Shopify Surges 33% in 90 Days Amid Rising Competition From OpenAI and Microsoft

Thinking about what to do with Shopify stock? You are absolutely not alone. With every little jump and dip in its share price, investors are left wondering if now is the smart time to buy, hold, or walk away. Shopify has been on a wild ride lately, but there is excitement brewing beneath the surface. In the past month, shares have risen nearly 7%, and over the past 90 days, they have surged by an eye-catching 33%. Over the last year, Shopify has delivered a stunning 80% total return. Those are the types of numbers that turn heads and spark debate.

Behind these moves are the familiar stories: continued strength in e-commerce, impressive revenue growth of 18% year-over-year, and strong net income expansion. But there is also a new sense of competition and shifting expectations about the future, especially as tech giants like OpenAI and Microsoft look to shake up online shopping and commerce platforms. None of the most recent deal rumors swirling in tech have directly involved Shopify, so the stock’s energy is about core performance and market sentiment rather than takeover hype.

The catch? Based on our standard valuation framework, Shopify scores 0 out of 6 on value checks for being undervalued. In other words, it does not check the box for undervaluation on any of our six measures. That might make you pause, but before ruling Shopify out or jumping in headfirst, let us look more closely at how different valuation approaches see this company’s potential. Also, stay tuned for a perspective at the end that might transform your understanding of what valuation really means.

Shopify delivered 80.3% returns over the last year. See how this stacks up to the rest of the IT industry.Approach 1: Shopify Cash Flows

To understand a company’s intrinsic value, investors often use a Discounted Cash Flow (DCF) model. This method projects the business's future cash flows and then discounts them back to today's value. The result is a theoretical fair price for the stock based on expected financial performance.

Shopify is currently generating Free Cash Flow (FCF) of $1.80 billion, with analysts forecasting robust growth over the coming years. By 2029, Shopify’s projected FCF reaches $5.34 billion, according to current estimates. Looking further ahead, by 2035, annual FCF could exceed $9.37 billion, reflecting strong confidence in Shopify’s ability to scale earnings.

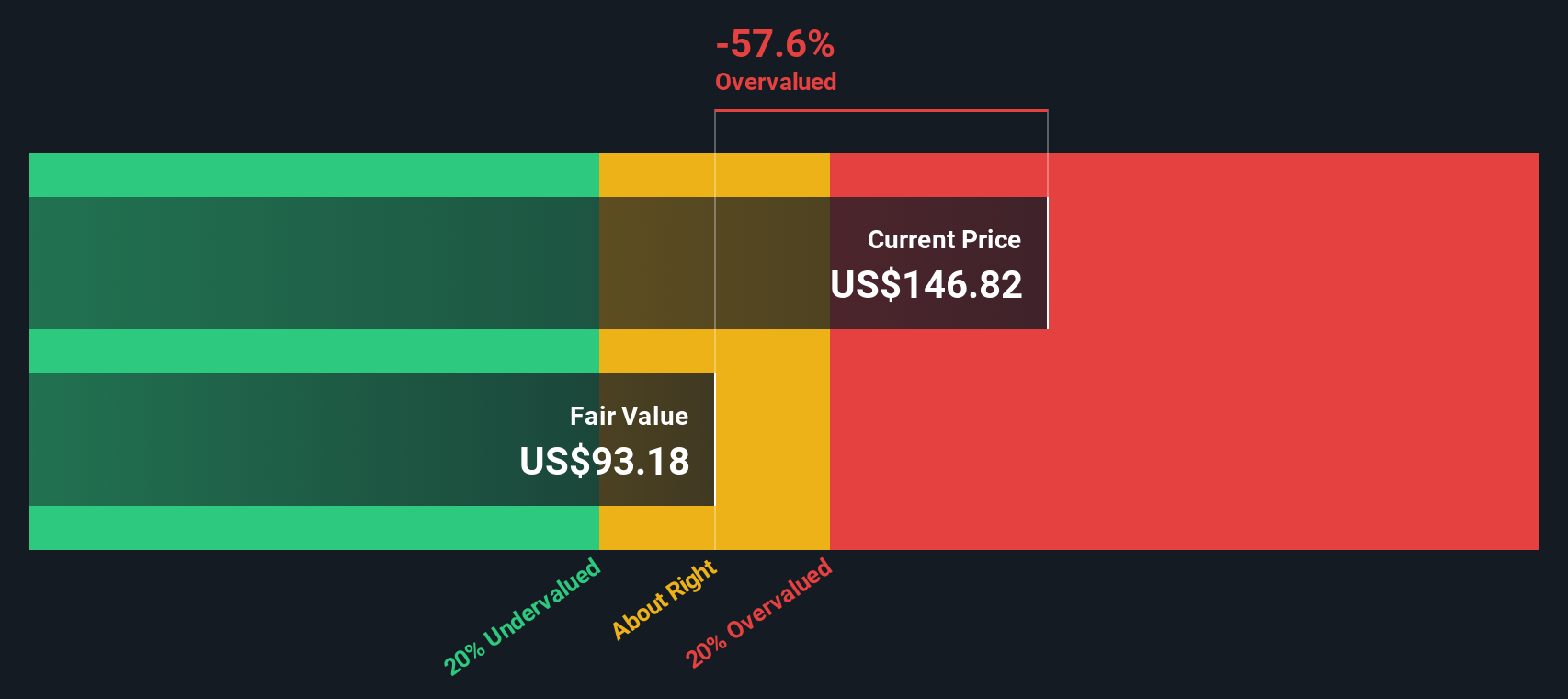

Based on these projections, the 2 Stage Free Cash Flow to Equity model arrives at an estimated intrinsic value of $95.60 per share. When compared to Shopify’s recent share price, this calculation suggests the stock is approximately 43.6% overvalued using this method.

Result: OVERVALUED

Approach 2: Shopify Price vs Earnings (PE)

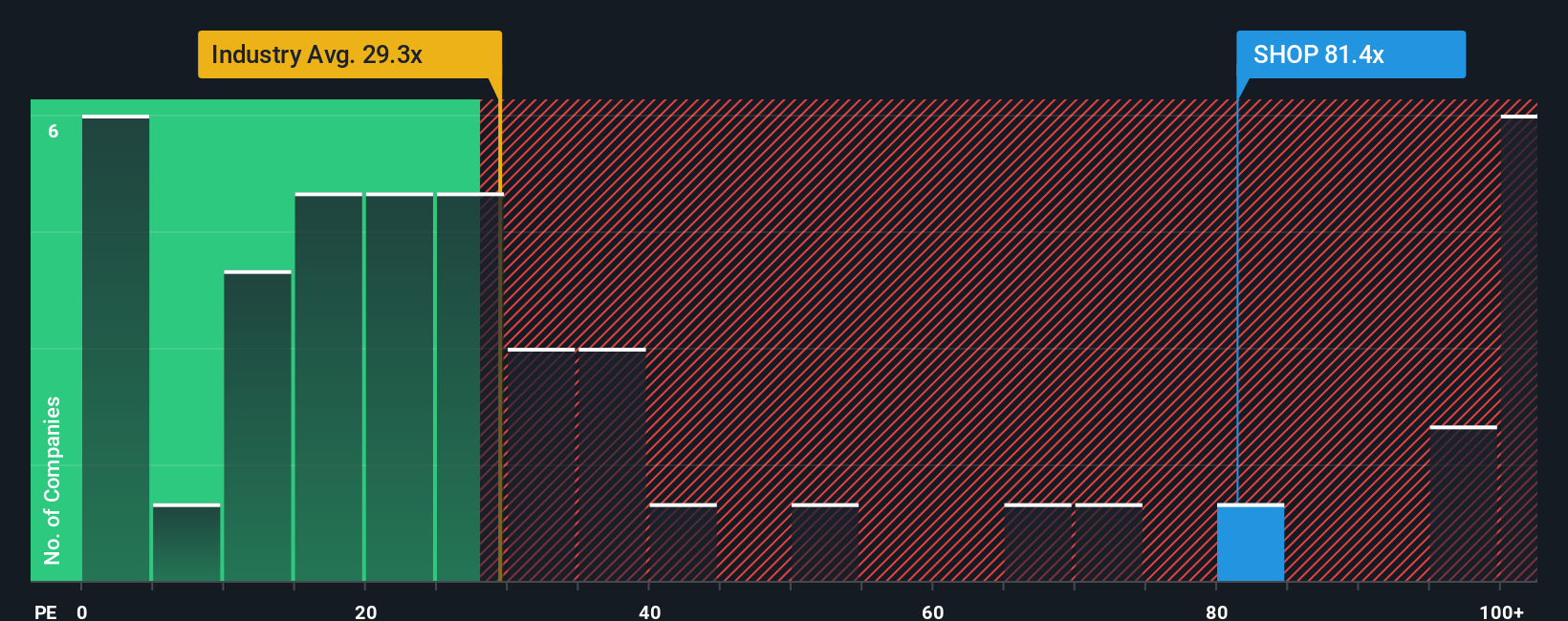

For profitable technology companies like Shopify, the Price-to-Earnings (PE) ratio is a popular and well-regarded valuation measure. This metric helps investors compare what the market is willing to pay today for a company’s earnings relative to peers and industry standards. A higher PE ratio often reflects expectations of strong future growth or lower perceived risk. In contrast, a lower PE suggests the opposite.

Currently, Shopify trades at a PE ratio of 76.1x. This figure stands well above the industry average for IT companies, which is 29.7x. It is also notably higher than the average for closely matched peers at 51.3x. Such a premium generally signals that investors expect Shopify to deliver superior earnings growth, defend its market position, or both.

Looking deeper, the Fair Ratio for Shopify as calculated by Simply Wall St’s proprietary model is 43.8x. This is determined by assessing Shopify’s specific earnings growth outlook, profitability, size, and risk factors. With Shopify’s actual PE of 76.1x considerably higher than the Fair Ratio, the conclusion is that, based on earnings, the stock appears significantly overvalued at current levels.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Shopify Narrative

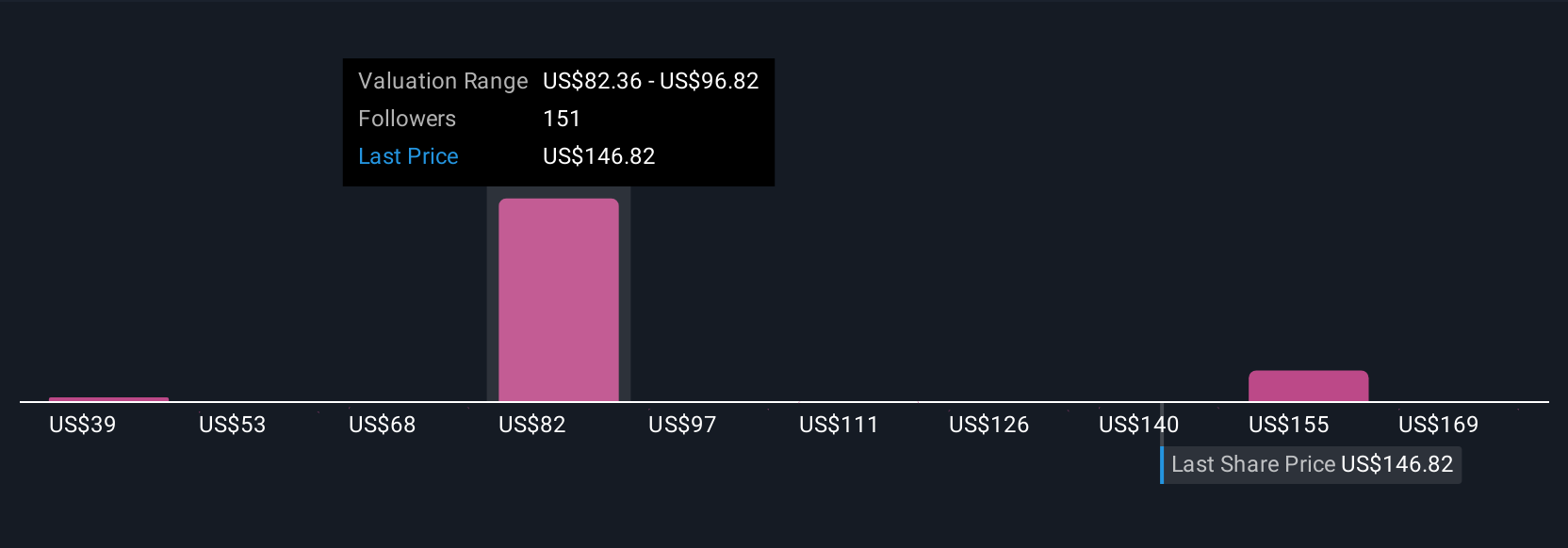

Beyond crunching numbers, every investor brings a unique Narrative to their decision making. A Narrative is simply your story about Shopify, combining what you believe about its future (like how fast revenue or profits might grow) with your own fair value estimate for the stock.

Instead of just looking at static ratios, Narratives help you connect Shopify’s story and circumstances to a dynamic financial outlook. This approach links how you think the business will perform, to an estimated fair value, and then all the way through to a buy or sell decision.

On the Simply Wall St platform, Narratives make this process surprisingly easy. Millions of investors create, test, and share their own perspectives, allowing you to explore a range of possible scenarios and fair values for Shopify with just a few clicks.

What is most powerful about Narratives is that they update automatically as new information (such as company news or earnings reports) is released, so your investment thesis can evolve in real time, keeping you informed and adaptable.

For example, some Shopify Narratives expect international expansion and AI integration to push fair value as high as $200. Others point to concerns about rising costs or competition, setting fair value closer to $105. This gives you a practical way to map your own expectations against current market prices.

Do you think there's more to the story for Shopify? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal