Strong data+hawkish statements on the eve of Powell Jackson Hole's speech suppressing expectations of interest rate cuts, six consecutive declines in emerging market currencies

The Zhitong Finance App learned that emerging market currencies showed a decline for the sixth day in a row on Thursday. Strong US manufacturing data combined with hawkish signals from Fed officials put further pressure on the market's expectations of the Fed's interest rate cuts. Today, market focus is turning to Federal Reserve Chairman Powell's speech at the Jackson Hole Global Central Bank Annual Meeting on Friday.

Figure 1

In response, Charlie Robertson, head of macroeconomic strategy at FIM Partners, predicted: “Powell may reaffirm that tariffs will continue to have limited impact on inflation, while acknowledging the weakening of the job market, all of which will reinforce market interest rate expectations. However, unexpected news may trigger risk aversion, weakening the results of the recent rebound in emerging markets.” The minutes of the Federal Reserve's policy meeting previously released on Wednesday showed that concerns about inflation continue to haunt the market.

According to information, Cleveland Federal Reserve Bank Governor Beth Hammark clearly stated that “if decisions are needed tomorrow, we will not support interest rate cuts”. Affected by this, important indicators for measuring the overall performance of emerging market currencies fell to their lowest level since the beginning of August.

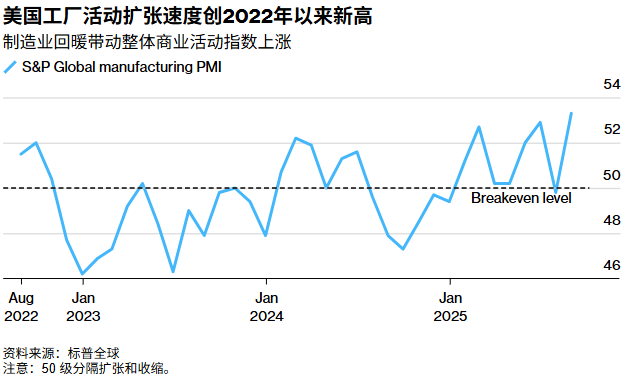

Previously, the index had been impacted by the initial manufacturing PMI for August announced by S&P Global — the figure climbed 3.5 points to 53.3, a new high since May 2022, far exceeding the boom and bust line of 50, highlighting that the US manufacturing industry is expanding at the fastest rate in more than three years, continuing to increase inflationary pressure.

Figure 2

Sun Ning, senior emerging market strategist at State Street Global Markets, pointed out, “It is challenging to assess the current outlook for the US economy, and factors on both sides of supply and demand are intertwined. It is recommended to be cautious about high-interest Emerging Market FX.”

As for the currencies of various countries, the Hungarian forint led the decline due to rumors of the escalation of the Russian-Ukrainian conflict. Previously, the market's expectations for a peace agreement were dashed. Latin America is divided: the Brazilian real and Mexican peso remained strong against the US dollar, but the Chilean peso weakened sharply due to news of the resignation of pro-market finance minister Mario Marcel. According to people familiar with the matter, the presidential palace will announce a successor at the cabinet reshuffle ceremony on Thursday. Currently, the benchmark stock index is still rising, and interest rate swaps are rising slightly.

On the stock market side, the MSCI Emerging Markets Index rebounded slightly by 0.1%, ending a series of declines caused by a sharp decline in US technology stocks over the previous two days. However, the bond market was divided: Ukrainian dollar bonds fell for the second day in a row. Some investors made a profit after a rebound related to peace negotiations; Jefferies adjusted their positions to neutral; Senegalese and Kenyan dollar bonds led the emerging market bond market.

In the field of geopolitics, US President Trump hinted on social media that he was willing to support Ukraine in launching more counterattacks against Russia, saying that former President Joe Biden “appeared incompetent because of restrictions on Ukraine's counterattack.” Although this statement is at odds with the “America First” faction's claim to stop aid to Ukraine, after the White House met Zelensky on Monday, Trump has instructed officials to coordinate meetings between Ukrainian and Russian leaders and subsequent summits, and the Kremlin has yet to respond.

Trump also asked the US and Europe to jointly develop a security plan to push Kiev to accept its proposed territorial replacement agreement. Currently, the date and place of the summit is yet to be determined, and the market is closely monitoring the continuing impact of the geographical situation on risk assets.

Wall Street Journal

Wall Street Journal