How Should Investors Approach Mettler-Toledo After Shares Jumped 10% This Month?

Thinking about what to do with Mettler-Toledo International stock right now? You are definitely not alone. Whether you already own shares or are sizing up the stock for the first time, it is the kind of company that sparks debate among serious investors. Over the last month, Mettler-Toledo shares have risen around 10.7%, rebounding impressively from recent volatility, and notched a solid 16.7% climb over the past three months. That rise comes after a tougher stretch earlier this year, and the company’s 1-year total return is still around -7.6%. Given this mixed backdrop, questions naturally pop up: is this renewed momentum a signal of undervalued opportunity, or is risk perception just changing?

On paper, the fundamentals remain solid, with annual revenue growth at 4.3% and net income up nearly 7.6% year-over-year. However, when we run Mettler-Toledo through six common valuation checks used by analysts to spot bargains, it scores zero out of six for being undervalued, resulting in a value score of just 0. That may raise some eyebrows, especially when the latest closing price of $1,322.57 sits noticeably above the median analyst target.

In short, recent price action hints at both growth potential and lingering market hesitation, drawing attention directly to the company’s valuation. Next, we will explore the most widely used valuation approaches, and before wrapping up, I will share a perspective that looks beyond simple numbers to help you better understand Mettler-Toledo’s worth.

Mettler-Toledo International delivered -7.6% returns over the last year. See how this stacks up to the rest of the Life Sciences industry.Approach 1: Mettler-Toledo International Cash Flows

The Discounted Cash Flow (DCF) model is a classic tool used by analysts to estimate a company's intrinsic value by projecting its future free cash flows and discounting them back to today’s dollars. The idea is straightforward: if you know what cash a company will generate in the future, you can calculate what that is worth right now.

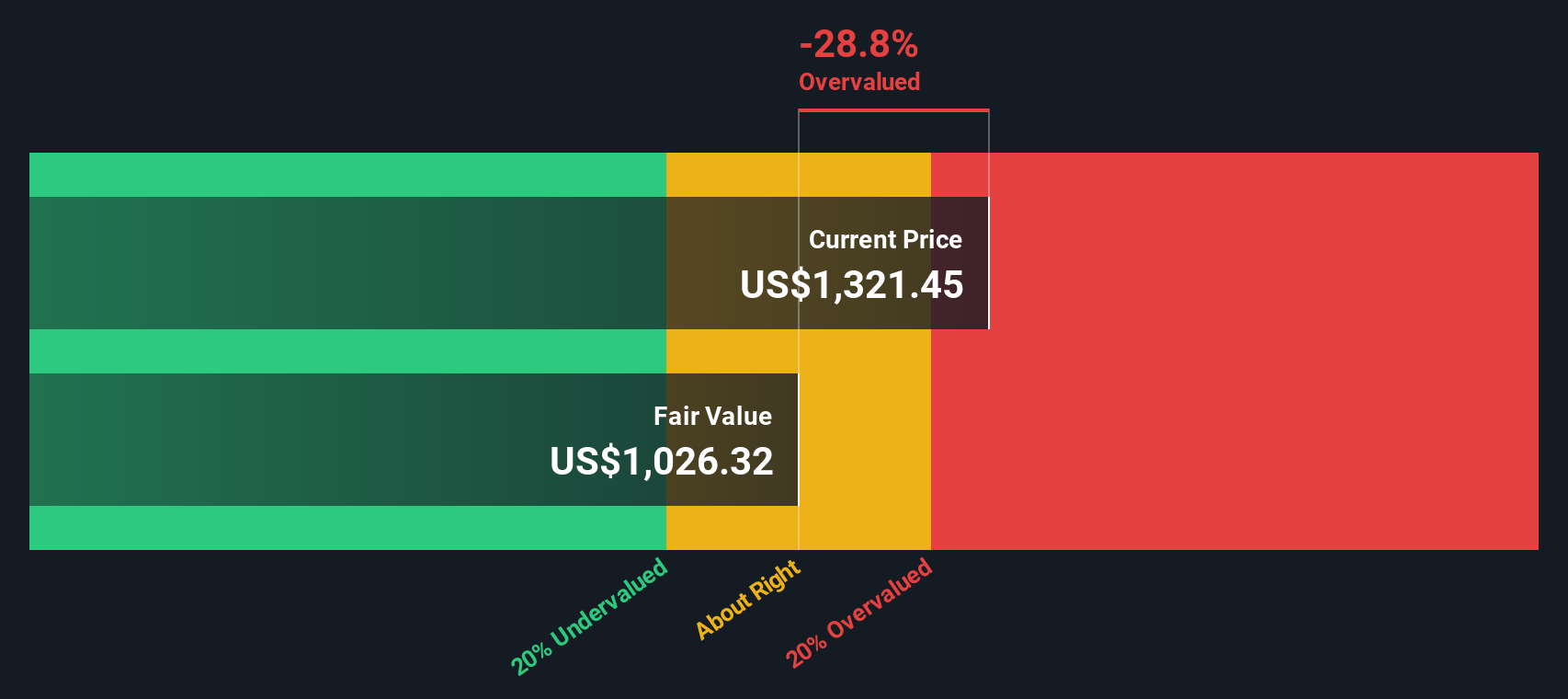

Mettler-Toledo International’s last twelve months of free cash flow stand at $848.3 million. Over the next decade, analyst and internal projections suggest steady growth, with free cash flow forecasted to reach $1.17 billion by 2035. Based on these projections and using a two-stage Free Cash Flow to Equity model, the estimated fair value is $1,027.52 per share.

Comparing this intrinsic value to the current share price of $1,322.57, the DCF model indicates that the stock is approximately 28.7% overvalued at today’s market price. Despite solid cash generation and projected growth, the market appears to be pricing in higher expectations than the model would suggest.

Result: OVERVALUED

Approach 2: Mettler-Toledo International Price vs Earnings

For profitable companies like Mettler-Toledo International, the Price-to-Earnings (PE) ratio is often the preferred valuation metric. It provides a straightforward way to measure how much investors are willing to pay today for a dollar of current earnings. The PE ratio is particularly useful because it reflects the market's expectations for future earnings growth as well as the level of risk investors associate with the company.

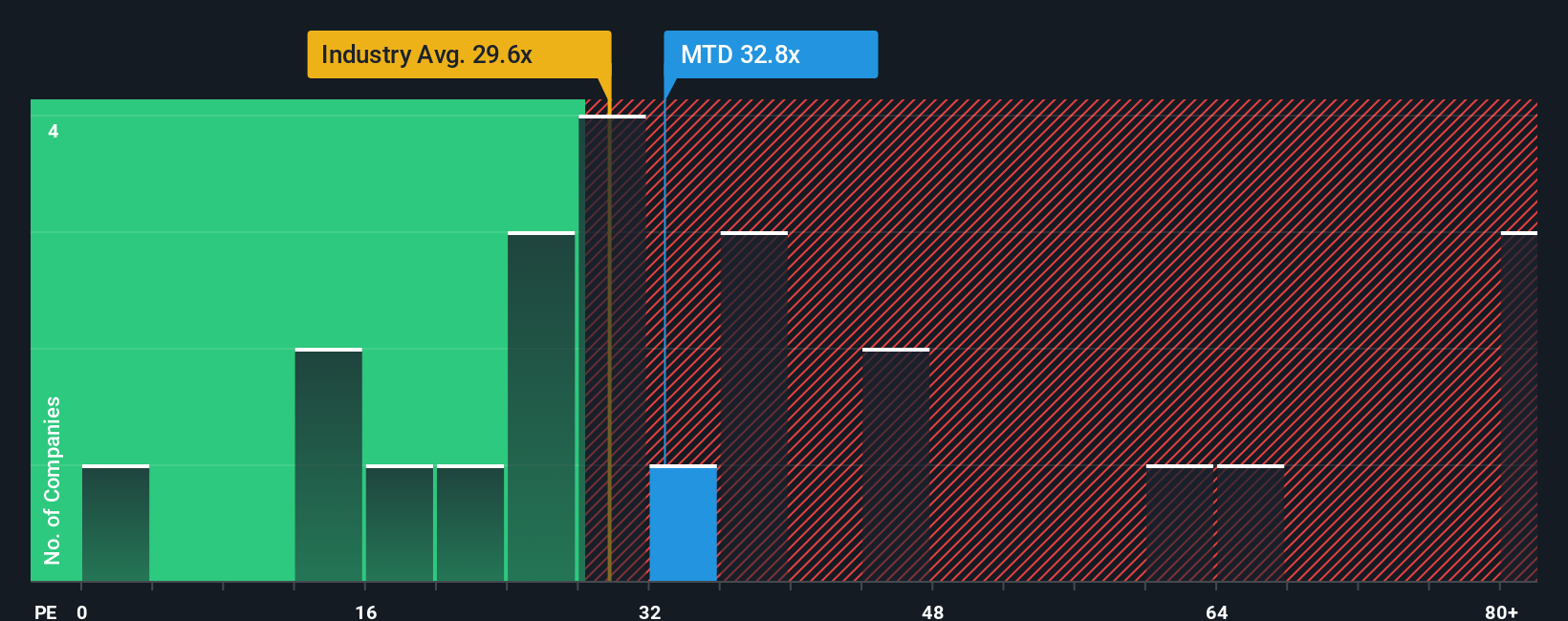

Currently, Mettler-Toledo trades at a PE ratio of 32.83x. This is higher than the Life Sciences industry average of 29.26x and its listed peer average of 29.73x. This may indicate that the market is pricing in higher growth, greater quality, or perhaps lower risk in comparison to its competitors. However, Simply Wall St’s “Fair Ratio,” which considers factors such as earnings growth, industry context, profitability, and company-specific risks, is 19.49x for Mettler-Toledo. This suggests that, even when accounting for its strong fundamentals, the company’s shares are trading well above what would generally be considered fair value according to this approach.

The significant difference between the actual PE ratio and the Fair Ratio implies that the stock price reflects more optimistic expectations than a balanced assessment might support.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Mettler-Toledo International Narrative

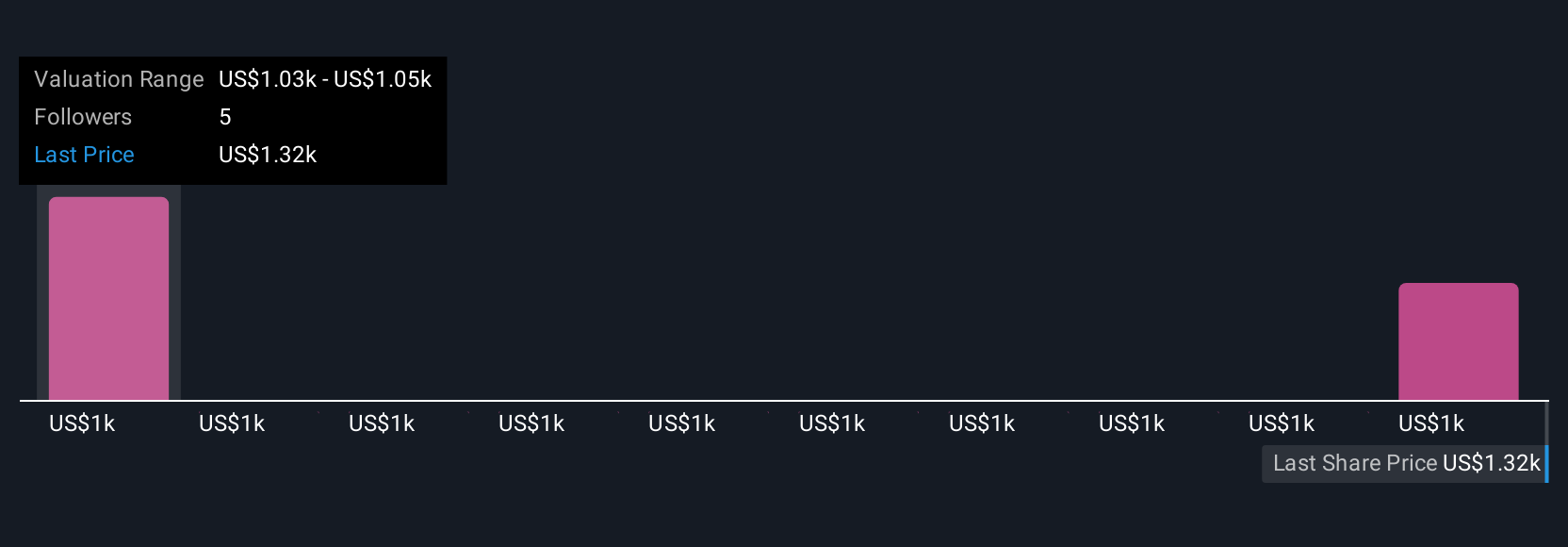

Instead of relying solely on static valuation numbers, investors can use Narratives, a simple and powerful way to connect the story behind a company to financial forecasts and ultimately to an estimated fair value. A Narrative is your perspective, based on your assumptions about Mettler-Toledo’s future revenue, earnings, and margins. It frames how you view the business beyond just the current figures. On the Simply Wall St platform, Narratives make this process easy and accessible, allowing millions of investors to craft, share, and update their views. Narratives help you decide when to buy or sell by comparing your personal Fair Value to today’s Price. They automatically update as news, earnings, or new analyst research becomes available. For example, some investors might see strong industry growth as justifying a fair value near $1,450, while others may focus on competition and margin risks, estimating a value closer to $1,150. With Narratives, you anchor your decision-making in both numbers and context, so you are always ready to act on new information with confidence.

Do you think there's more to the story for Mettler-Toledo International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal