Does Leadership Reshuffle and Capacity Expansion Redefine the Investment Case for AXIS Capital (AXS)?

- In August 2025, AXIS Capital Holdings announced the appointment of Matthew Kirk as its next Chief Financial Officer, launched the AXIS Capacity Solutions business unit, and named David Murie as its head as part of a planned leadership transition and business expansion.

- These developments highlight AXIS’s emphasis on strengthening executive leadership and expanding specialty capacity solutions to capture growth opportunities in the evolving insurance market.

- We'll now examine how the appointment of a new CFO and the launch of AXIS Capacity Solutions could influence AXIS Capital’s investment outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

AXIS Capital Holdings Investment Narrative Recap

To be a shareholder in AXIS Capital Holdings, one must believe in the company’s focus on specialty insurance, operational efficiency, and disciplined risk selection amid a competitive and evolving industry. While the appointment of Matthew Kirk as CFO and the launch of AXIS Capacity Solutions signal a strong intent to position for future growth, these moves do not materially impact the most immediate catalyst: AXIS’s ability to sustain underwriting profitability amid ongoing pricing pressure and rising claims costs.

The launch of AXIS Capacity Solutions stands out, as expanding structured insurance offerings aligns directly with growth opportunities in specialty lines. This business unit’s performance will be closely watched in the context of industry dynamics, especially as effective execution could contribute to margin improvements and help counter industry-wide headwinds.

But even as AXIS forges ahead with new leadership and business units, investors should also be aware that competitive pricing pressure in core markets remains a key risk...

Read the full narrative on AXIS Capital Holdings (it's free!)

AXIS Capital Holdings' narrative projects $7.0 billion revenue and $1.1 billion earnings by 2028. This requires 4.0% yearly revenue growth and a $238.5 million earnings increase from $861.5 million currently.

Uncover how AXIS Capital Holdings' forecasts yield a $113.50 fair value, a 16% upside to its current price.

Exploring Other Perspectives

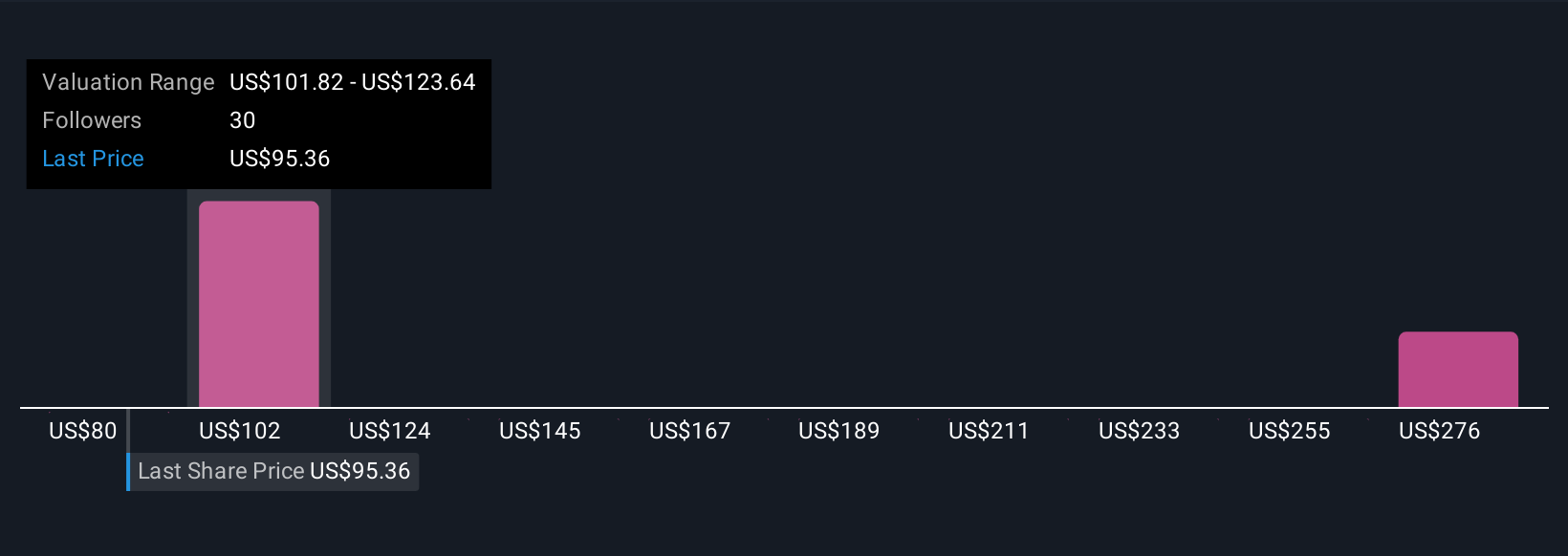

Fair value estimates from the Simply Wall St Community span a wide range, from US$80 to US$297.60, across five independent perspectives. The company’s push into specialty insurance capacity comes as pricing pressure and shifting margins keep investors cautious, making it valuable to compare alternative viewpoints.

Explore 5 other fair value estimates on AXIS Capital Holdings - why the stock might be worth 18% less than the current price!

Build Your Own AXIS Capital Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AXIS Capital Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free AXIS Capital Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AXIS Capital Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal