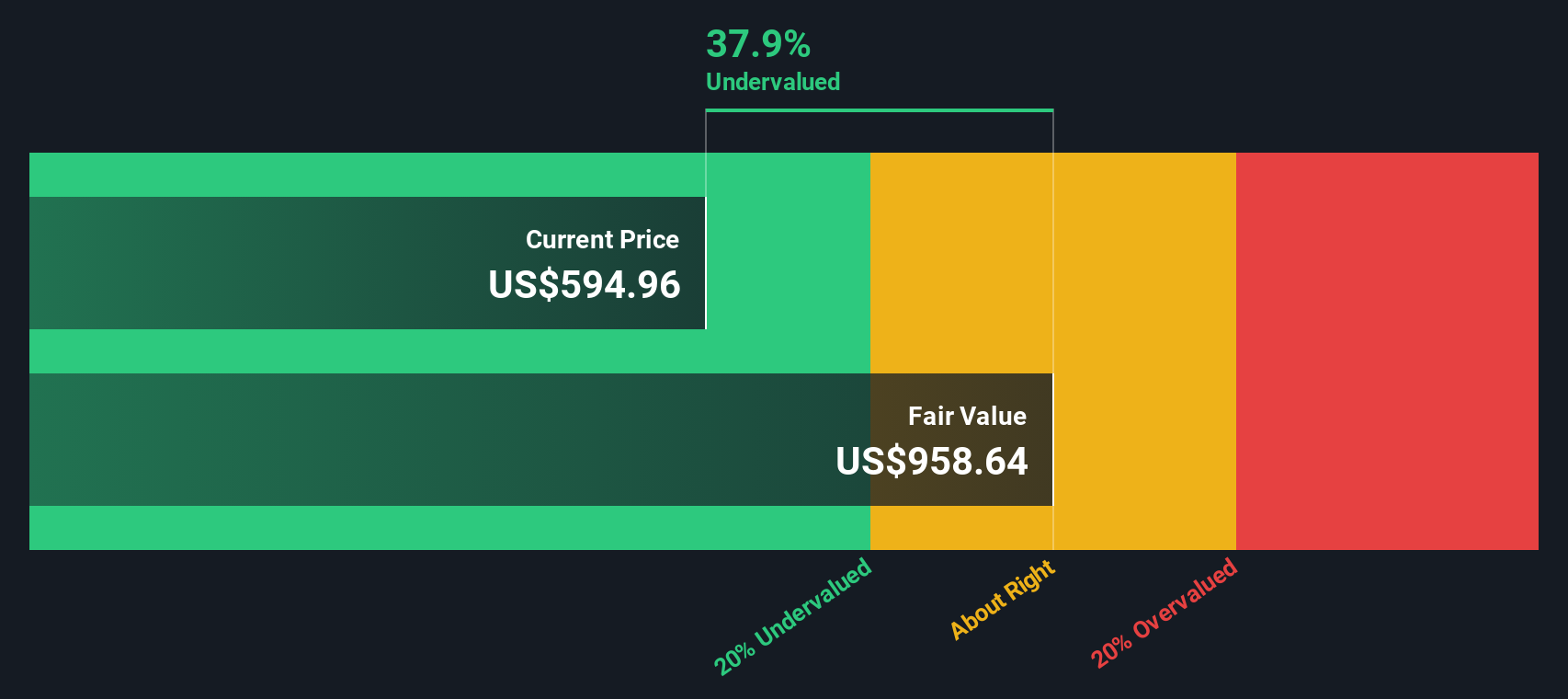

Result: Fair Value of $961.89 (UNDERVALUED)

See our latest analysis for Vanguard Index Funds - Vanguard S&P 500 ETF.However, risks remain, as broader economic headwinds or unexpected earnings disappointments from key S&P 500 members could quickly shift sentiment around VOO.

Find out about the key risks to this Vanguard Index Funds - Vanguard S&P 500 ETF narrative.Another View: Discounted Cash Flow Model

Taking a different approach, our DCF model also signals that VOO is undervalued at current levels. While both methods point to potential upside, they rely on different assumptions about future growth and returns. Can both be correct, or is the market missing an important factor?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Vanguard Index Funds - Vanguard S&P 500 ETF Narrative

If you see the data differently or want to dig deeper, you have the option to build your own narrative in a matter of minutes, so do it your way.

A great starting point for your Vanguard Index Funds - Vanguard S&P 500 ETF research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t settle for less when you could be uncovering some of the market’s most compelling stories. The Simply Wall Street Screener can help you pinpoint unique opportunities that others might overlook. Take charge and give yourself every advantage by checking out these powerful investing ideas:

- Capture dividend growth by checking out dividend stocks with yields > 3%, which offer attractive yields and steady income potential.

- Ride the next wave in healthcare innovation by targeting healthcare AI stocks that are reshaping patient care and medical technology with AI breakthroughs.

- Unlock value in overlooked sectors by sorting for undervalued stocks based on cash flows with strong fundamentals and upside potential based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal