Dole (DOLE) Valuation in Focus After Q2 Beat, Strategic Shift, and Cautious Outlook

After Dole (NYSE:DOLE) released its second quarter results, investors found themselves with plenty to digest. The company topped expectations on both revenue and adjusted profit, driven mainly by growth in its Diversified Fresh Produce and Fresh Fruit segments. Management’s decision to complete the sale of the Fresh Vegetable division also signals a clearer focus on areas where Dole sees the highest returns. Additionally, the push toward debt reduction reflects a more cautious, long-term approach. However, the tone was not entirely upbeat, as the team flagged ongoing supply chain issues, cost spikes, and tariffs that could limit future upside.

In the bigger picture, these results come after a year of changing fortunes for Dole’s stock. The share price is up 6% year to date and has gained 3% over the past three months, a sign that some momentum is building, but it remains down 6% in the past year. Recent dividend affirmations may appeal to income-focused holders, but the volatility in profit and operational challenges keep uncertainty in the mix. The market’s reaction seems ambivalent so far, with investors weighing bright spots against ongoing risks.

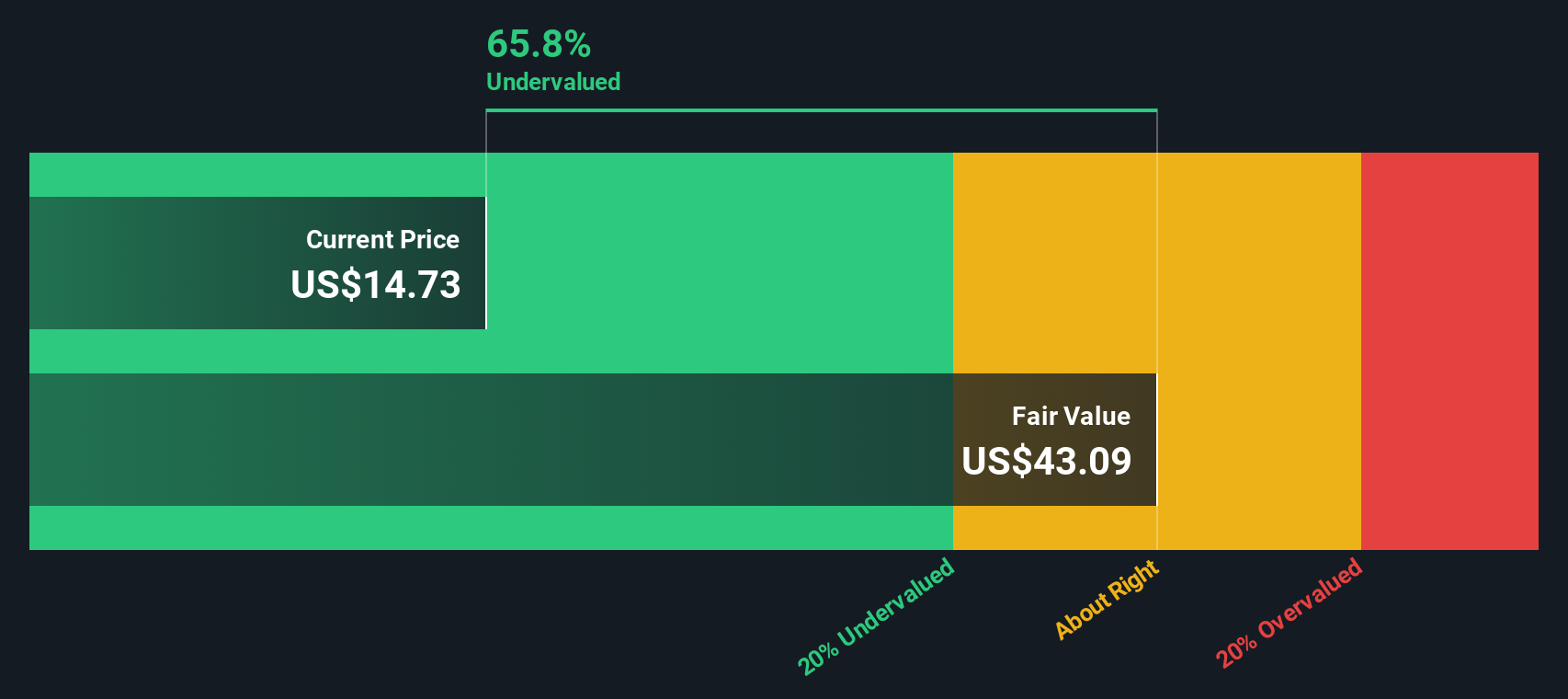

With the valuation debate heating up after these results, some investors are considering whether Dole is trading at a discount with potential for further gains, or whether the warnings indicate that the market is already factoring in future growth.

Most Popular Narrative: 19.2% Undervalued

According to community narrative, Dole is currently perceived as significantly undervalued by analysts, with future prospects tied to operational improvements and market positioning. The narrative bases its view on assumptions about sustained demand, margin expansion, and strategic investments.

Continued investments in logistics, vertical integration, supply chain optimization, and digitalization, along with targeted regional and product expansion (including value-added and packaged produce), are expected to improve operational efficiency and support margin accretion over time.

Curious about what is fueling the analysts' bold upside call? The numbers behind their forecast hint at steady sales growth and profit margin gains, but there is a surprising twist in their assumptions about future profits and Dole’s potential valuation multiple. If you want to discover what really drives this undervaluation thesis and the critical metrics that could unlock further upside, take a closer look at the details behind this narrative.

Result: Fair Value of $17.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, setbacks from extreme weather or shifting global trade policies could disrupt Dole’s progress and alter the outlook outlined by analysts.

Find out about the key risks to this Dole narrative.Another View: Discounted Cash Flow Model Offers a Different Perspective

Switching gears, our DCF model paints a contrasting picture by analyzing future cash flows rather than relying on market multiples. This approach also suggests undervaluation. However, can any single method alone capture the whole story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dole Narrative

If you want to take a different approach, you can dive into Dole’s numbers and build a unique perspective in just a few minutes, or even do it your way.

A great starting point for your Dole research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Expand your portfolio by tapping into high-potential stocks tailored to your strategy. Whether you want stability, innovation, or hidden value, there are standout picks ready to spark your next move.

- Unlock potential in healthcare by zeroing in on companies at the forefront of medical innovation with healthcare AI stocks.

- Capitalize on passive income by targeting companies that offer higher-than-average yields through dividend stocks with yields > 3%.

- Catalyze your portfolio’s growth by riding the AI wave with market leaders powered by AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal