US Market's Undiscovered Gems To Explore In August 2025

As the U.S. stock market navigates a period of mixed performance, with the S&P 500 and Nasdaq experiencing declines while the Dow Jones Industrial Average hovers near all-time highs, investors are keenly watching for signals from Federal Reserve Chair Jerome Powell that could influence future monetary policy. Amidst this backdrop of market fluctuations and economic uncertainty, identifying undiscovered gems in the small-cap sector can be particularly rewarding for those looking to capitalize on potential growth opportunities. In such an environment, a good stock is often characterized by strong fundamentals and resilience to broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Morris State Bancshares | NA | 3.34% | 3.70% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.79% | -0.59% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Mill City Ventures III | NA | 16.40% | -30.66% | ★★★★★★ |

| FineMark Holdings | 115.14% | 2.22% | -28.34% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Rich Sparkle Holdings | 26.73% | -6.13% | 1.75% | ★★★★★☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

We'll examine a selection from our screener results.

QuantaSing Group (QSG)

Simply Wall St Value Rating: ★★★★★☆

Overview: QuantaSing Group Limited offers online learning services in the People’s Republic of China and has a market cap of $383.35 million.

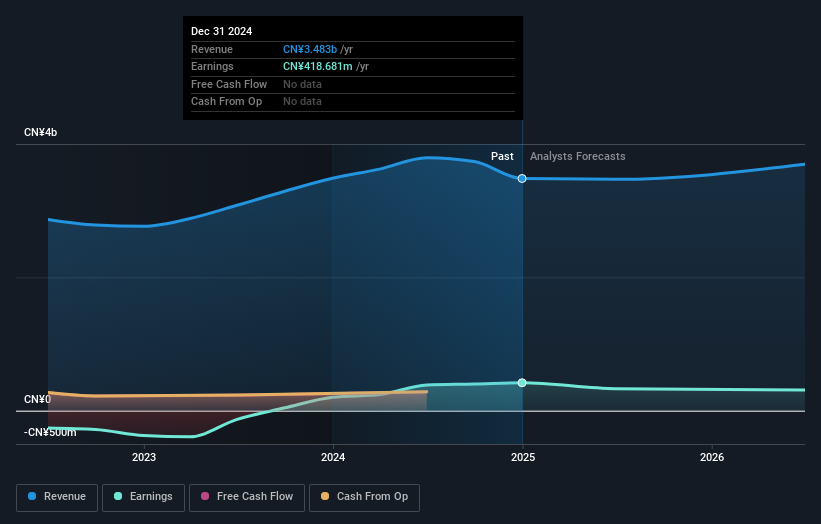

Operations: QuantaSing Group generates revenue primarily through its online learning services in China. The company focuses on monetizing its educational content and platforms, which contribute significantly to its financial performance.

QuantaSing Group, a relatively small player in the market, has shown remarkable earnings growth of 84% over the past year, outperforming the Consumer Services industry average of 25.5%. Despite this impressive performance, revenue stability remains a challenge with a recent 25.9% drop in revenues year-over-year and gross billings from individual online learning services falling by 42.2%. Trading at US$2.70 per share, it's considered to be undervalued by about 62% compared to its estimated fair value. The company plans to repurchase up to US$20 million of shares using existing cash reserves until June 2026.

Cricut (CRCT)

Simply Wall St Value Rating: ★★★★★★

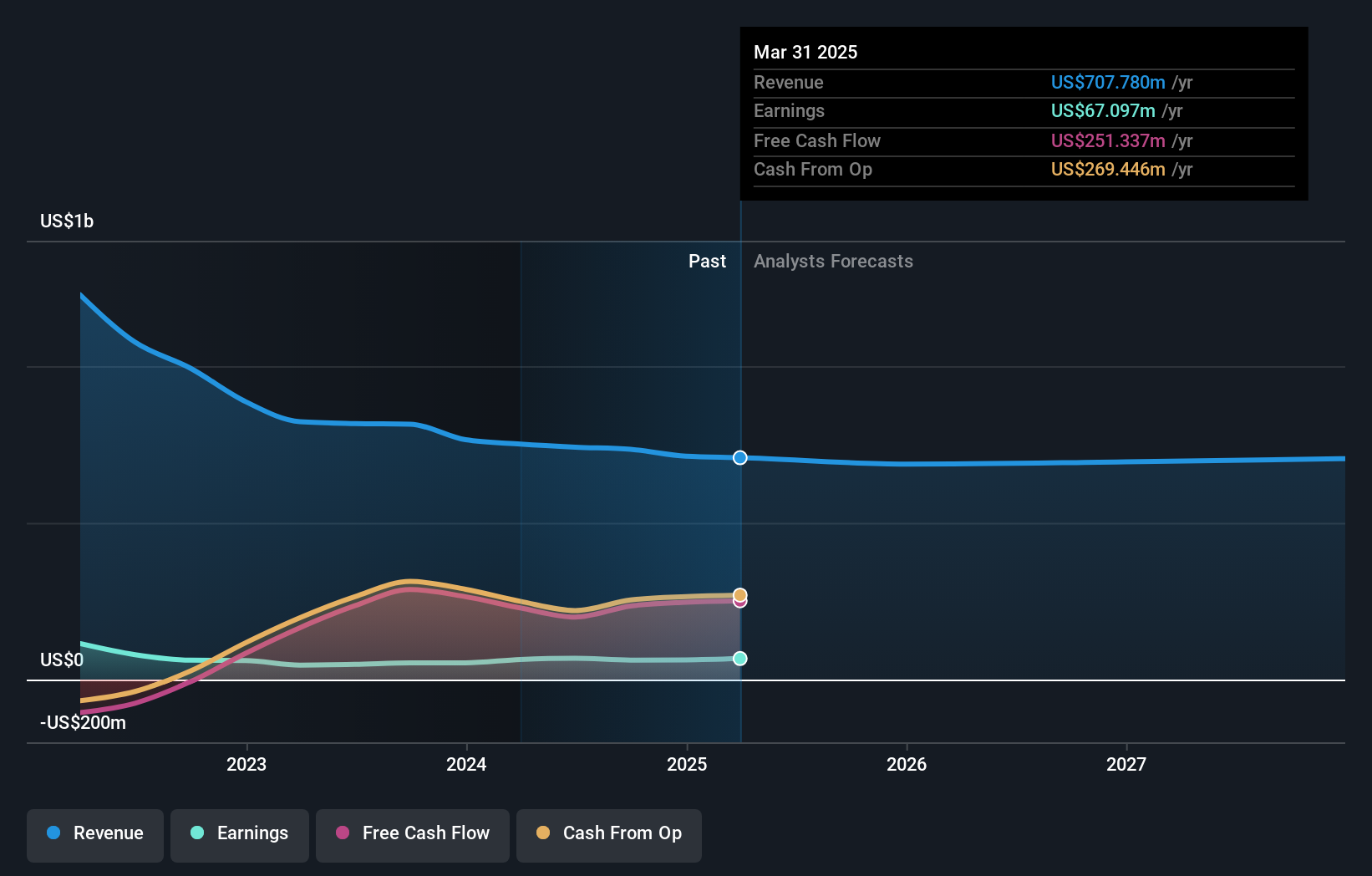

Overview: Cricut, Inc. designs, markets, and distributes a creativity platform for crafting handmade goods across various regions including the United States, Canada, and several international markets with a market cap of $1.18 billion.

Operations: Cricut generates revenue primarily from its platform segment, which accounted for $317.72 million. The company also reports a segment adjustment of $394.22 million.

Cricut, a player in the crafting industry, showcases an intriguing financial profile. The company reported earnings growth of 5.7% over the past year, outpacing the Consumer Durables sector's performance. Despite a 26.8% annual decline in earnings over five years, Cricut remains debt-free with its previous debt-to-equity ratio at 12.4%. Free cash flow is positive and recent buybacks saw 7.41 million shares repurchased for US$43.13 million under its ongoing program since May 2024. However, recent insider selling and removal from several Russell indices could raise eyebrows among potential investors looking for stability amidst growth potential.

- Click to explore a detailed breakdown of our findings in Cricut's health report.

Gain insights into Cricut's past trends and performance with our Past report.

CoastalSouth Bancshares (COSO)

Simply Wall St Value Rating: ★★★★★★

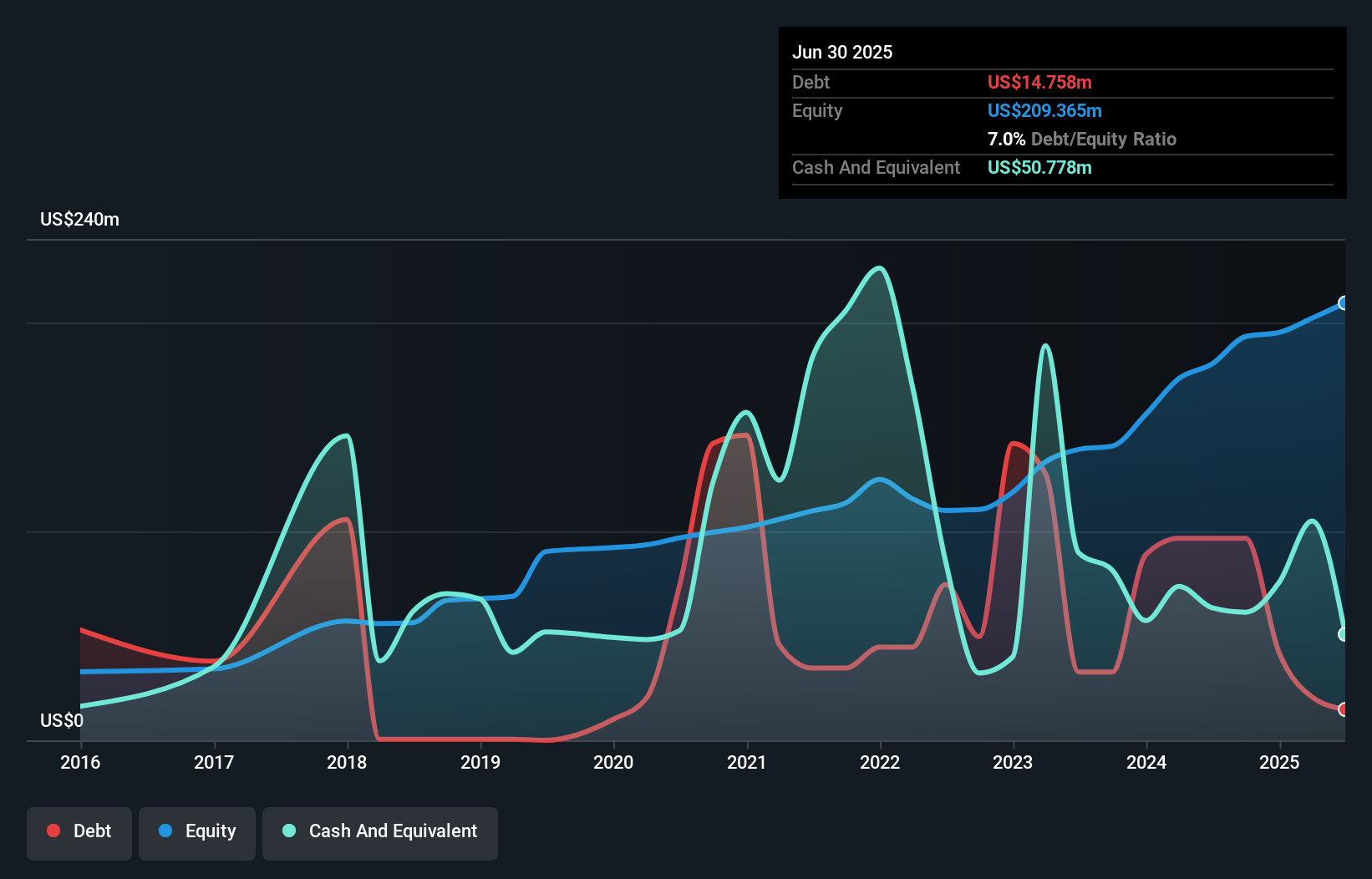

Overview: CoastalSouth Bancshares, Inc. is the bank holding company for Coastal States Bank, offering a range of banking products and services to retail and commercial customers, with a market cap of $253.47 million.

Operations: CoastalSouth's primary revenue stream is from its community banking segment, generating $75.07 million.

CoastalSouth Bancshares, with assets totaling US$2.2 billion and equity of US$209.4 million, stands out for its solid financial footing. The bank's deposits amount to US$2 billion against loans of US$1.5 billion, reflecting a prudent lending strategy supported by an allowance for bad loans at 1% of total loans. Trading at 68.8% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in the banking sector. Recent earnings growth of 21.5%, outpacing the industry average, highlights strong performance, while primarily low-risk funding underpins stability amidst market fluctuations.

- Click here and access our complete health analysis report to understand the dynamics of CoastalSouth Bancshares.

Understand CoastalSouth Bancshares' track record by examining our Past report.

Seize The Opportunity

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 287 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal