Did Rising Sales and Lower Profits Just Shift Dole’s (DOLE) Investment Narrative?

- Dole plc reported its second quarter 2025 financial results, revealing sales of US$2,428.43 million and net income of US$9.97 million, both compared to the same period last year, alongside an affirmed quarterly dividend payment of US$0.085 per share.

- Despite higher sales, the company experienced a substantial decline in net income year-over-year, highlighting a divergence between revenue growth and profitability.

- We'll explore how Dole's sales increase amid lower net income could affect the company's investment narrative and future outlook.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Dole Investment Narrative Recap

To be a shareholder in Dole, you need to believe the company can convert strong global demand for fresh produce and strategic international expansion into sustained revenue and earnings growth, despite exposure to commodity price swings and operational risks. The recent second quarter results showed higher sales but a steep fall in net income, which raises concerns about profitability trends; however, this does not appear to materially shift the most important short-term catalyst, Dole’s ability to improve margins through operational efficiency, or the main risk, which remains margin pressure from weather and supply shocks.

Among recent announcements, Dole’s completion of major credit facility refinancing in May is especially relevant given margin trends. By expanding available credit and restructuring debt, the company has sought to strengthen liquidity and support ongoing investment in logistics and infrastructure, a critical factor in addressing both cost inflation and margin recovery, which ties directly into current investor focus following the latest earnings volatility. Despite this refinancing, investors should be aware that rising working capital and capex requirements could...

Read the full narrative on Dole (it's free!)

Dole's narrative projects $9.1 billion in revenue and $163.0 million in earnings by 2028. This requires 1.4% yearly revenue growth and a $49.1 million earnings increase from $113.9 million today.

Uncover how Dole's forecasts yield a $17.83 fair value, a 25% upside to its current price.

Exploring Other Perspectives

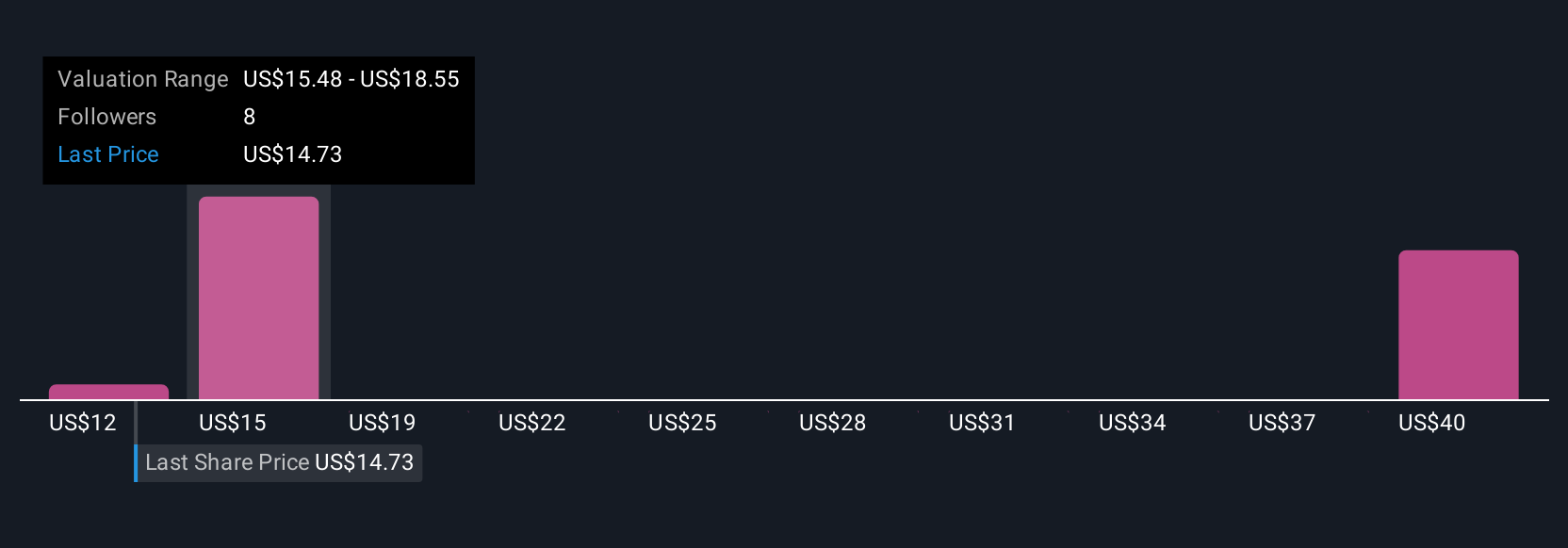

Simply Wall St Community members placed Dole’s fair value estimates between US$12.41 and US$42.63 across three views, highlighting substantial differences in outlook. With margin pressure weighing on net income, you’ll find sharp divides among contributors worth exploring in depth.

Explore 3 other fair value estimates on Dole - why the stock might be worth over 2x more than the current price!

Build Your Own Dole Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dole research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dole research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dole's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal