How UGI's (UGI) New $300 Million Credit Facility May Reshape Its Capital Structure Strategy

- On August 6, 2025, UGI Corporation amended its credit agreement to secure a new US$300 million senior secured revolving loan facility, enhancing its financial flexibility to address the conversion of its 2028 Notes and aligning with JPMorgan Chase Bank, N.A. as the administrative agent.

- This development signals UGI's proactive approach to managing upcoming debt obligations and reinforces its focus on liquidity and capital planning.

- We'll explore how securing this revolving loan facility could influence UGI’s investment narrative and its approach to capital structure management.

Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

UGI Investment Narrative Recap

To be a shareholder in UGI right now, you need to believe that the company can balance near-term challenges, like demand declines across its LPG and propane segments, against opportunities in rate increases, renewable investments, and operational efficiencies. The newly secured US$300 million revolving loan facility improves UGI’s liquidity and debt flexibility, but is unlikely to substantially change the headline short-term catalyst of pending Pennsylvania rate approvals or the biggest ongoing risk of long-term demand erosion in its core fuels business.

The recent cessation of share repurchases is noteworthy in this context, as it highlights the company's focus on managing capital commitments amid tightening profit margins and elevated leverage. This move ties directly to ongoing free cash flow challenges and the need to prioritize debt and investment flexibility over immediate shareholder returns as UGI positions for its next phase of capital allocation. In contrast, investors should be aware of how persistent demand declines in key European and US markets could limit margin recovery in the coming years...

Read the full narrative on UGI (it's free!)

UGI's narrative projects $9.0 billion revenue and $794.3 million earnings by 2028. This requires 7.0% yearly revenue growth and a $376.3 million earnings increase from $418.0 million.

Uncover how UGI's forecasts yield a $41.00 fair value, a 18% upside to its current price.

Exploring Other Perspectives

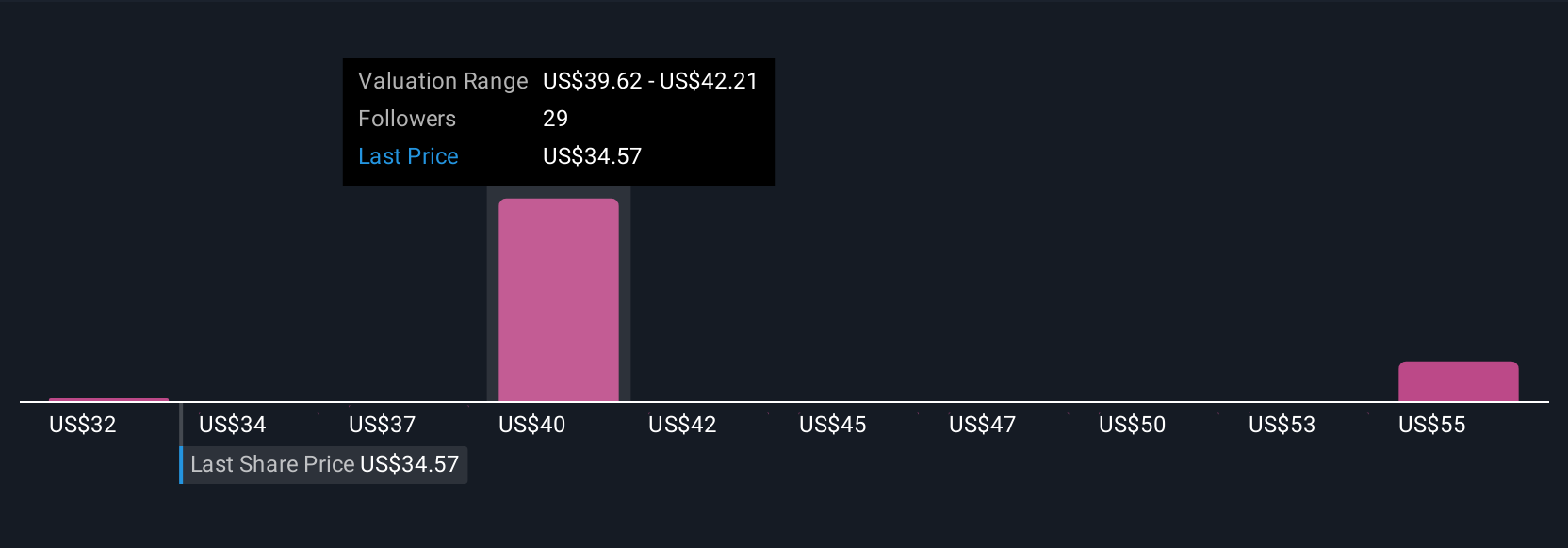

Simply Wall St Community members have set five fair value targets for UGI stock, ranging from US$31.87 to US$58.74 per share, capturing wide variations in outlook. Several participants point to customer attrition and fossil fuel demand decline as core issues, which could weigh on longer-term earnings and the company's ability to sustain dividends, make sure to review these alternative views.

Explore 5 other fair value estimates on UGI - why the stock might be worth as much as 69% more than the current price!

Build Your Own UGI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UGI research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free UGI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UGI's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal